Depreciation Schedule Excel Template

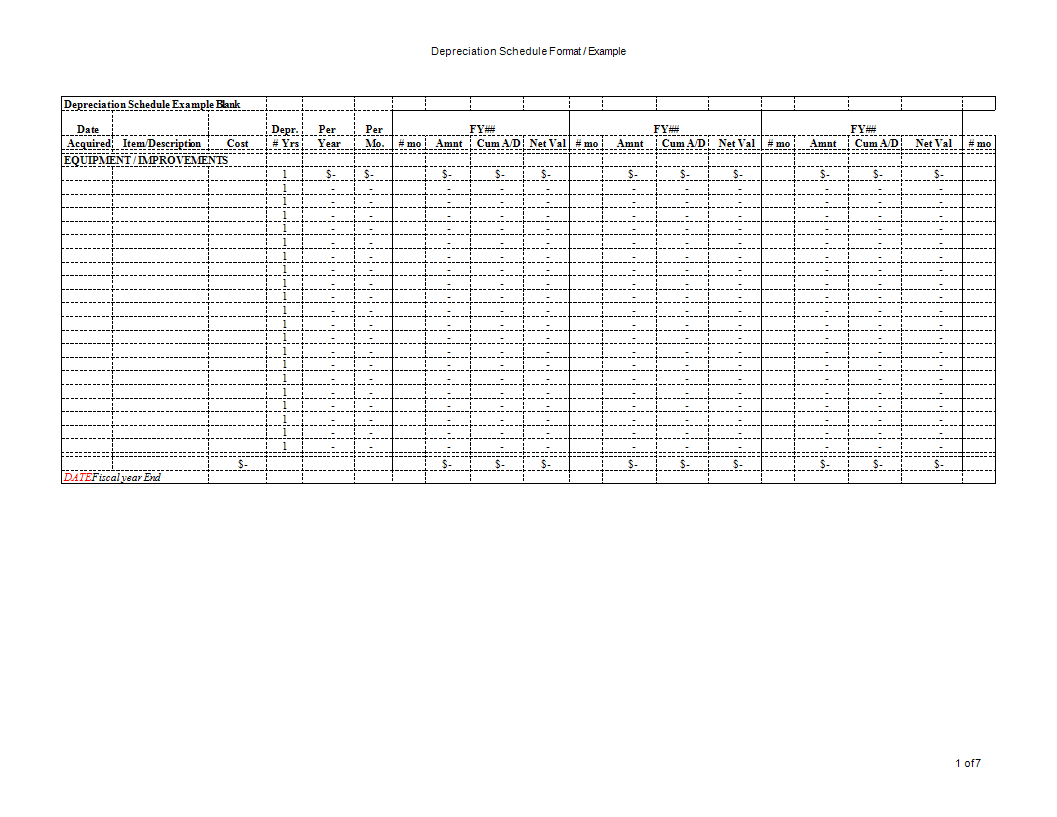

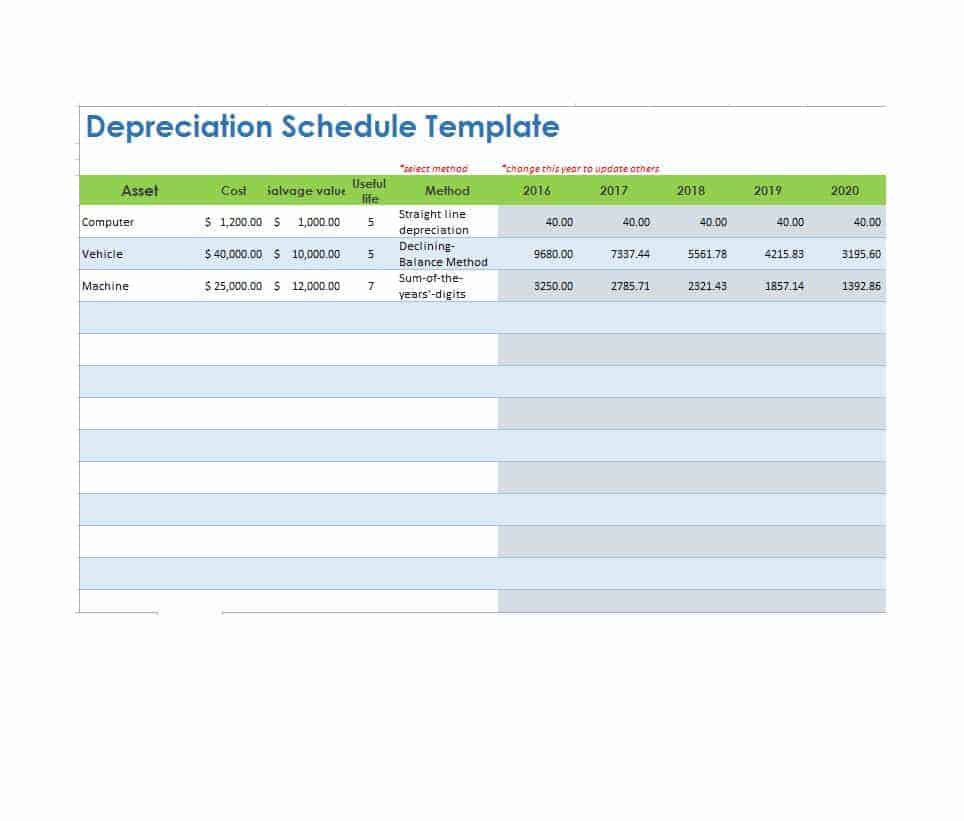

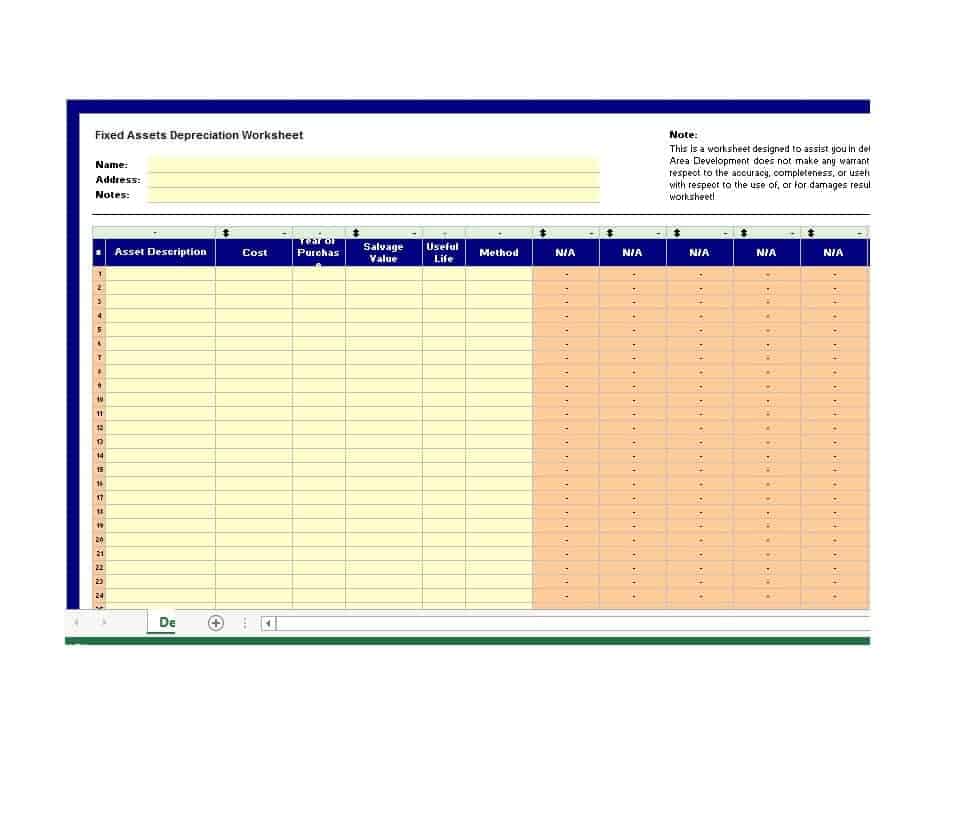

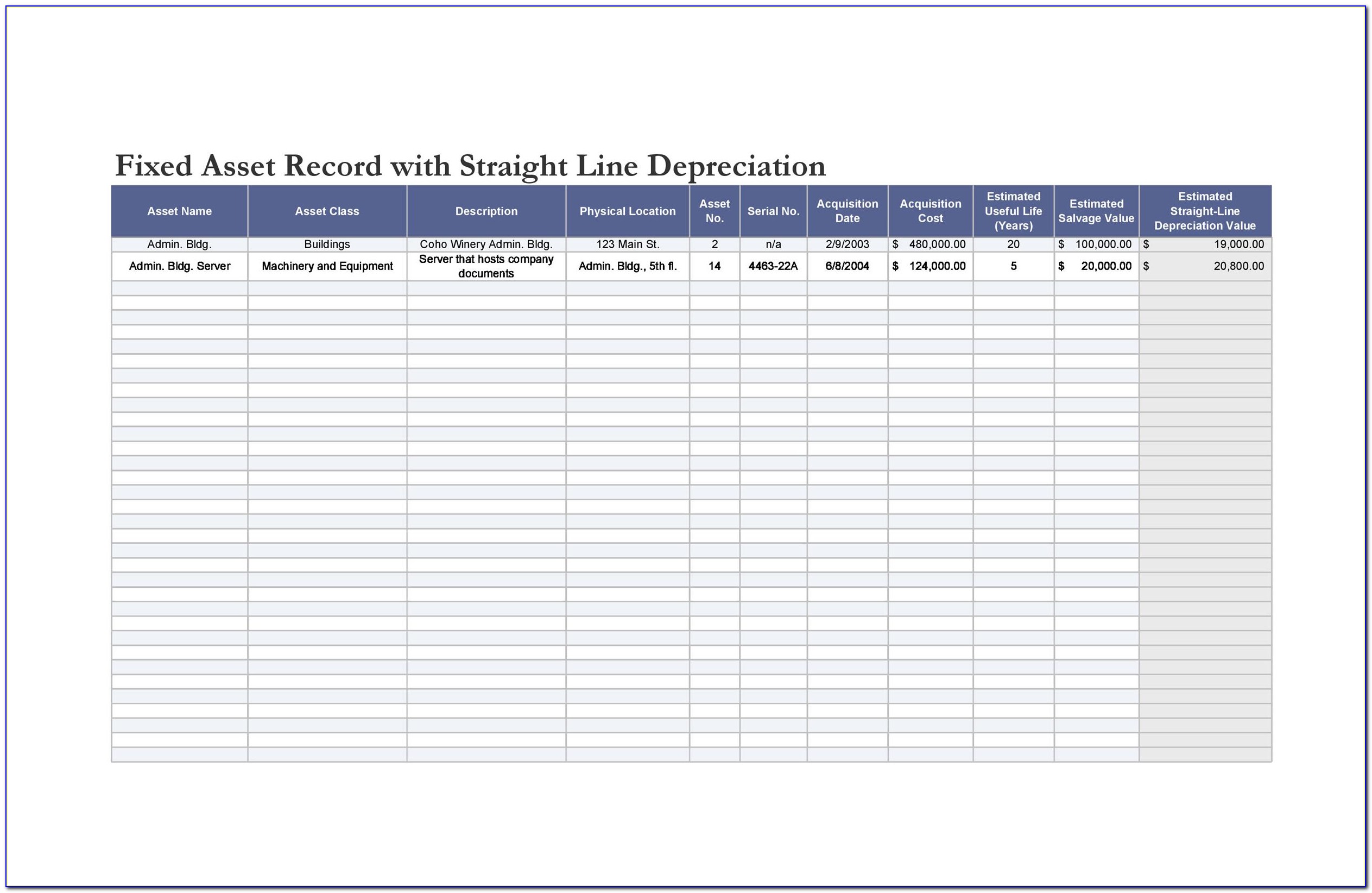

Depreciation Schedule Excel Template - Web download a depreciation schedule template for excel. Web the schedule will list the different classes of assets, the type of depreciation method they use, and the cumulative depreciation they’ve incurred at various points in time. Fixed asset record with depreciation; Further, using this dataset, we will create a monthly depreciation schedule in excel. We’ve also prepared a downloadable depreciation worksheet template that’s ready to use.

The spreadsheet should be updated after an asset is acquired, sold or retired to ensure accurate record keeping within the spreadsheet. Web depreciation schedule report template; You can use any available excel version. Non profit depreciation schedule template; The depreciation schedule may also include historic and. Fixed asset and depreciation schedule; Web in the following dataset, you can see the assets, purchase date, actual cost, salvage value, and depreciations rate columns.

Depreciation schedule Excel format Templates at

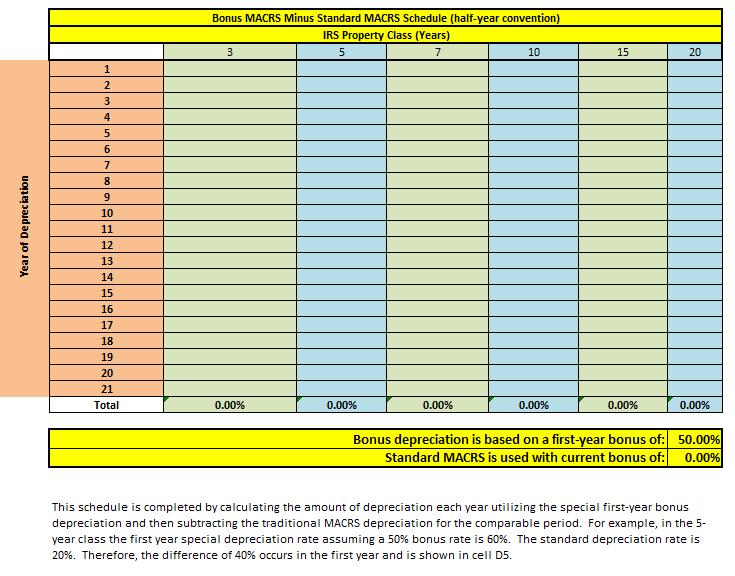

Web in the following dataset, you can see the assets, purchase date, actual cost, salvage value, and depreciations rate columns. You can use any available excel version. These eight depreciation methods are discussed in two.

9 Free Depreciation Schedule Templates in MS Word and MS Excel

Web in this article, we’ll teach you how to make a depreciation worksheet in excel, from assembling column headers to entering formulas, and explain the usage and arguments in each depreciation formula. Annual depreciation expense.

20+ Free Depreciation Schedule Templates MS Excel & MS Word

Annual depreciation expense = (cost of the asset − salvage value) / useful life of the asset. You can use any available excel version. Fixed assets depreciation schedule template; Non profit depreciation schedule template; We’ve.

Fixed Asset Monthly Depreciation Schedule Excel Template

Web the depreciation schedule template is an effective and easy way to help business owners keep a working long term depreciation schedule for their assets. Further, using this dataset, we will create a monthly depreciation.

Straight Line Depreciation Schedule Excel Template For Your Needs

Cost of the asset is the purchase price of the asset. Web depreciation schedule report template; Fixed assets depreciation schedule template; Fixed asset and depreciation schedule; These eight depreciation methods are discussed in two sections,.

13+ Depreciation Schedule Templates Free Word Excel Templates

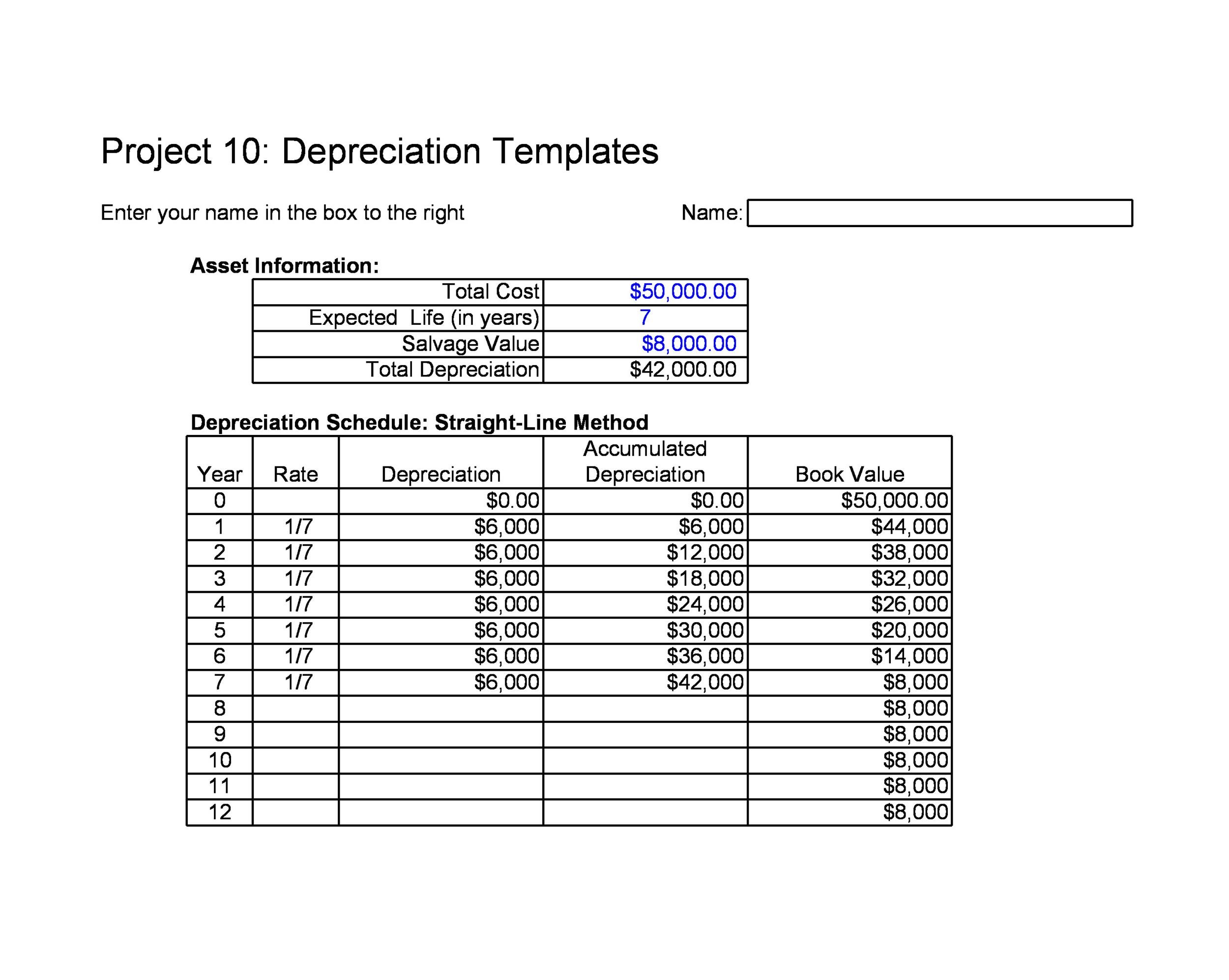

Web the depreciation schedule records the depreciation expense on the income statement and calculates the asset’s net book value at the end of each accounting period. Web depreciation schedule report template; We’ve also prepared a.

Create Depreciation Schedule in Excel (8 Suitable Methods) ExcelDemy

Here, we used microsoft 365. The depreciation schedule may also include historic and. Fixed assets depreciation schedule template; Web the excel depreciation calculator, available for download below, is used to produce a straight line depreciation.

Depreciation Schedule Template Excel Free PRINTABLE TEMPLATES

Web the excel depreciation calculator, available for download below, is used to produce a straight line depreciation schedule by entering details relating to the cost and salvage value of the asset and the straight line.

Depreciation Schedule Template Excel Free For Your Needs

Here, we used microsoft 365. Fixed assets depreciation schedule template; Non profit depreciation schedule template; Web download a depreciation schedule template for excel. The depreciation schedule may also include historic and.

Depreciation Schedule Excel Template

Further, using this dataset, we will create a monthly depreciation schedule in excel. Fixed assets depreciation schedule template; Web depreciation schedule report template; Fixed asset record with depreciation; Web in the following dataset, you can.

Depreciation Schedule Excel Template Cost of the asset is the purchase price of the asset. Web the depreciation schedule records the depreciation expense on the income statement and calculates the asset’s net book value at the end of each accounting period. Web depreciation schedule report template; Web the schedule will list the different classes of assets, the type of depreciation method they use, and the cumulative depreciation they’ve incurred at various points in time. These eight depreciation methods are discussed in two sections, each with an accompanying video.