941 Reconciliation Template Excel

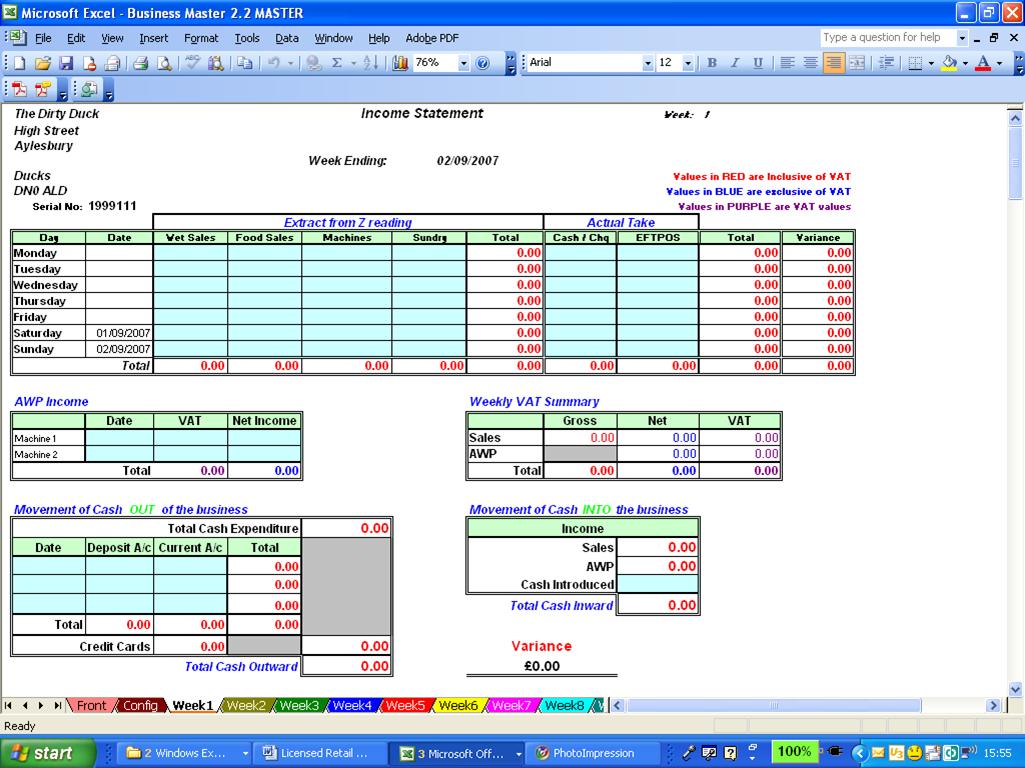

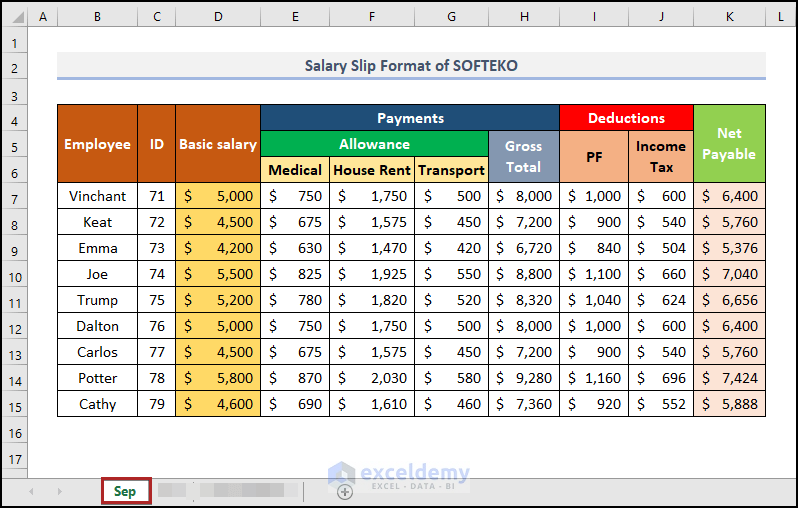

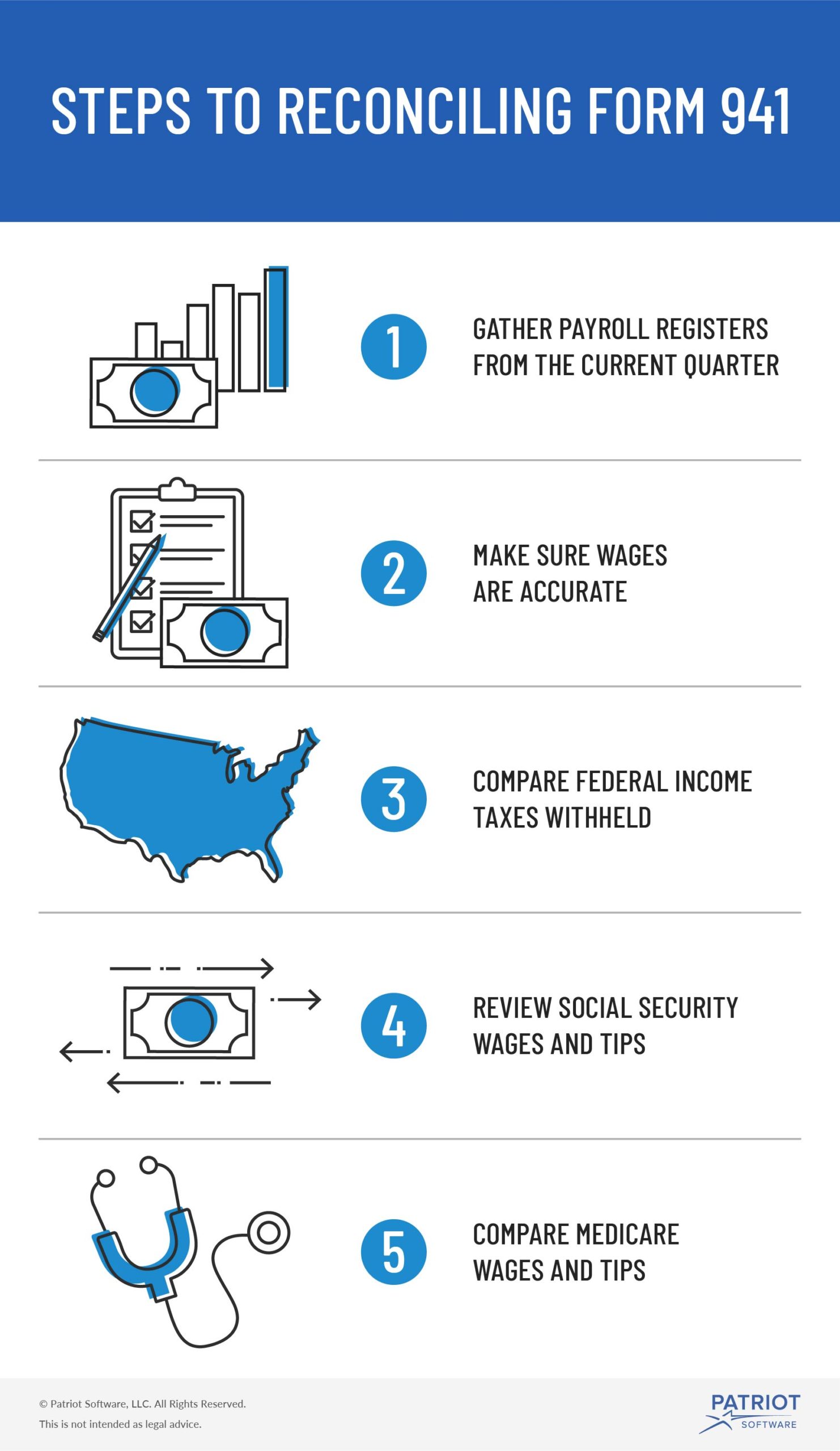

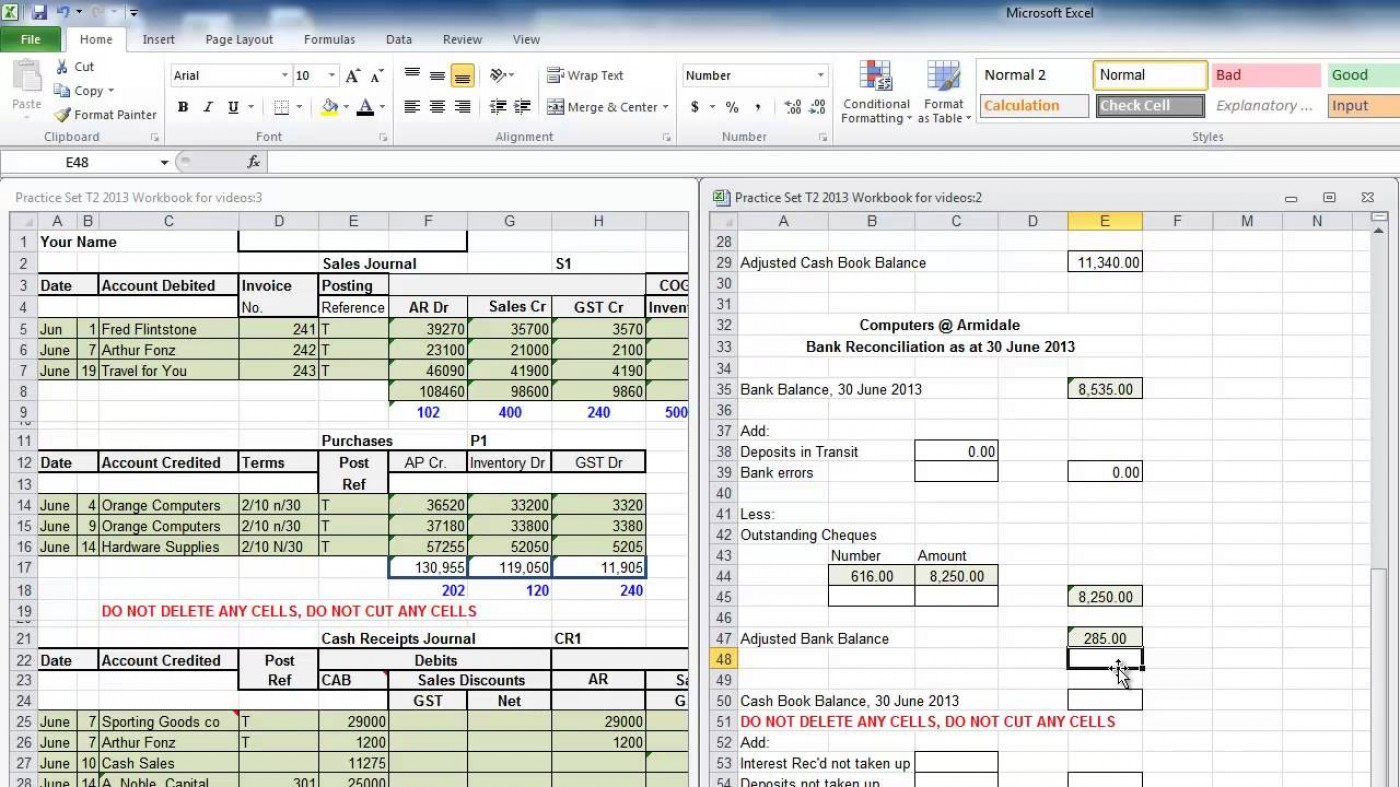

941 Reconciliation Template Excel - Document the following items on the reconciliation spreadsheet: Below you’ll see an overview of doing three way reconciliation in excel and finding discrepancies among the transaction values. Run a report that shows annual payroll amounts. This template typically includes sections to input information such as wages, tips, and other compensation, federal income tax withheld, social security and medicare taxes, and adjustments for tips. For payroll, this means you need to verify that your ledger matches the actual payments sent to employees.

Include the day/time and place your electronic signature. Web payroll reconciliation should happen frequently, including: Instructions for form 941 ( print version pdf) recent developments. Run a report that shows annual payroll amounts. Web a much more extensive list of accounts for the reconciliation. Whether it’s an excel spreadsheet, a calculator tape, or a handwritten computation, verify your numbers before you submit anything to the irs or ssa. Every pay period before you cut employee checks—ideally, at least two days before your payday;

941 Reconciliation Template Excel

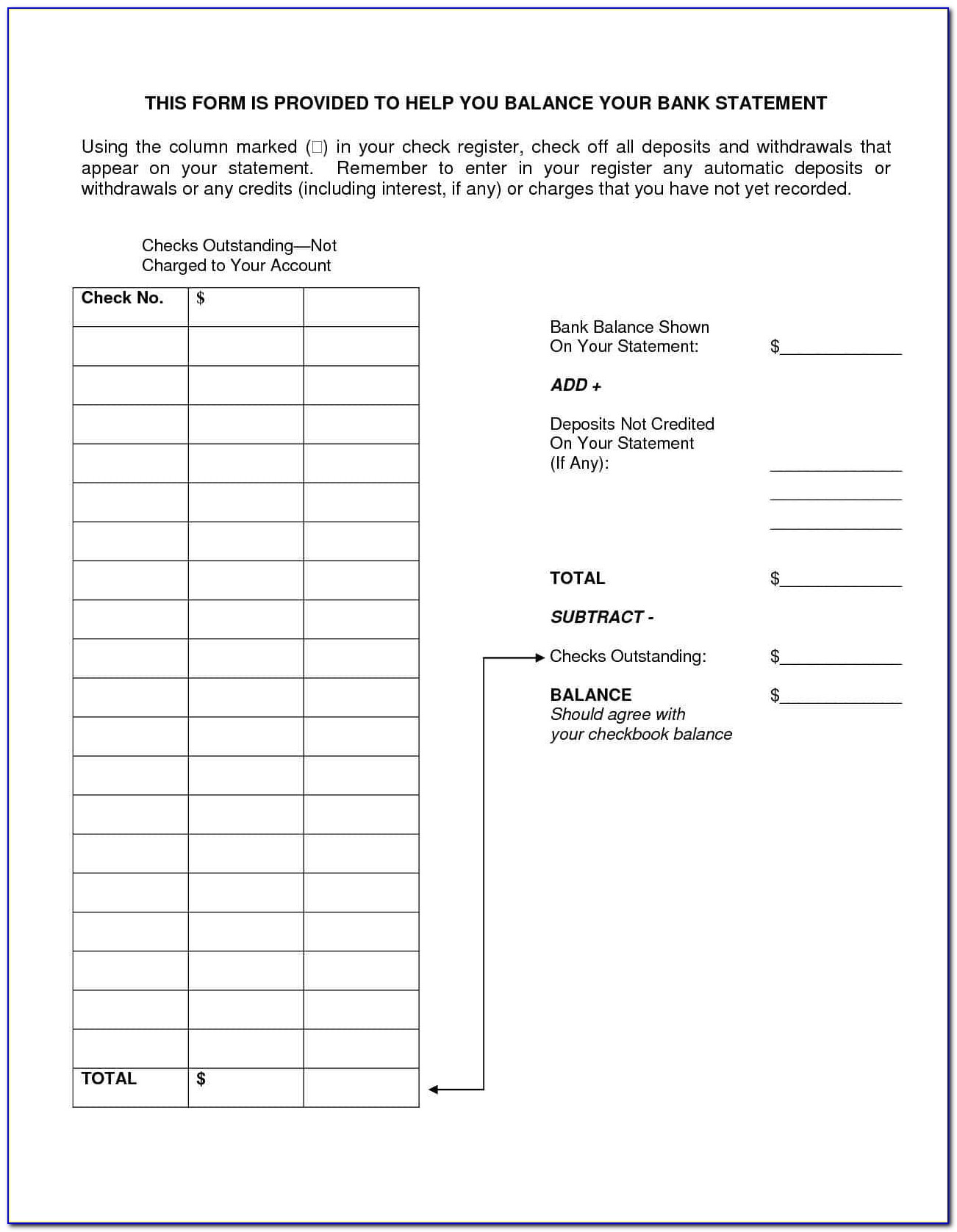

This bank reconciliation template from the cfi team for excel is an excellent resource for businesses or individuals who need to reconcile their bank statements with their own financial records. Include the day/time and place.

Payroll Reconciliation Excel Template

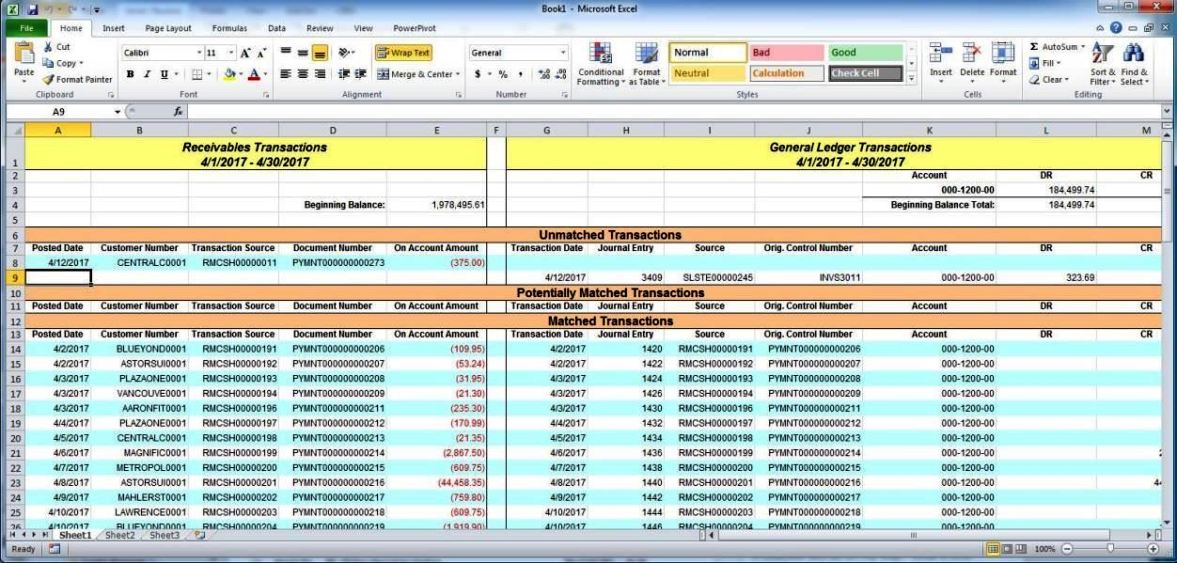

Below you’ll see an overview of doing three way reconciliation in excel and finding discrepancies among the transaction values. Quarterly when you submit form 941 with your quarterly federal tax return; Engaged parties names, places.

941 Reconciliation Template Excel

The irs has made changes to form 941 for the 2nd quarter of 2022. This bank reconciliation template from the cfi team for excel is an excellent resource for businesses or individuals who need to.

941 Reconciliation Template Excel

This bank reconciliation template from the cfi team for excel is an excellent resource for businesses or individuals who need to reconcile their bank statements with their own financial records. Whether you track payroll taxes.

How to Do Payroll Reconciliation in Excel (with Easy Steps)

How to filter the data on this report. Web payroll reconciliation should happen frequently, including: Most employers must report employees' wages paid and taxes withheld plus their own share of certain payroll taxes quarterly to.

941 Reconciliation Template Excel

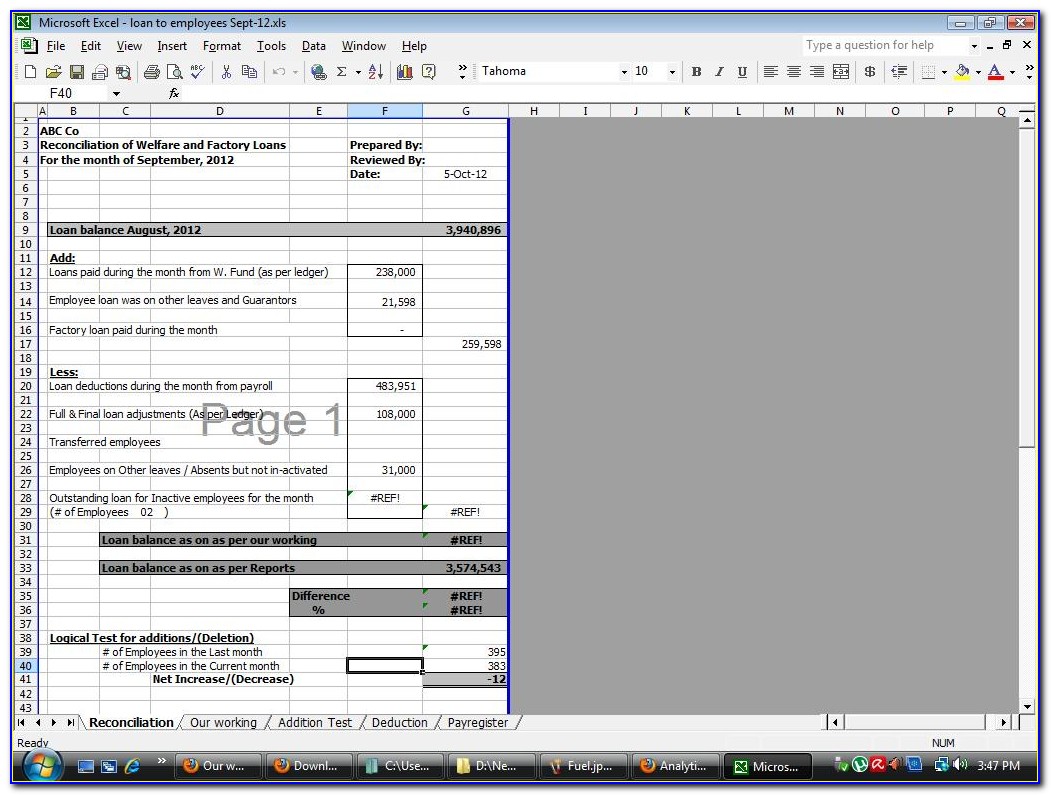

Web web refer to sample excel reconciliation template. Web the three way reconciliation in excel is useful to compare transaction records from 3 different sources and match them to find any error in calculation. Bank.

941 Reconciliation Template Excel

Whether you track payroll taxes and wages in a spreadsheet or software, the first step in reconciling form 941 is printing or reviewing your payroll registers. Compare those figures with the totals reported on all.

Account Reconciliation Template Excel SampleTemplatess SampleTemplatess

Whether it’s an excel spreadsheet, a calculator tape, or a handwritten computation, verify your numbers before you submit anything to the irs or ssa. Every pay period before you cut employee checks—ideally, at least two.

941 Reconciliation Template Excel

Document the following items on the reconciliation spreadsheet: Most employers must report employees' wages paid and taxes withheld plus their own share of certain payroll taxes quarterly to the irs. Web the three way reconciliation.

941 Reconciliation Template Excel

This topic does not apply to versions of microsoft dynamics ax 2012 prior to cumulative update 7 for ax 2012 r2. Fill in the empty fields; This bank reconciliation template from the cfi team for.

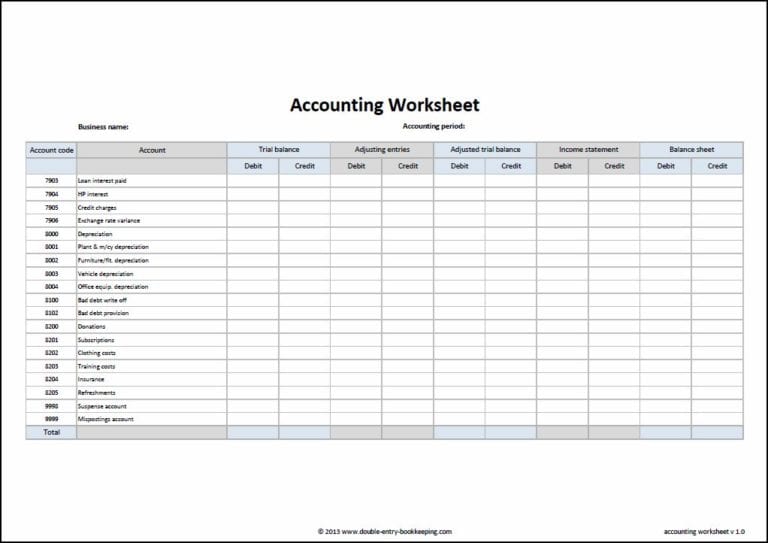

941 Reconciliation Template Excel Web a much more extensive list of accounts for the reconciliation. All of your bookkeeping records need to reflect the employee’s actual pay plus all of the deductions from their. Web below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. Web the three way reconciliation in excel is useful to compare transaction records from 3 different sources and match them to find any error in calculation. Whether you track payroll taxes and wages in a spreadsheet or software, the first step in reconciling form 941 is printing or reviewing your payroll registers.