Business Debt Schedule Template Excel

Business Debt Schedule Template Excel - Web easily editable, printable, downloadable. Web business debt schedule template. However, to save time, our easy to use debt schedule includes: Making a business debt schedule is straightforward. Here’s how to make one, and why it’s important for your company.

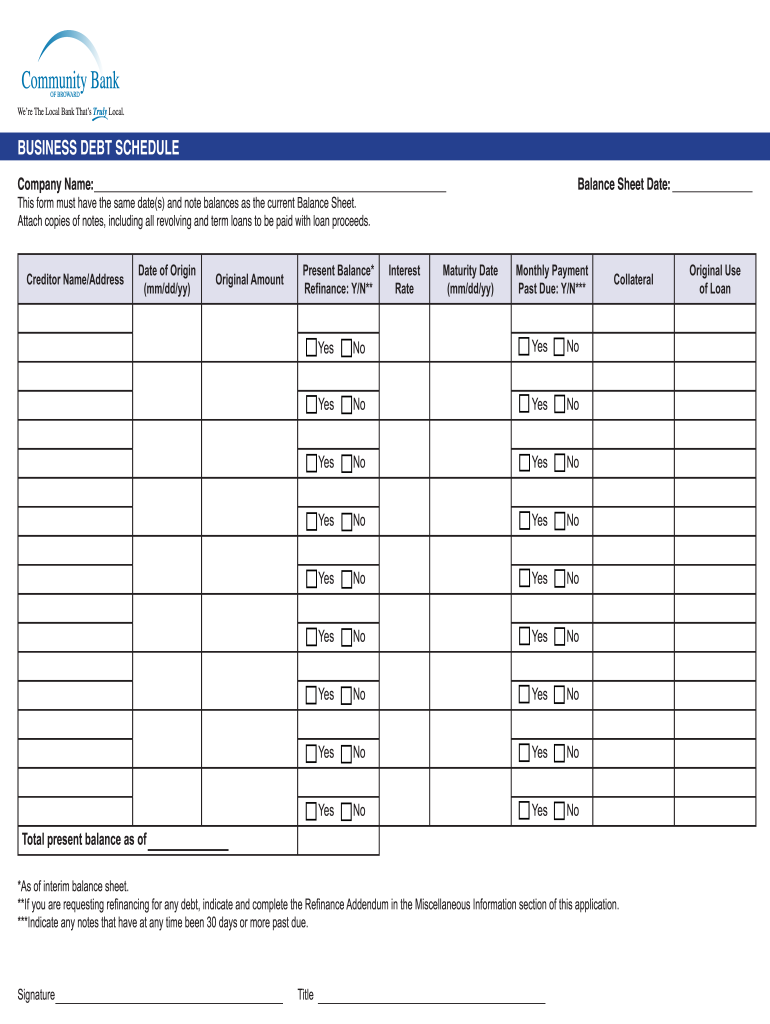

Simple to use and available to download immediately, this debt schedule will help to track payments over a number of years. A business debt schedule, or schedule of debt, tracks the money your company currently owes someone else. This template will guide you in detailing a company’s outstanding debts, their respective interest rates, and repayment schedules. Why do i need a business debt schedule template? It’s easy to make your own business debt schedule using a simple spreadsheet program like excel or google sheets. Web maximize your financial organization and streamline your debt management with our flexible business debt schedule template. Web download wso's free debt schedule model template below!

Business Debt Schedule Form Ethel Hernandez's Templates

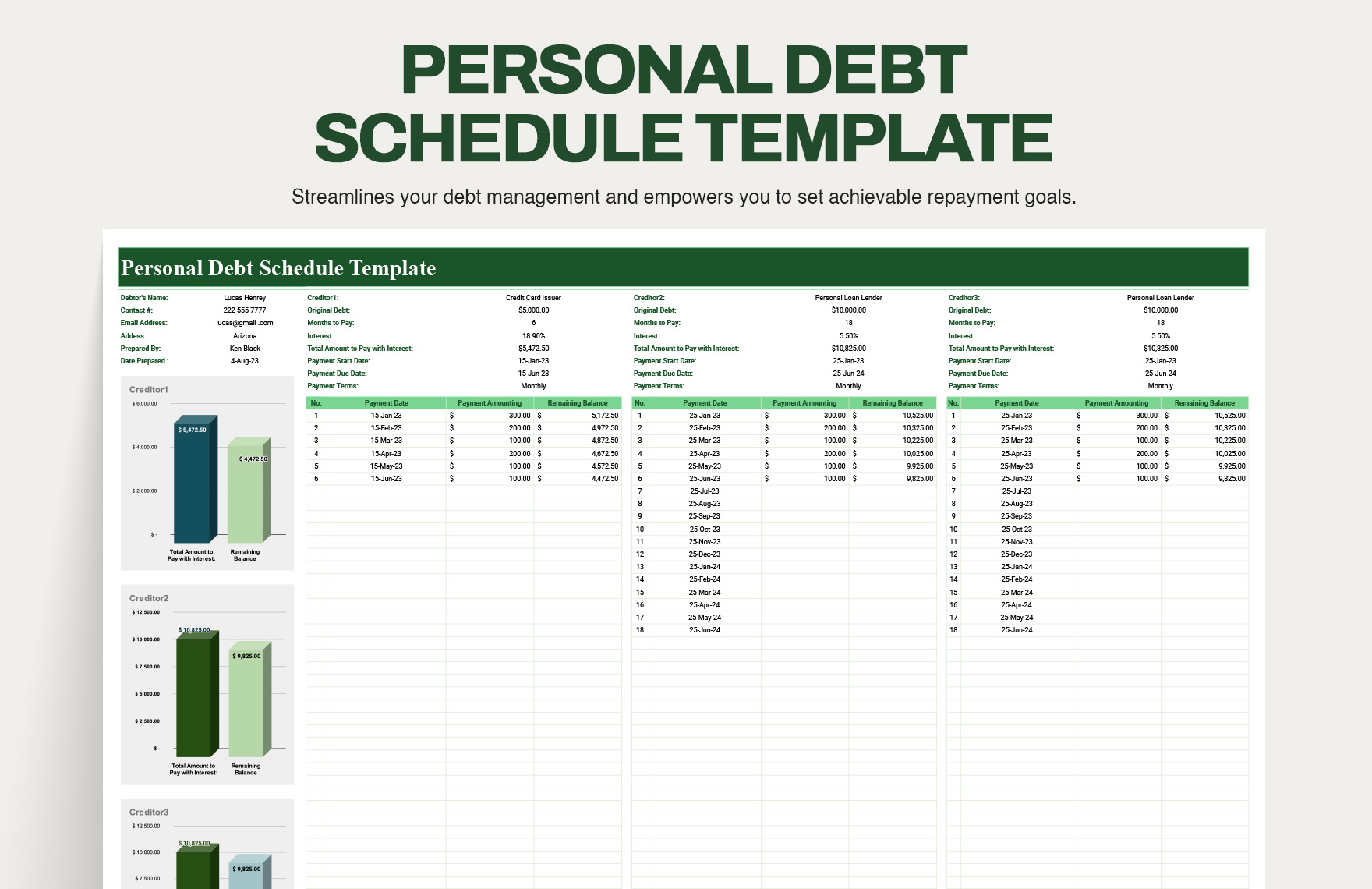

This template allows you to record debt and interest payments over time. The template includes both a senior debt schedule and a subordinated debt schedule. First, we need to set up the model by inputting.

Business Debt Schedule Template Excel Darrin Kenney's Templates

A business debt schedule, or schedule of debt, tracks the money your company currently owes someone else. These may include small business loans , business lines of credit and credit cards. This template allows you.

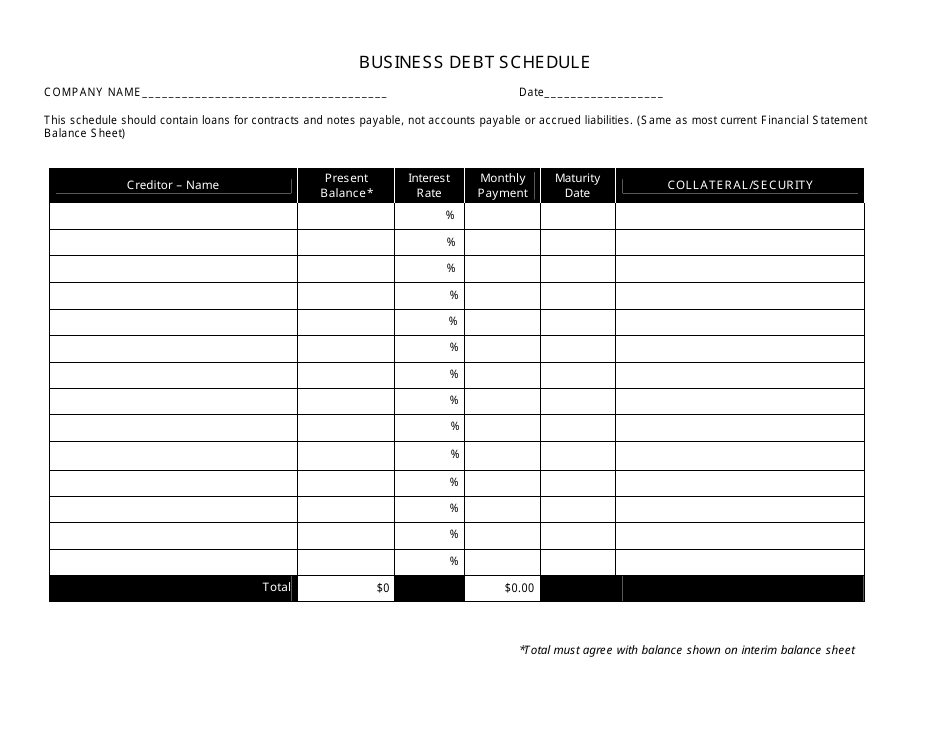

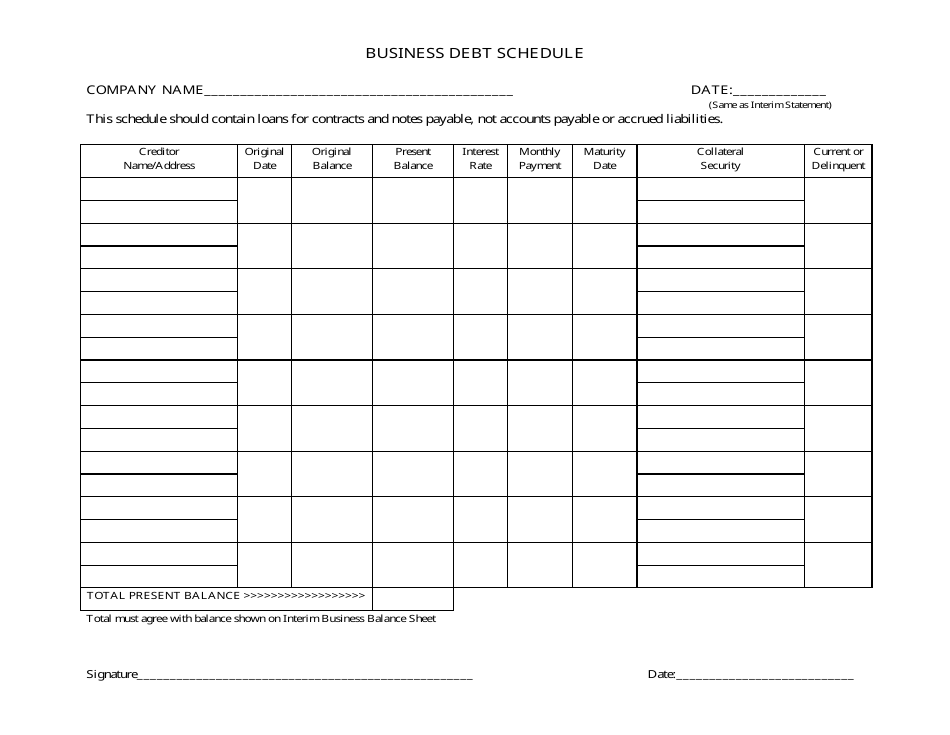

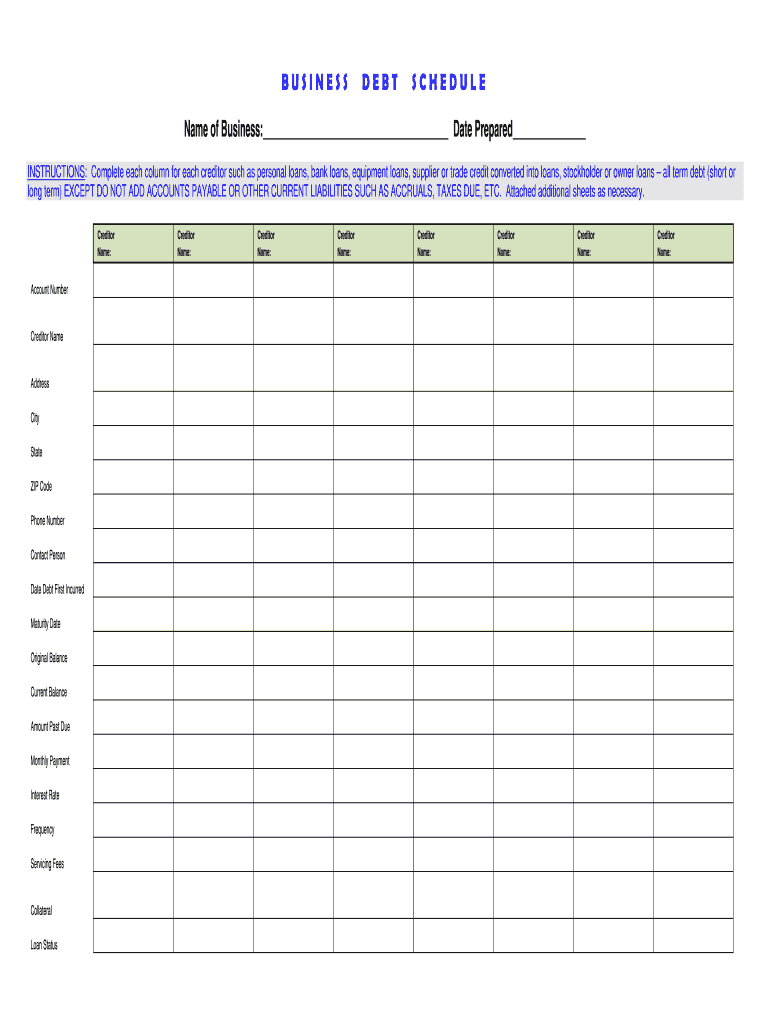

Business Debt Schedule Template Black and White Download Fillable PDF

Web download wso's free debt schedule model template below! Web debt schedules in excel are an important tool for managing your finances and keeping track of your debts. Creating your own schedule will give you.

Business Debt Schedule Template Fill Out, Sign Online and Download

It provides a clear overview of the outstanding debts, including the creditor, the amount owed, the terms and conditions, and the repayment schedule. Do you need to calculate your business debt? This template allows you.

Business Debt Schedule Template Download in Excel, Google Sheets

Web the business debt schedule template is designed for small businesses to maintain accurate tracking of those debts. Web maximize your financial organization and streamline your debt management with our flexible business debt schedule template..

Business Debt Schedule Template Excel Darrin Kenney's Templates

Optional repayment (cash sweep) step 6. Web debt schedules in excel are an important tool for managing your finances and keeping track of your debts. The template includes both a senior debt schedule and a.

Debt Schedule Template Complete with ease airSlate SignNow

Here’s an example of a debt schedule that a business might use: Operating assumptions and financial forecast. Web maximize your financial organization and streamline your debt management with our flexible business debt schedule template. These.

Business Debt Schedule Template Varicolored Fill Out, Sign Online

Download the debt schedule template. This template allows you to record debt and interest payments over time. It provides a clear overview of the outstanding debts, including the creditor, the amount owed, the terms and.

Debt Schedule Template Excel Fill and Sign Printable Template Online

Web business debt schedules can help small business owners stay on top of their debt and liabilities. Web download wso's free debt schedule model template below! Using the debt schedule template Ensure the value in.

》Free Printable Debt Schedule Template

Mandatory loan repayment percentage assumptions. Web debt schedule — excel template. Download wso's free debt schedule model template below! Web business debt schedule template. It helps to provide a clear overview of the debt structure,.

Business Debt Schedule Template Excel Web we can use excel’s pmt, ipmt, and if formulas to create a debt schedule. It’s a great document to prepare internally so you always know your debt situation. Web a business debt schedule allows you to see how much money is going out of your business every month and can help you set revenue goals and calculate projections. In this example, we assume the debt to be $5,000,000, the payment term to be 5 years, and the interest rate to be 4.5%. Simple to use and available to download immediately, this debt schedule will help to track payments over a number of years.