How To Find Interest Rate In Excel

How To Find Interest Rate In Excel - Web formula to calculate an interest rate in excel. This represents the total number of payment periods, which could be months, years, etc. Create row headers for principal, interest, periods, and payment. Web the rate function in excel (rate) calculates the interest rate for a financial transaction, such as for an annuity or lump sum. This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly.

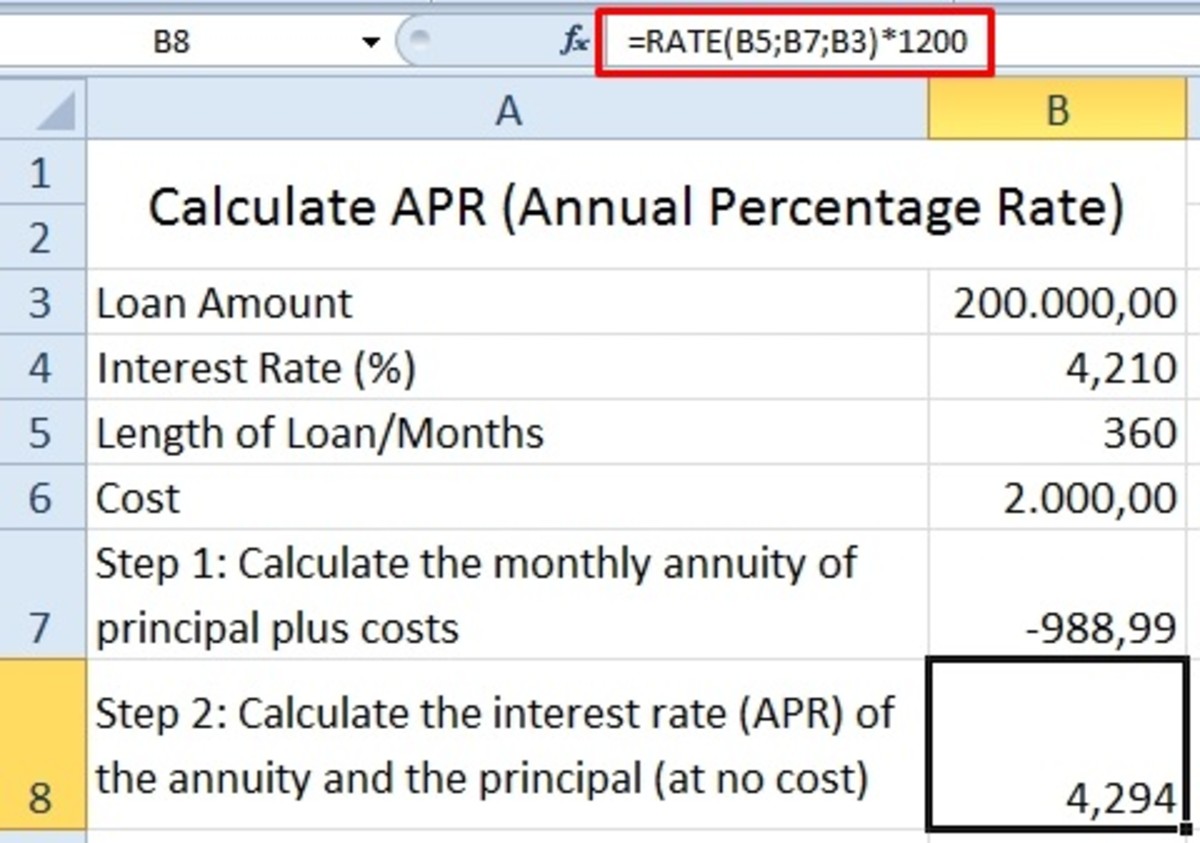

This represents the total number of payment periods, which could be months, years, etc. 4% (expressed as a decimal, so 4% becomes 0.04) loan term: Let’s break down how to calculate interest on a loan in excel using the pmt function. Web you know the present value of the loan ($1000) and the periodic payments to be made against it ($300 per year). Get the interest rate per period of an annuity. To use the rate excel worksheet function, select a cell and type: The generic formula for calculating ear (in excel formula syntax) is:

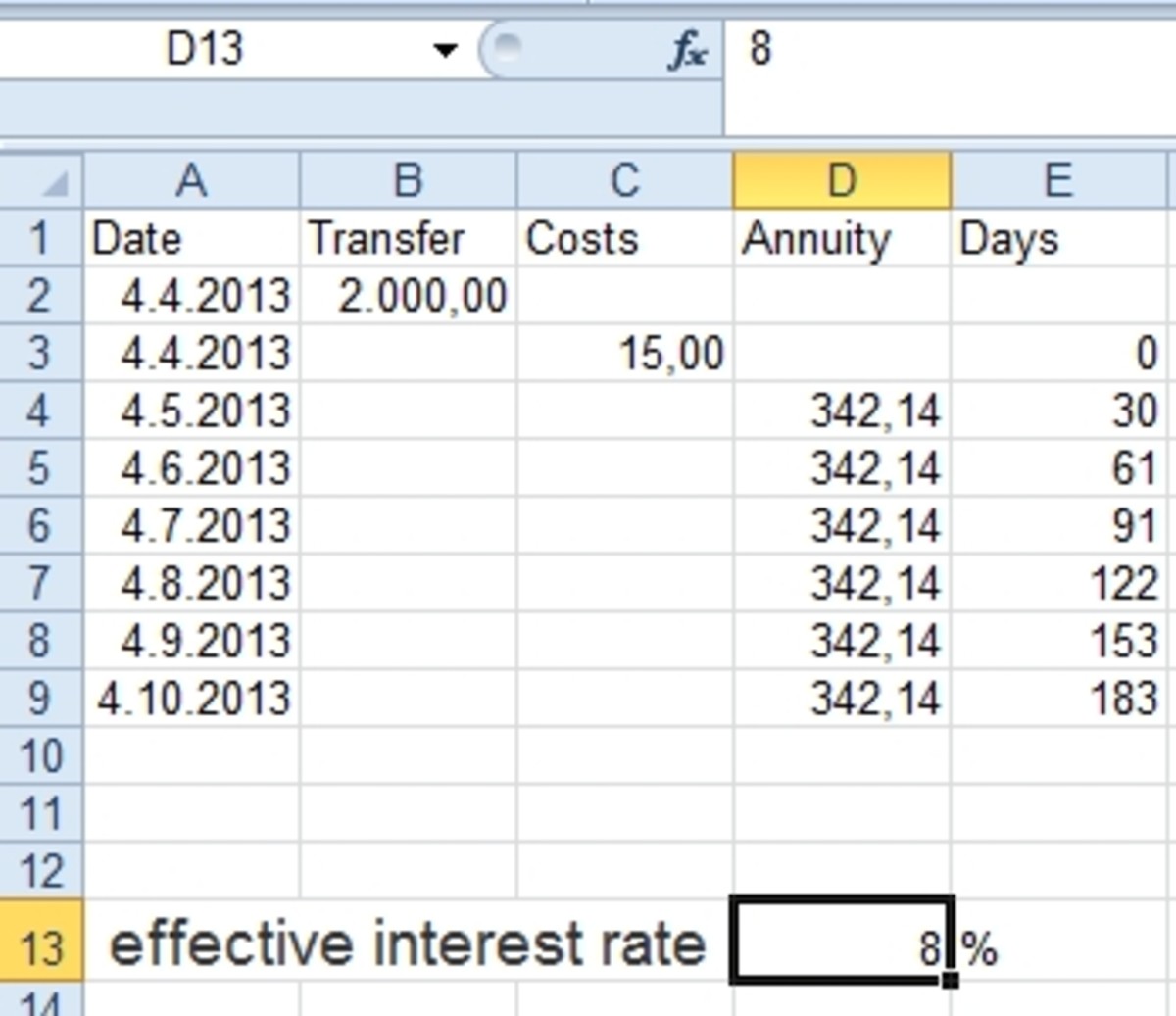

How to Calculate Effective Interest Rate and Discount Rate Using Excel

Web the usage of the rate function in excel is most common for calculating the interest rate on a debt instrument, such as a loan or bond. Web you know the present value of the.

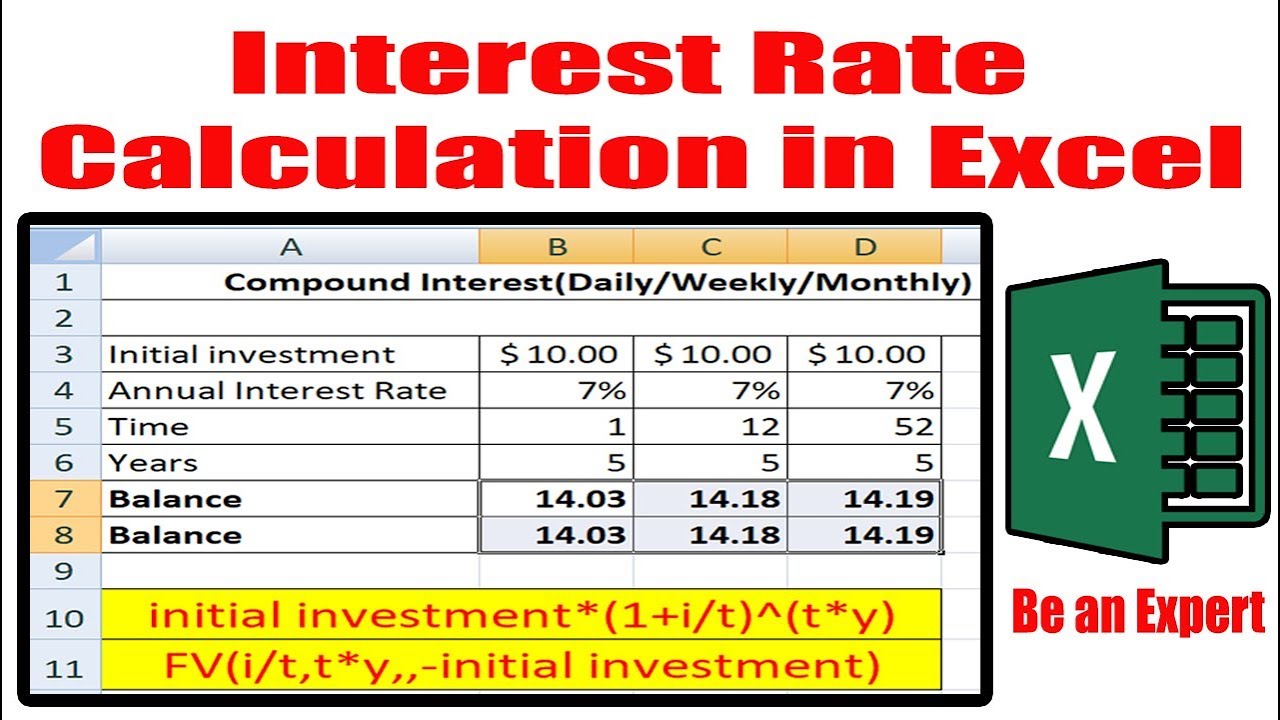

Interest Rate Calculation in Excel YouTube

In e5, the formula is: Interest that is not compounded), you can use a. The generic formula for calculating ear (in excel formula syntax) is: This represents the total number of payment periods, which could.

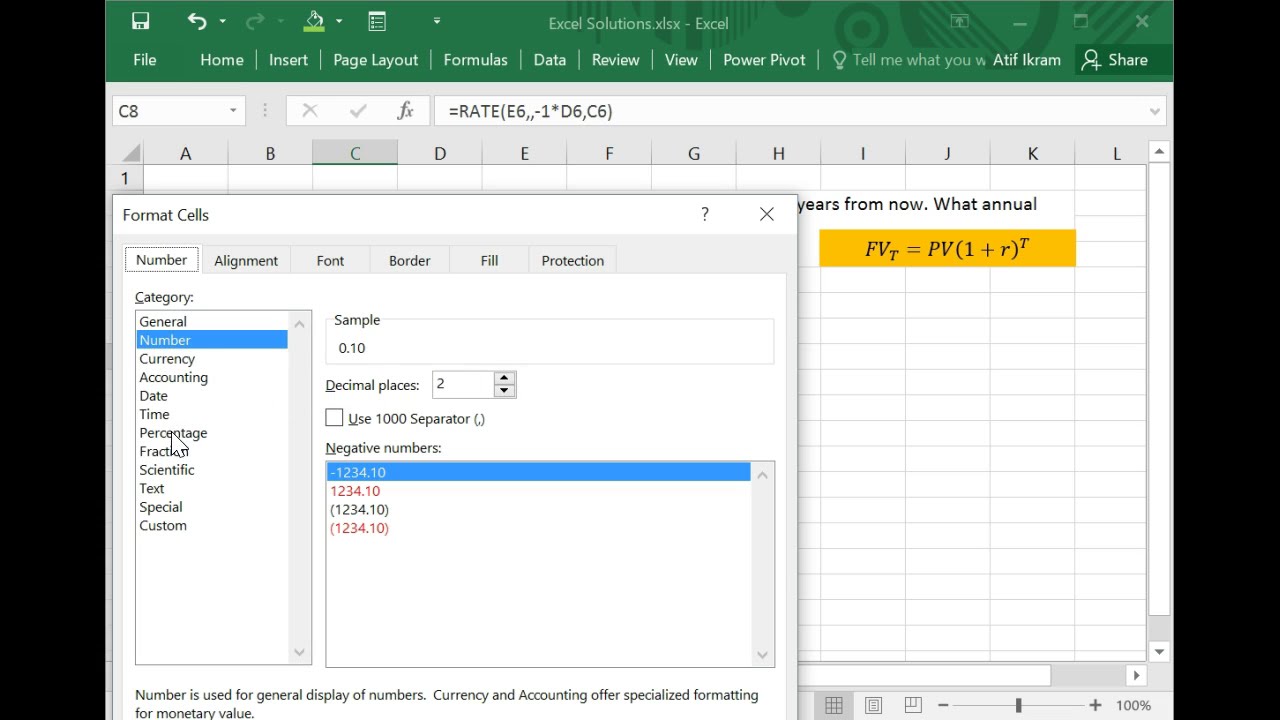

How to Calculate the Interest Rate (=RATE) in MS Excel YouTube

The generic formula for calculating ear (in excel formula syntax) is: Web this example uses the rate function to calculate the interest rate of a loan given the total number of payments ( totpmts ),.

How to Calculate Interest Rate on a Loan in Excel (2 Criteria) ExcelDemy

Step 2) as the nper argument, give the number of years for loan repayment. To calculate the interest on investments instead, use. This represents the total number of payment periods, which could be months, years,.

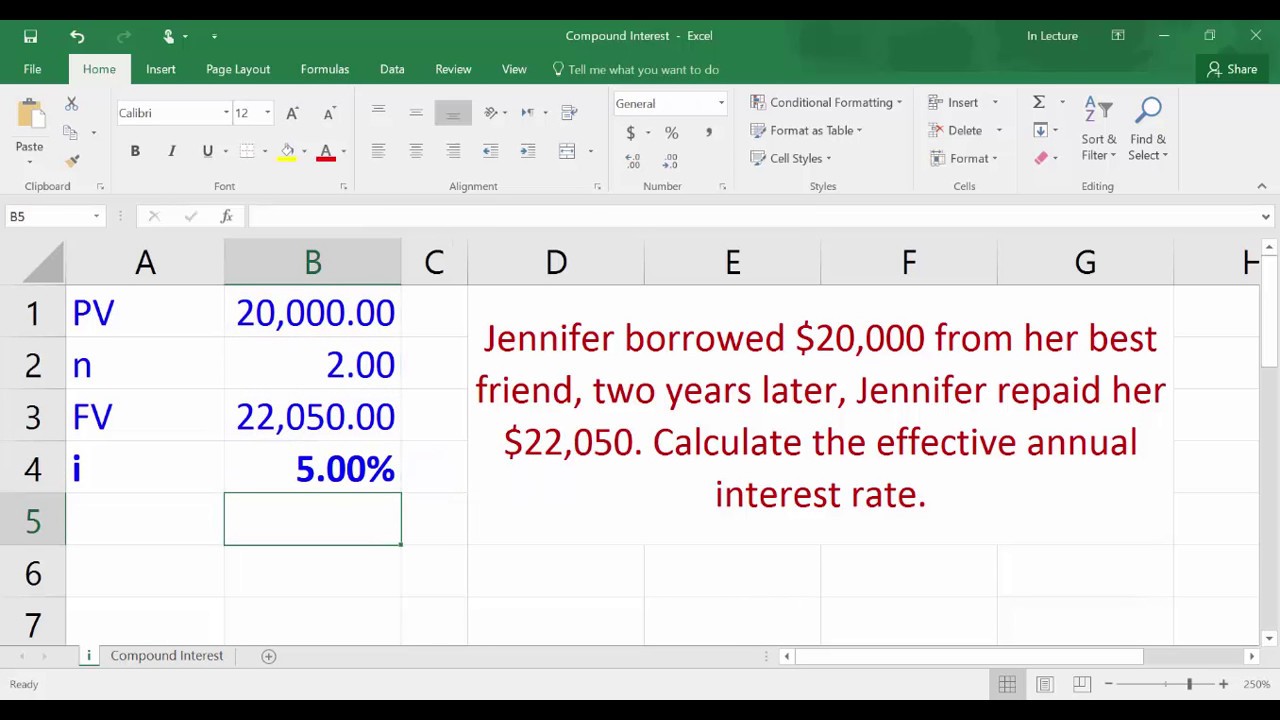

Finance Basics 2 Compound Interest in Excel YouTube

Maybe you have an existing loan and want to quickly see the annual interest rate you're paying. Step 1) begin writing the rate function. So, using cell references, we have: You will also find the.

Compound Interest Calculating effective interest rate using Excel YouTube

Using the general compound interest formula to calculate compound interest in excel. To calculate simple interest in excel (i.e. Web the rate function calculates the interest rate. An annuity is a series of equal cash.

How to calculate Interest Rate in Excel How to calculate interest

This represents the total number of payment periods, which could be months, years, etc. =rate (nper, pmt, pv, [fv], [type], [guess]) the function has six arguments (three mandatories and three optional): (notice how the formula.

How to Calculate Effective Interest Rate Using Excel ToughNickel

What is the rate function? As simple as calculating a payment with basic loan details, you can do the same to determine the interest rate. Fill out the principal amount, interest rate, and the number.

How to Calculate Effective Interest Rate in Excel with Formula

Web you know the present value of the loan ($1000) and the periodic payments to be made against it ($300 per year). Additionally, we can also calculate the monthly interest rate on a savings account..

How to Calculate an Interest Payment in Excel 7 Easy Steps

Web two ways to calculate compound interest in excel. Additionally, we can also calculate the monthly interest rate on a savings account. Step 2) as the nper argument, give the number of years for loan.

How To Find Interest Rate In Excel The syntax is as follows: You will also find the detailed steps to create your own excel compound interest calculator. In the payment row, use the formula =ipmt(b2, 1, b3, b1) to calculate the interest payment. Web to calculate the periodic interest rate for a loan, given the loan amount, the number of payment periods, and the payment amount, you can use the rate function. Web =rate(nper, pmt, pv, [fv], [ type ], [guess]) the function requires three key arguments: