How To Record Construction Draws In Quickbooks

How To Record Construction Draws In Quickbooks - From your detail type menu, hit notes payable. These reports help you monitor project costs, identify potential issues, and make informed decisions to optimize your construction business. Web click the plus ( +) icon. Web you can record construction costs by debiting construction from the processing system and crediting construction in progress or cash. Web quickbooks, the renowned accounting software, offers a reliable solution for recording construction draws effectively.

Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1. To do this, create an asset account and enter the construction costs as the account’s starting balance. Go to the transactions menu. Canada (english) canada (french) call sales: Web in quickbooks, you can capitalize construction costs by recording them as assets. Web quickbooks, the renowned accounting software, offers a reliable solution for recording construction draws effectively. For the account name, you can put work in progress.

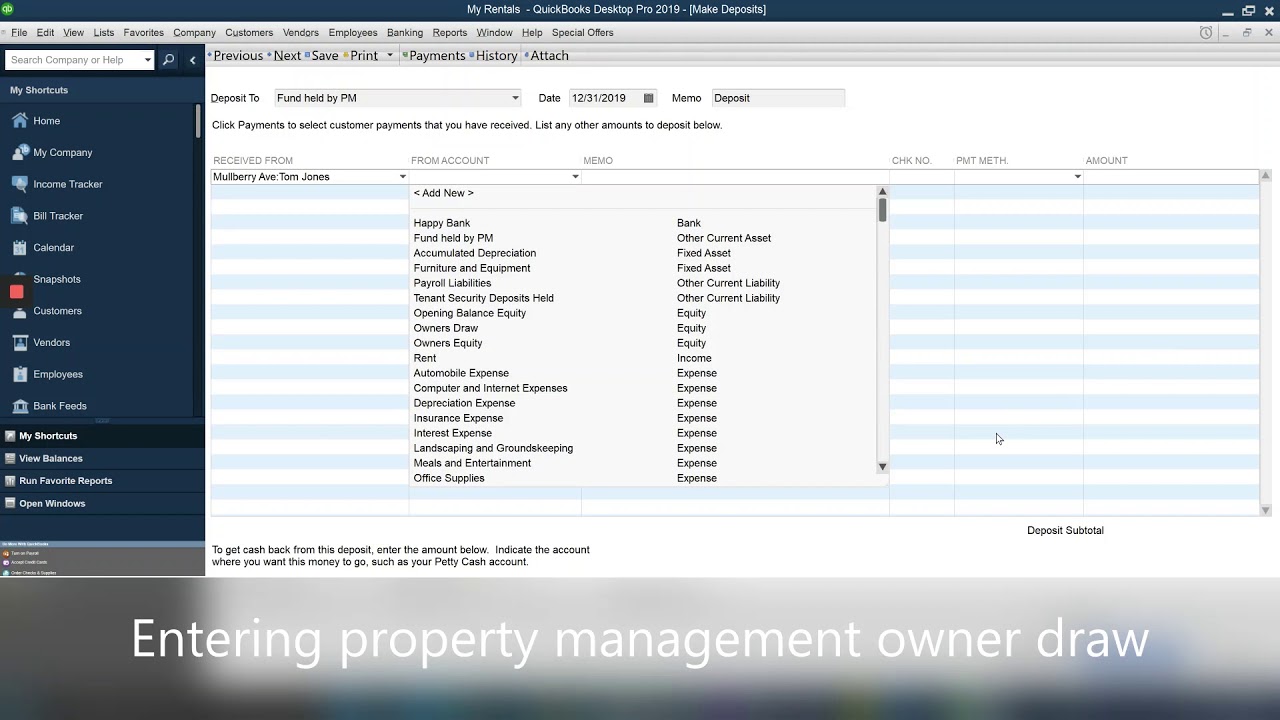

How to enter the property management owner draw to QuickBooks YouTube

Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1. Go to lists at the top menu bar and click on chart of accounts..

QuickBooks Enterprise Construction Cost Estimating, Job Costing

Select other current asset for the account type. Go to the transactions menu. Thus in that case you can add the interest. Web do i categorize a construction draw received as income? From your detail.

Construction Draws Accounting

Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1. Go to lists at the top menu bar and click on chart of accounts..

how to take an owner's draw in quickbooks Masako Arndt

Web 29k views 6 months ago. Your owner's draw account is the cumulative total of all draws you have taken out of the business since day 1. Web one way is to create a loan.

how to take an owner's draw in quickbooks Masako Arndt

Fill in the needed information. I was thinking with the open database i could automate the draws using crystal reports and let it take the information from qb to generate the draw report. Click the.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Fill in the needed information. Web in quickbooks, you can capitalize construction costs by recording them as assets. Web the first method is to create an owner’s draw account in quickbooks. A construction loan draw.

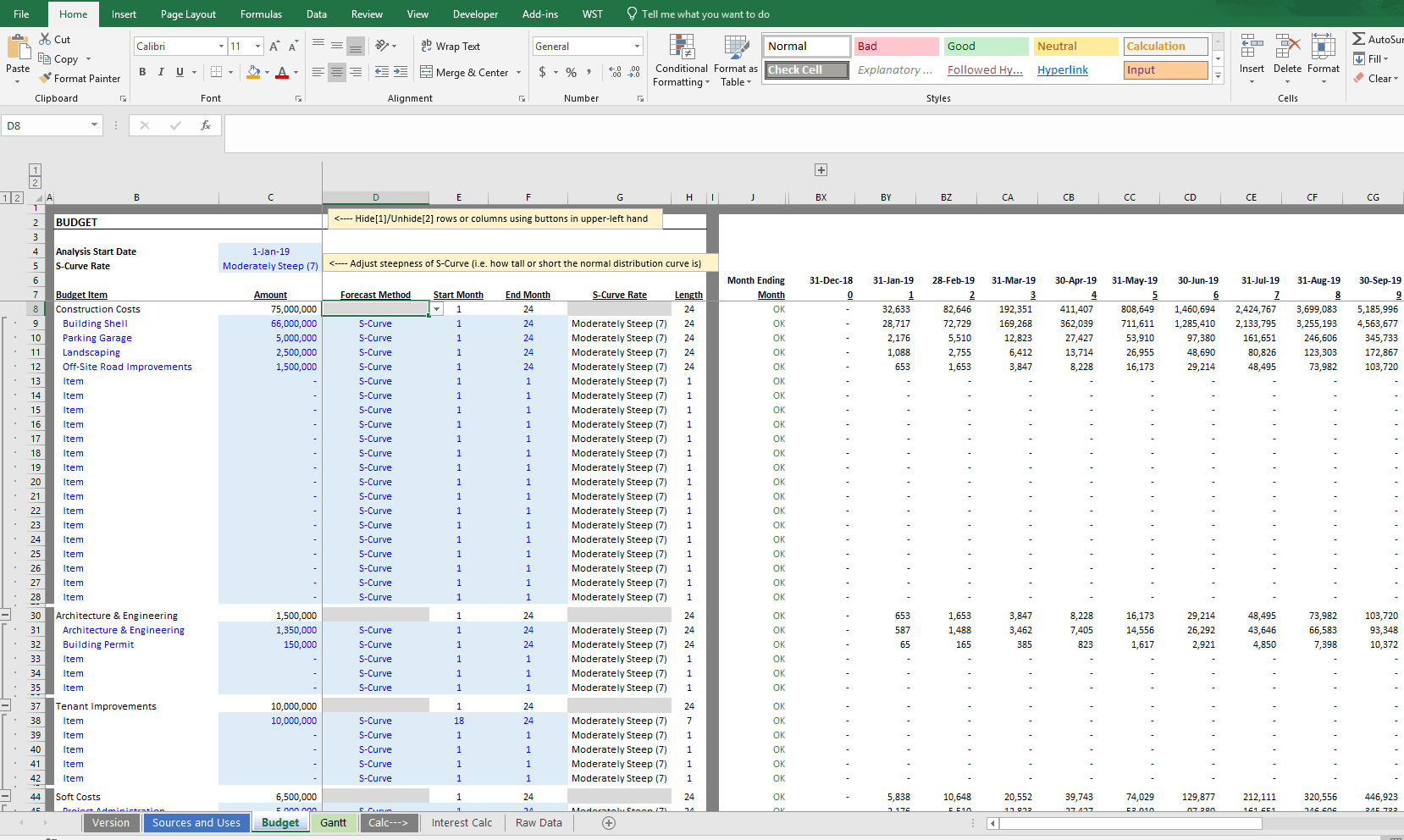

Tutorial Construction Draw and Interest Calculation Model

Second, the construction company will need to set up a construction budget. Then, click on the account button and select new. To do this, create an asset account and enter the construction costs as the.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Web understanding construction loan draw requests. Select other account types, then select the right account type for your loan: A construction loan draw schedule is a detailed payment plan for the construction project. And when.

Construction Estimating Construction Estimating Quickbooks

In this review, we will explore the positive aspects and benefits of using quickbooks to record construction draws, along with the ideal conditions for its implementation. Web quickbooks, the renowned accounting software, offers a reliable.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

In this review, we will explore the positive aspects and benefits of using quickbooks to record construction draws, along with the ideal conditions for its implementation. I'd also recommend reaching out to an accountant to.

How To Record Construction Draws In Quickbooks Web you can record construction costs by debiting construction from the processing system and crediting construction in progress or cash. Quickbooks desktopquickbooks for construction |job costing| construction projects accounting in quickbooks| quickbooks desktop for contractors how to setup. Web the first method is to create an owner’s draw account in quickbooks. These are typically split up into. Then, as you incur additional costs, record them as journal entries to the asset account.