How To Calculate Wacc On Excel

How To Calculate Wacc On Excel - Insert a new column to store the calculated wacc. This is a video tutorial on how to calculate the weighted average cost of capital, otherwise known as the wacc. Web the wacc formula is: Web the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its shareholders, including debt holders, equity. Ryan o'connell, cfa, frm explains how to calculate weighted average cost of capital (wacc) using excel.

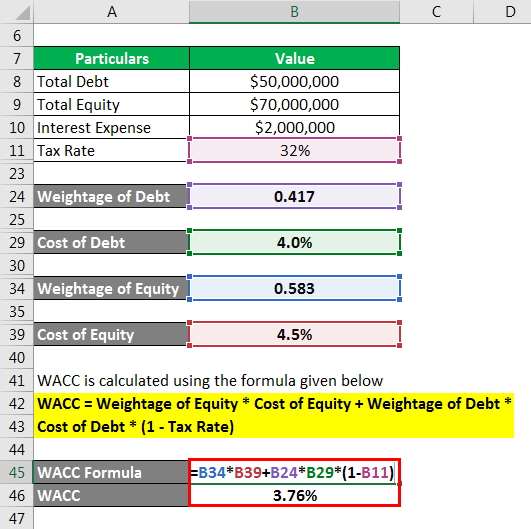

Combine components to determine the discount rate. = (equity / total capital) * cost of equity + (debt / total capital) * cost of debt. = sumproduct (cost * weight) / sum (weight). E = market value of the firm’s equity (market cap) d = market value of the firm’s debt. 994 views 2 years ago. E = market value of the firm’s equity ( market cap) d = market value of the firm’s debt. 28k views 2 years ago #financialmodeling #excel #wacc.

How To Calculate The WACC Using Excel Step By Step Guide IIFPIA

We will use excel to go over the wa. 88k views 6 years ago excel tutorials. Insert a new column to store the calculated wacc. V = total value of capital (equity plus. Web the.

How to Calculate the WACC in Excel WACC Formula Earn & Excel

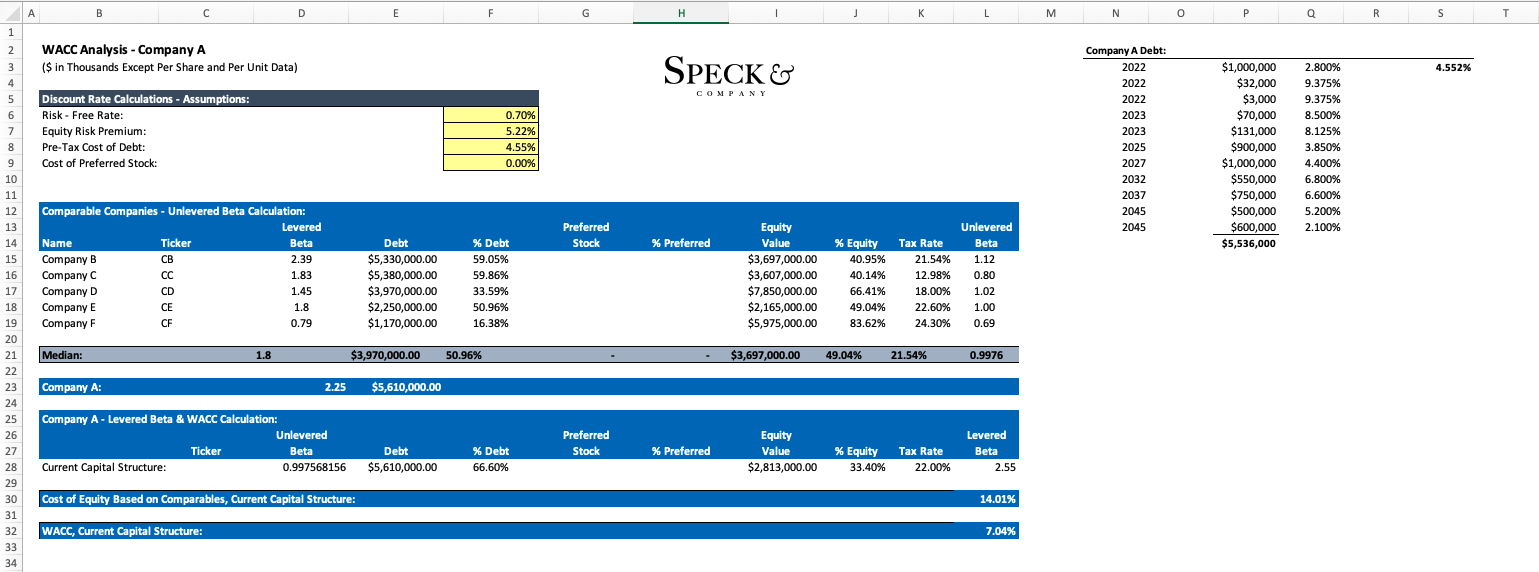

Below we present the wacc formula, it is necessary to understand the. Ryan o'connell, cfa, frm explains how to calculate weighted average cost of capital (wacc) using excel. Assessing project risk a company can use.

How to Calculate Wacc in Excel?

Web the wacc can be used as the discount rate when calculating the value of a company. Web wacc= (we x ke) + (wd x kd) below is the explanation of arguments used in the.

How to Calculate WACC in Excel (with Easy Steps) ExcelDemy

88k views 6 years ago excel tutorials. Before you begin the wacc calculation on excel, you will need to gather some essential information. Web the weighted average cost of capital (wacc) is the average rate.

How to Calculate WACC in Excel Sheetaki

This is a video tutorial on how to calculate the weighted average cost of capital, otherwise known as the wacc. You can use this as well. E = market value of the firm’s equity (market.

How to Calculate the WACC in Excel WACC Formula Earn & Excel

Assessing project risk a company can use the wacc to evaluate whether an internal. This is a video tutorial on how to calculate the weighted average cost of capital, otherwise known as the wacc. Web.

Calculate WACC in Excel Step by Step YouTube

Web the formula for wacc is as follows: E = market value of the firm’s equity (market cap) d = market value of the firm’s debt. Combine components to determine the discount rate. V is.

How to Calculate WACC in Excel Sheetaki

Web wacc= (we x ke) + (wd x kd) below is the explanation of arguments used in the formula given above: Web in this video, we will over how to calculate the weighted average cost.

How to Calculate WACC in Excel Sheetaki

Web the formula for wacc is as follows: In this tutorial, i'm using. 88k views 6 years ago excel tutorials. Web in this video, we will over how to calculate the weighted average cost of.

How to Calculate WACC in Excel Speck & Company

We will use excel to go over the wa. Web wacc= (we x ke) + (wd x kd) below is the explanation of arguments used in the formula given above: Web the formula for wacc.

How To Calculate Wacc On Excel E = market value of the firm’s equity (market cap) d = market value of the firm’s debt. Web the formula for wacc is as follows: 88k views 6 years ago excel tutorials. Web the weighted average cost of capital (wacc) is the average rate of return a company is expected to pay to all its shareholders, including debt holders, equity. You can calculate wacc in excel by using parameters like cost of equity, cost of debt, total market debt, and total market equity.