How To Calculate Interest On A Loan In Excel

How To Calculate Interest On A Loan In Excel - For this step, you might want to include cells for the principal amount of the loan, your annual interest rate, how many years you plan to repay the loan, what your starting period is and what your ending period is. Web pmt, one of the financial functions, calculates the payment for a loan based on constant payments and a constant interest rate. To build a loan or mortgage amortization schedule in excel, we will need to use the following functions: Web we can calculate accrued interest on a loan in excel using several methods. For example, it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan.

Web the tutorial explains the syntax and basic uses of excel ipmt function with formula examples to calculate the interest portion of a periodic payment on a loan or mortgage. Gather the annual interest rate, monthly payment, and loan amount and place them in your sheet. Web mind your money. For this step, you might want to include cells for the principal amount of the loan, your annual interest rate, how many years you plan to repay the loan, what your starting period is and what your ending period is. Web to calculate the total interest for a loan in a given year, you can use the cumipmt function. Web the ppmt function in excel calculates the principal portion of a loan payment for a given period based on a constant interest rate and payment schedule. The amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per period.

Calculate payment for a loan Excel formula Exceljet

Web how to create a loan amortization schedule in excel. The amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per period. Web to calculate the interest portion.

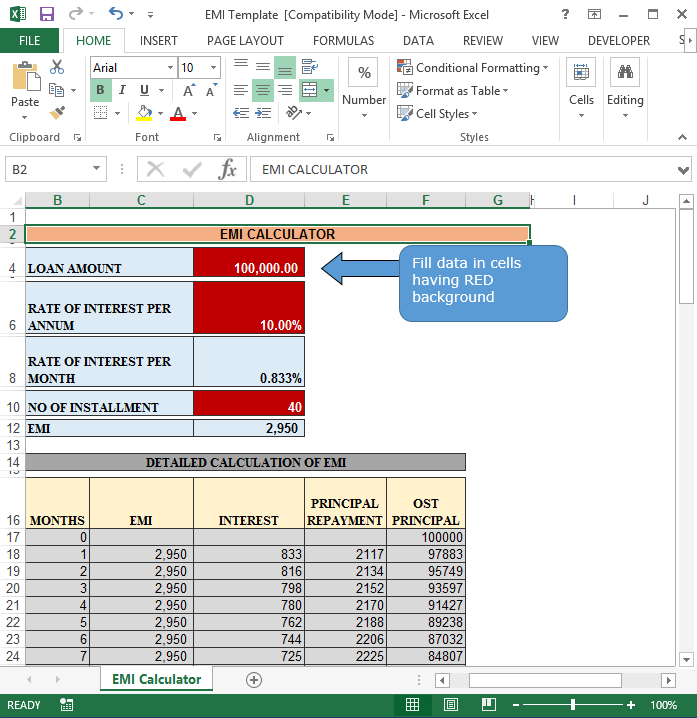

Loan Calculator in Microsoft Excel

Web the interest rate calculator determines real interest rates on loans with fixed terms and monthly payments. Web here’s how you can calculate the total interest paid over the duration of a loan: Pmt calculates.

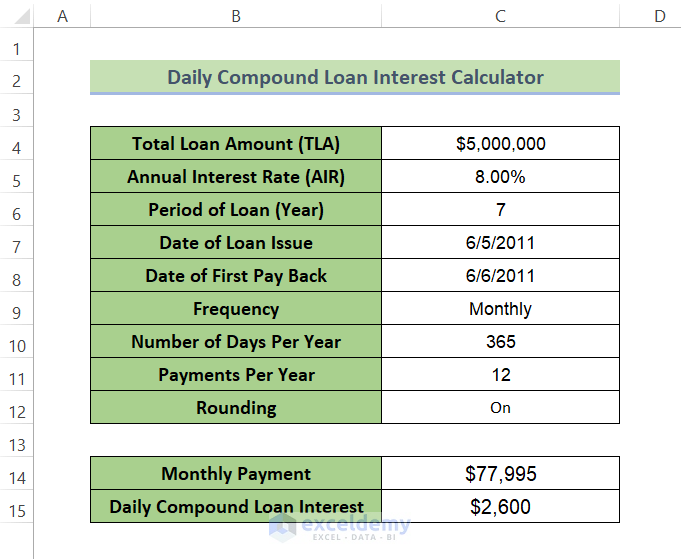

Daily Loan Interest Calculator in Excel (Download for Free) ExcelDemy

In the example shown, the formula in c10 is: In the example shown, the total interest paid in year 1 is calculated by using 1 for start period and 12 for end period. Use the.

Calculate loan interest in given year Excel formula Exceljet

You can calculate interest payments. Web divide your annual interest rate by 12 to determine your monthly interest rate. Web to calculate the periodic interest rate for a loan, given the loan amount, the number.

How To Calculate Total Interest Paid Over The Life Of A Loan In Excel

Subtract your interest charge from your monthly bill and get your principal cost. Loan calculator templates for excel. Web the tutorial explains the syntax and basic uses of excel ipmt function with formula examples to.

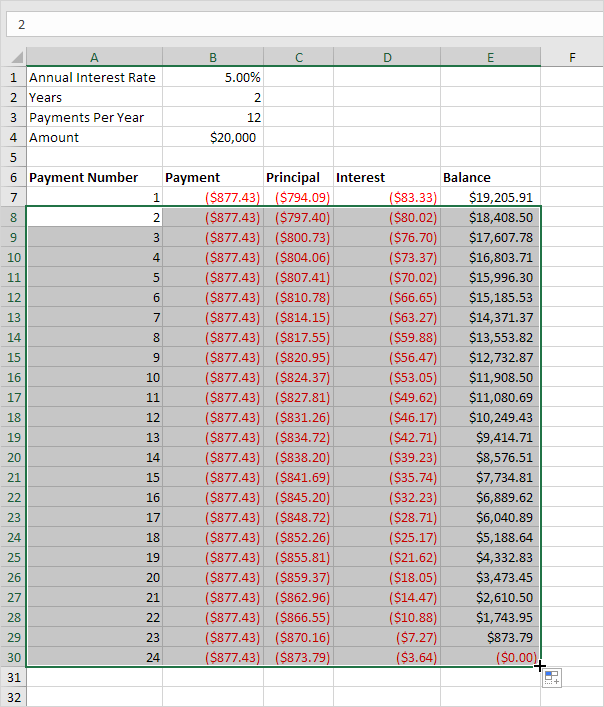

How to create a loan amortization schedule In Excel Excel Examples

Web how to calculate a payment term in excel. Pv is the principal loan amount (total loan amount). Web find out about compound interest and how to use the compounding interest formula in microsoft excel.

How To Calculate A Loan Payment In Excel

Step 2) as the nper argument, give the number of years for loan repayment. Pmt calculates the payment for a loan based on constant payments and a constant interest rate. Web divide your annual interest.

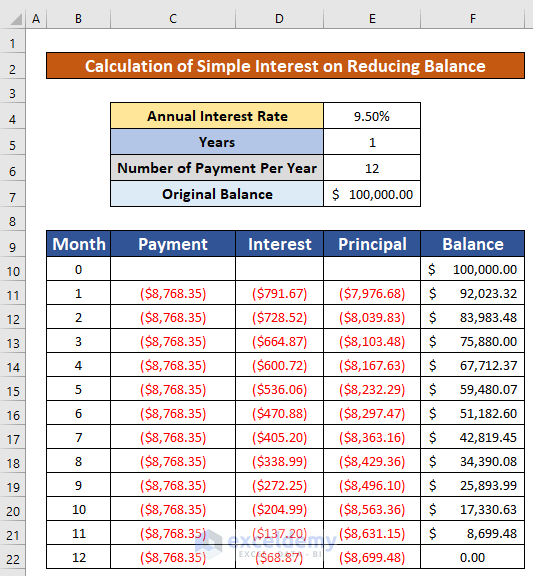

How to Calculate Simple Interest on Reducing Balance in Excel

You can use the pmt function to get the payment when you have the other 3 components. The amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per.

How to Calculate Principal and Interest on a Loan in Excel ExcelDemy

Web calculate the simple interest, cumulative and compound interest on a loan in excel using functions like pmt, ipmt, ppmt, cumimpt and pv. Let’s now find the interest rate implicit in it. In the example.

How to Use Compound Interest Formula in Excel Sheetaki

These schedules are commonly used when financing a major purchase like a home or car. Web excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it.

How To Calculate Interest On A Loan In Excel Understanding how to calculate interest on a loan in excel is crucial for effective financial management. For your better understanding, we will use a sample data set containing the loan amount, yearly interest rate, daily interest rate, and accrued interest period to calculate accrued interest on a loan for method 1. In the example shown, the formula in c10 is: You can then use the ipmt function to determine how much you'll have to pay in interest in each period. You can use the pmt function to get the payment when you have the other 3 components.