How To Calculate Annualised Return In Excel

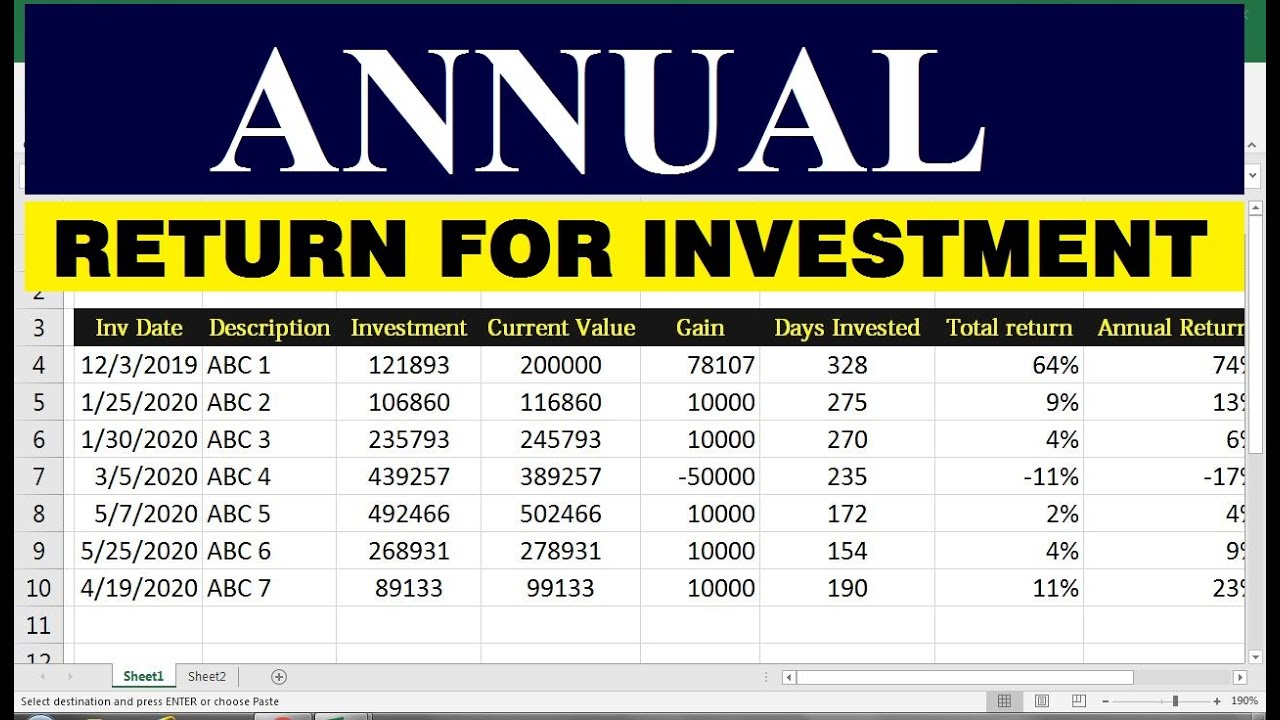

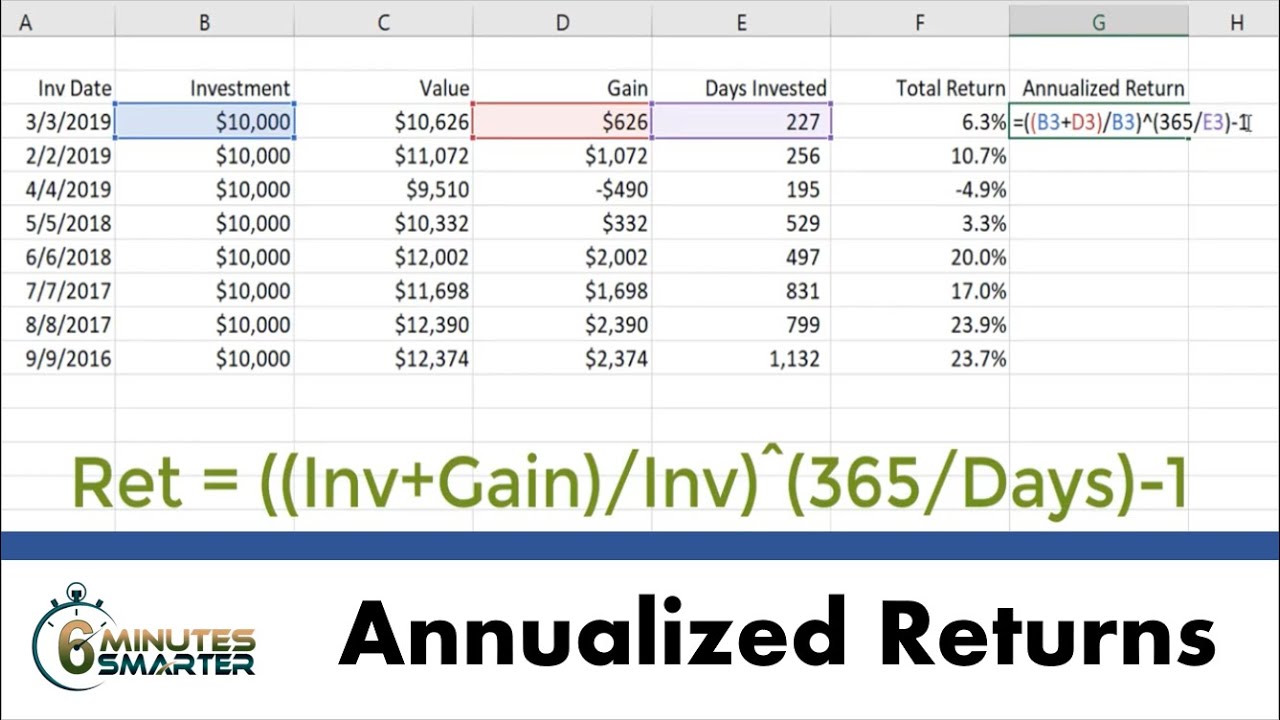

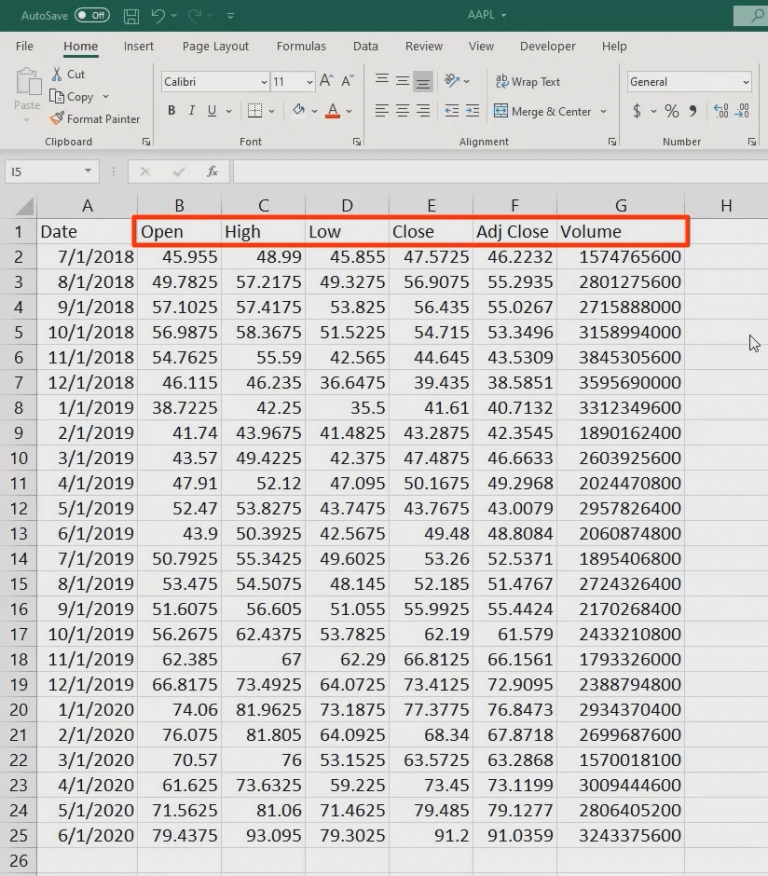

How To Calculate Annualised Return In Excel - The annualized return is a key measure. Let’s say we have a data set that represents initial values, returned values, and the holding. Enter the data into excel. Calculating annualized rate of return in excel is an essential skill for anyone involved in finance, investments, or business analysis. Web when it comes to calculating the annual rate of return for an investment, excel offers a powerful tool in the form of the rate function.

Web to calculate the annualized rate of return from monthly returns in excel, you can use various methods, each suitable for different scenarios. Web the formula for an annualized rate of return is expressed as the sum of initial investment value and gains or losses during the given period divided by its initial value,. Understanding the basic formula, time value of money, and. Excel’s rate function is what you’ll use here. Web 1.1 step 1: Calculate the rate of return. Master investment analysis quickly and efficiently.

How To Calculate Annualized Returns From Monthly Returns In Excel

Understanding the basic formula, time value of money, and. Web when it comes to calculating the annual rate of return for an investment, excel offers a powerful tool in the form of the rate function..

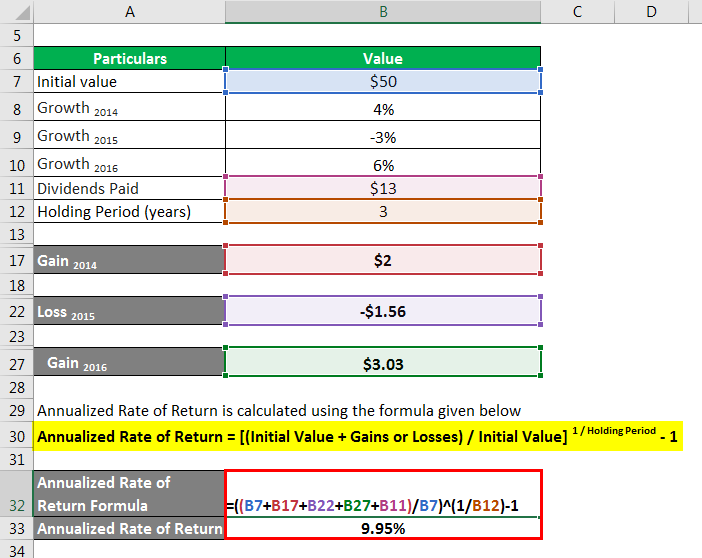

Annualized Rate of Return Formula Calculator Example Excel Template

Web the formula for an annualized rate of return is expressed as the sum of initial investment value and gains or losses during the given period divided by its initial value,. Web when it comes.

How To Calculate Annualized Returns From Monthly Returns In Excel

Web excel calculates the average annual rate of return as 9.52%. Web the formula for an annualized rate of return is expressed as the sum of initial investment value and gains or losses during the.

Annual Return Formula How to Calculate Annual Return? (Example)

Web the basic formula for calculating annualized return is: Understanding the basic formula, time value of money, and. Total return is the total return on investment over a. Web by following these steps, you’ll learn.

how to annualized returns in excel YouTube

Let’s say we have a data set that represents initial values, returned values, and the holding. Web the formula for an annualized rate of return is expressed as the sum of initial investment value and.

How To Calculate Annualized Returns From Monthly Returns In Excel

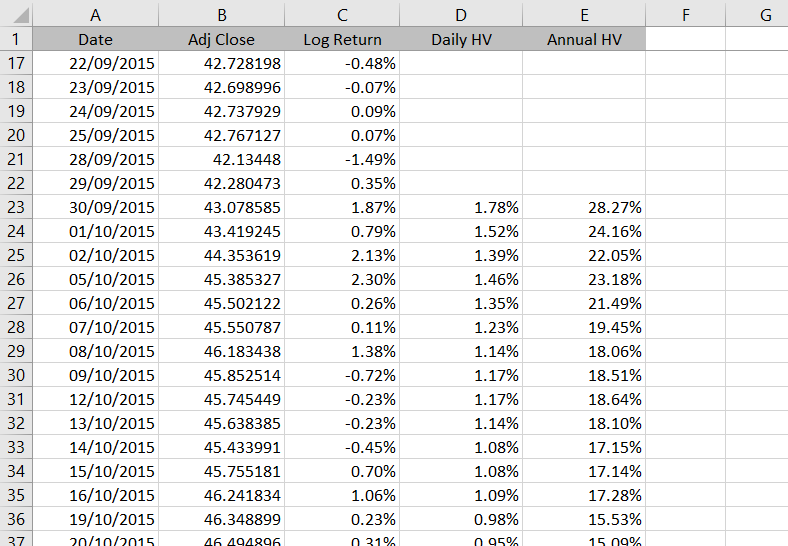

Total return is the total return on investment over a. Web in this tutorial, we will delve into the process of calculating annualized return from daily returns in excel, offering you a clear and straightforward.

How To Calculate Annualized Return From Monthly Returns In Excel

Total return is the total return on investment over a. The power function in excel can be used to calculate. This formula raises the monthly return by 12 (the number of months in a year).

Calculate Annualized Returns for Investments in Excel YouTube

This formula raises the monthly return by 12 (the number of months in a year) and subtracts 1 to convert it to an annualized. What is the rate of return? Web use excel to determine.

Microsoft Excel 3 ways to calculate internal rate of return in Excel

Web in an empty cell, type in the rate function formula to calculate the average annual rate of return. Web to calculate the annualized rate of return from monthly returns in excel, you can use.

How to Calculate Rate of Return in Excel 365 Financial Analyst

Excel’s rate function is what you’ll use here. The annualized return is a key measure. Web step 5) divide this percentage by the number of years over which the loan is spread to calculate the.

How To Calculate Annualised Return In Excel What is the rate of return? Master investment analysis quickly and efficiently. Web calculating annualized return in excel can provide a clear understanding of average annual rate of return. Web the basic formula for calculating annualized return is: Calculating annualized rate of return in excel is an essential skill for anyone involved in finance, investments, or business analysis.