Npv Template In Excel

Npv Template In Excel - What is the net present value formula? It is a financial measure to tell if an investment is going to be profitable or if it is worth investing in. It is used in capital budgeting and investment planning to determine whether a project or investment is worth pursuing. Web open excel and click blank workbook. Web the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment.

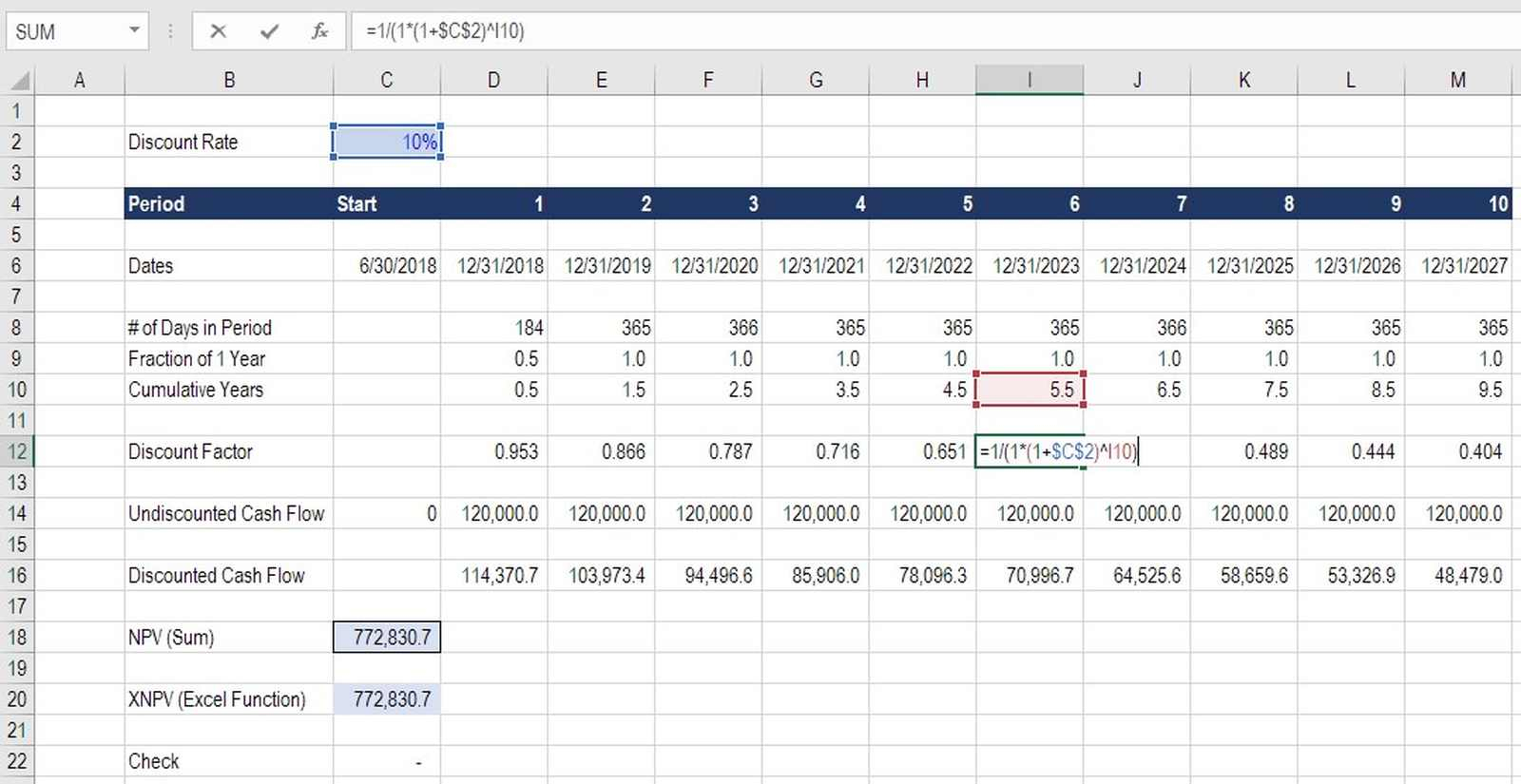

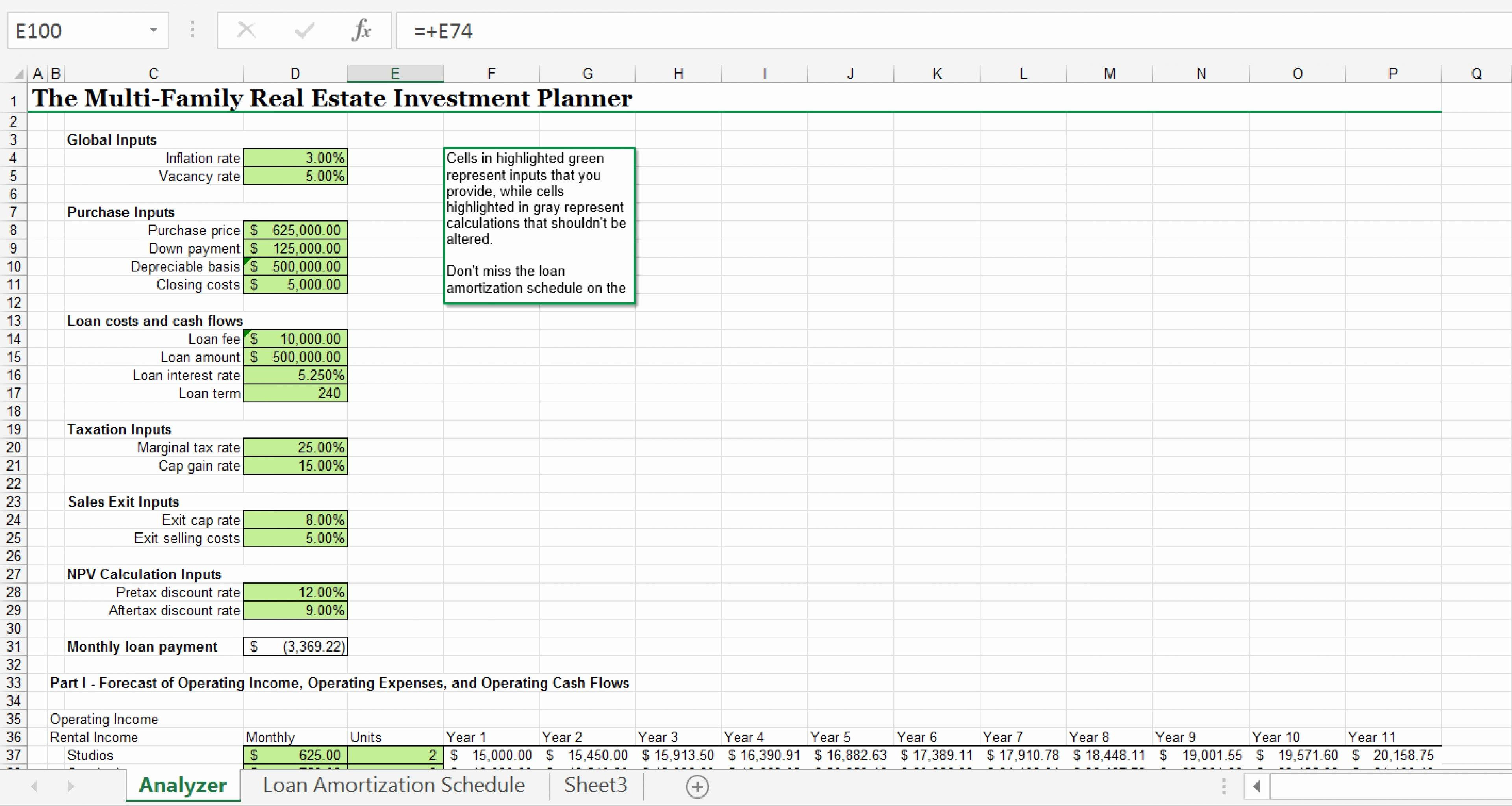

Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. =npv(rate, value1, [value2],.) the above formula takes the following arguments: 'replace instances of codes (from excel column b) in word doc with values from excel column c. In this example, we will calculate the npv over a 10 years period. The row titled ‘project npv’ displays your net present value for the specified investment. It is used in capital budgeting and investment planning to determine whether a project or investment is worth pursuing. It's perfect for team leaders and small business owners who are in the early.

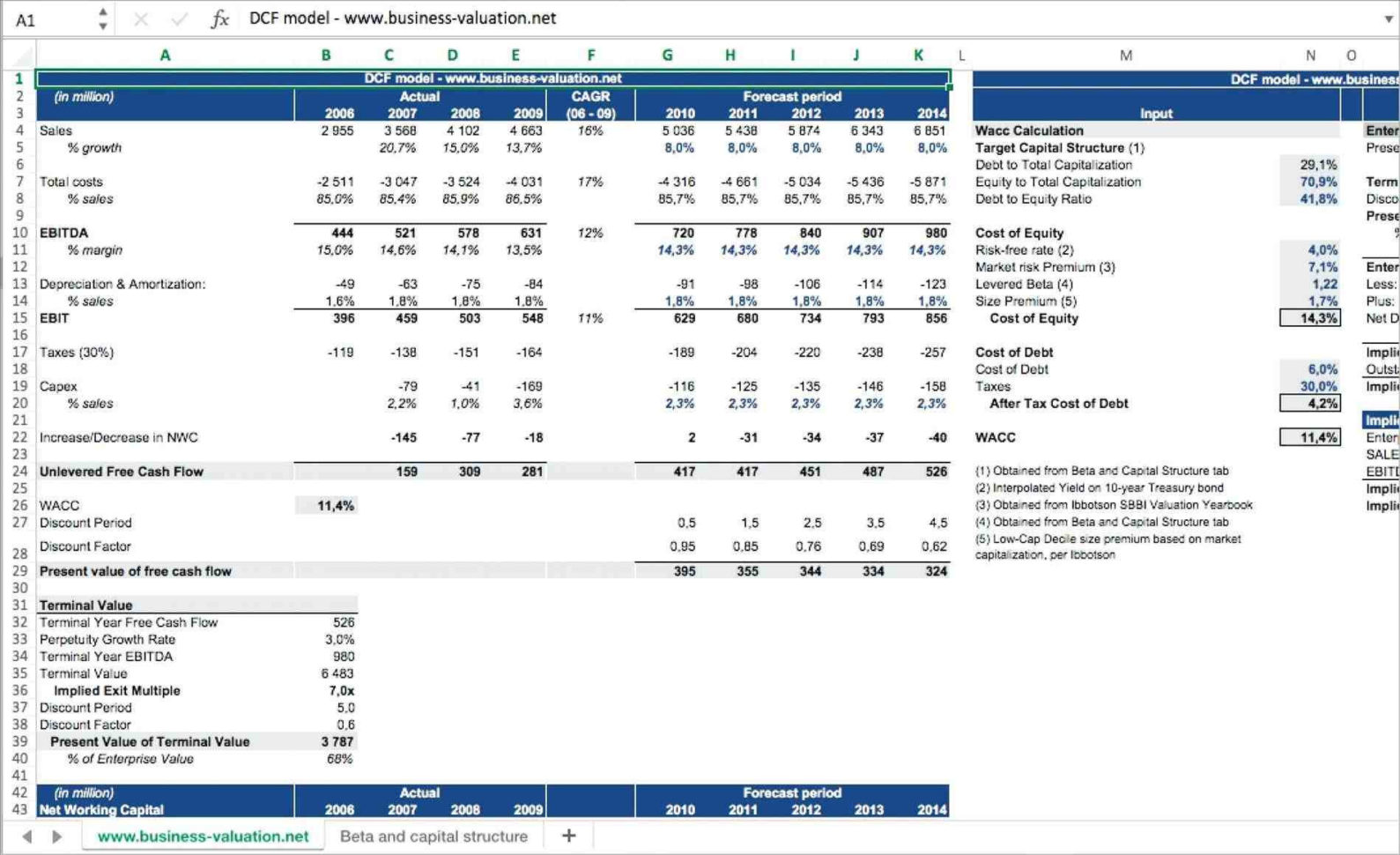

Npv Excel Spreadsheet Template —

Where n is the number of cash flows, and i is the interest or discount rate. Here, pv = cashflow / (1+r)t. It measures the present value of future cash inflows and outflows, discounted back.

Npv Excel Spreadsheet Template Spreadsheet Downloa Npv Excel

Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. =npv(rate, value1, [value2],.) the above formula takes the following arguments: Where, r = discount rate..

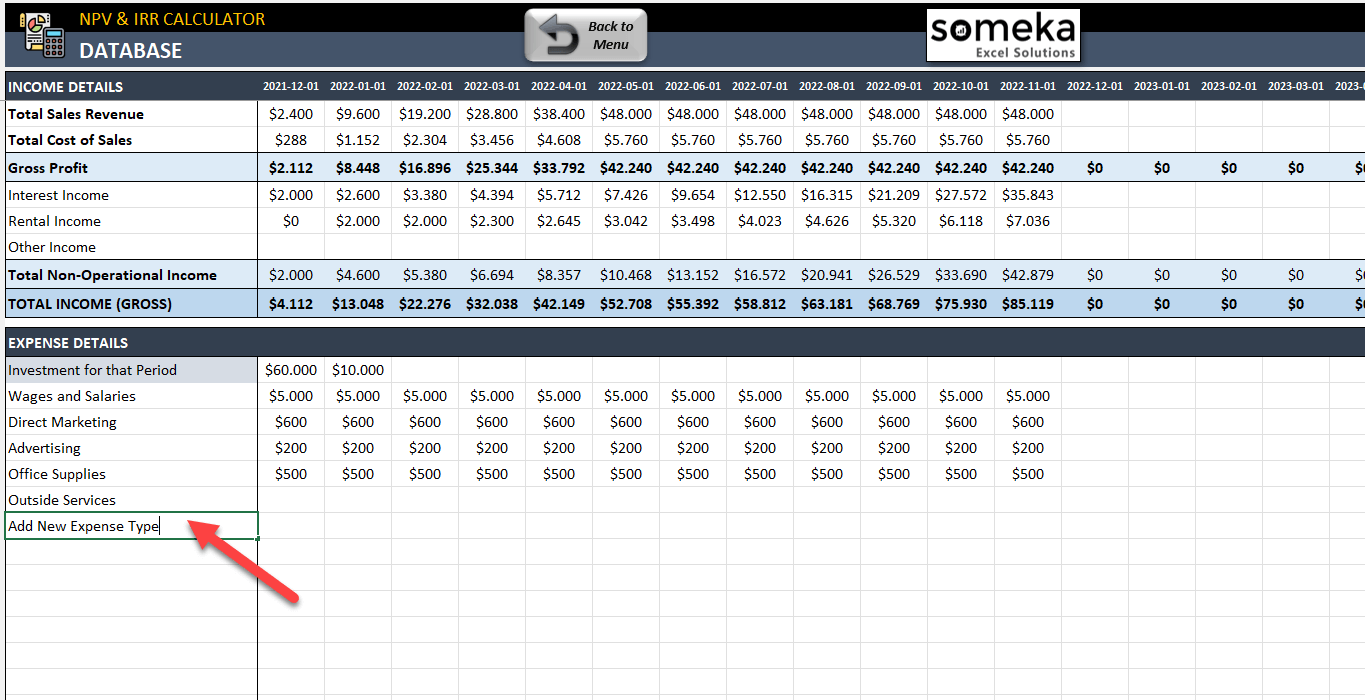

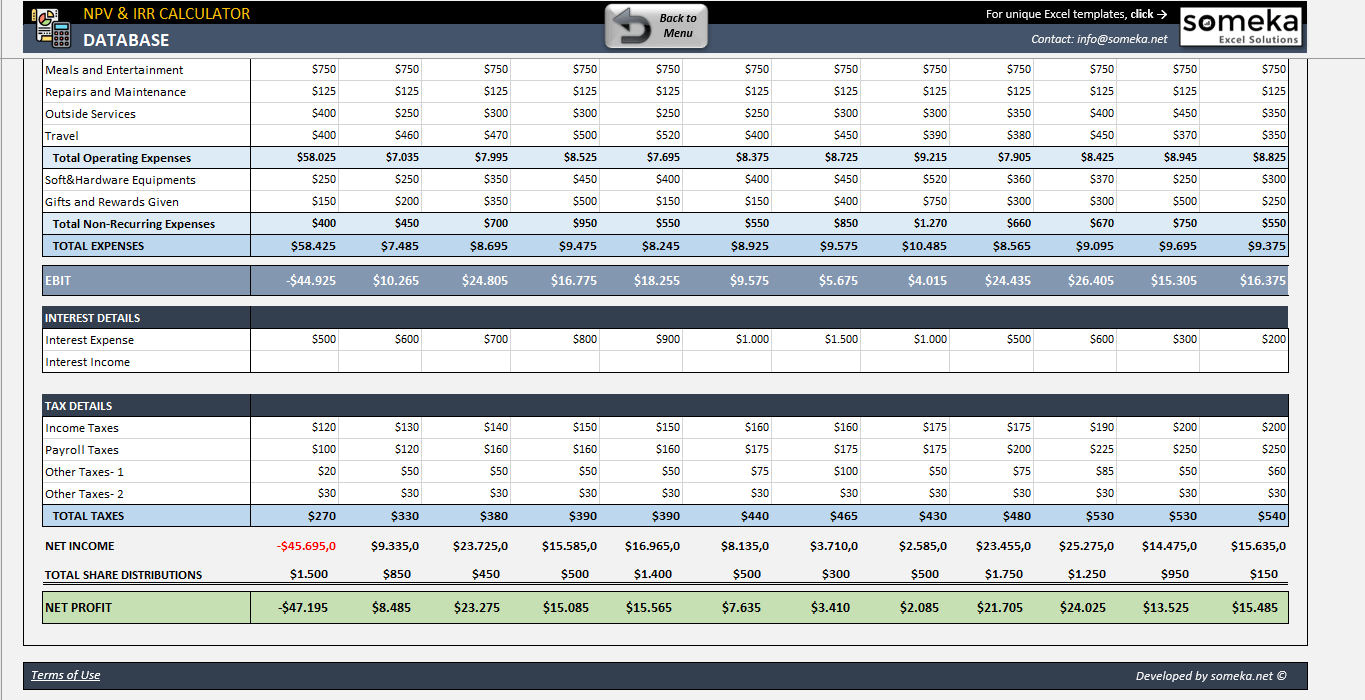

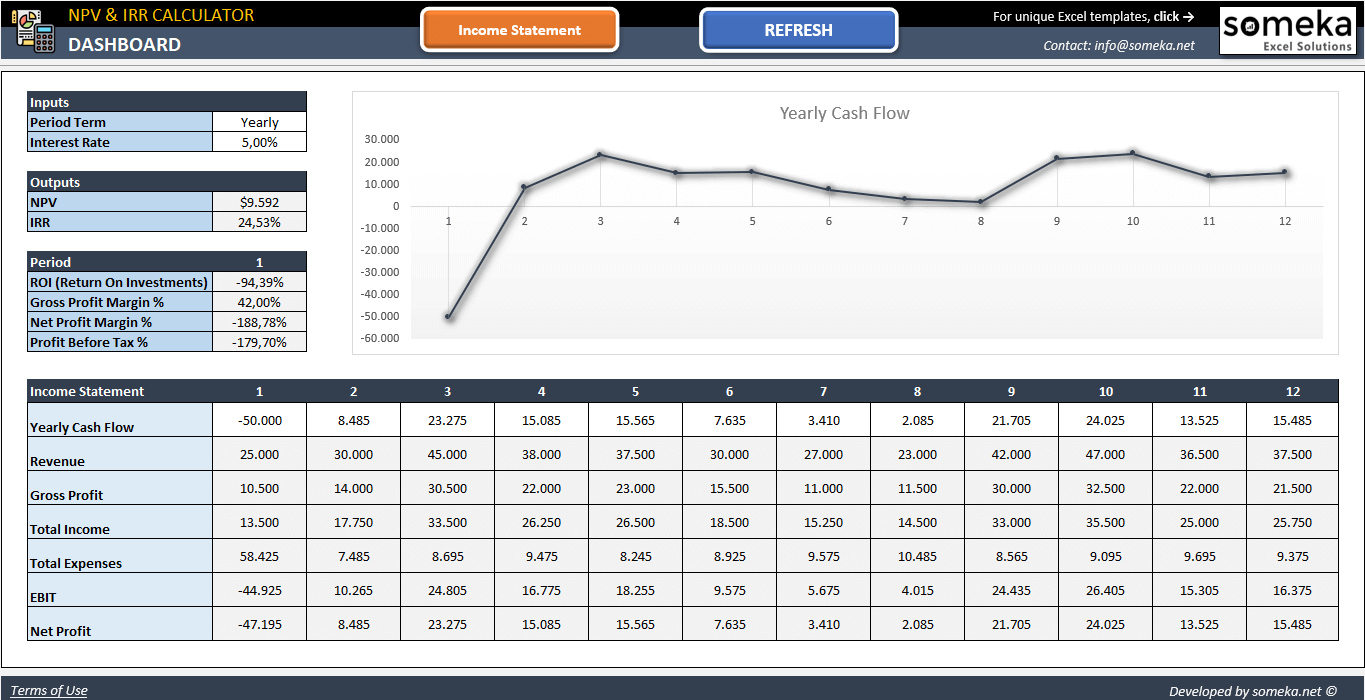

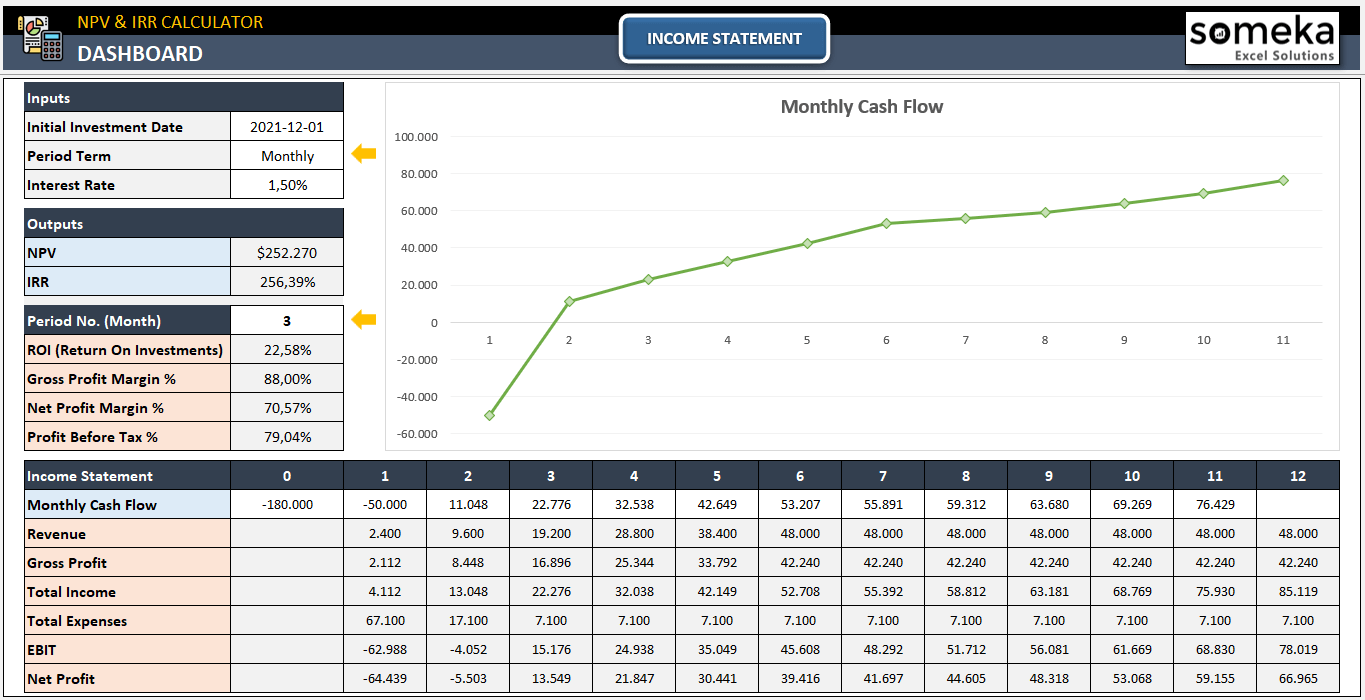

NPV Calculator Template Free NPV & IRR Calculator Excel Template

Step 1) create a sheet and set up values: =npv(rate, value1, [value2],.) the above formula takes the following arguments: Copy the values to follow the example. You can click on individual cells within npv excel.

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

Assuming the initial cash flow for a project is $10,000 invested for a project and subsequent cash flows for each year for 5 years is $3,000. It is important to understand the time value of.

NPV Calculator Template Free NPV & IRR Calculator Excel Template

Click on a shape, then click in your excel spreadsheet to add the shape. To calculate npv, we estimate the cashflows (outflows and inflows) to be generated from a. Web the npv function [1] is.

Professional Net Present Value Calculator Excel Template Excel TMP

Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. What is net present value? Net present value (npv) is the.

NPV Calculator Template Free NPV & IRR Calculator Excel Template

It shows you whether a project is going to be profitable for you or not. For example, if your cashflows are happening every year, this would be the annual discount rate. Web net present value.

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

Web this article describes the formula syntax and usage of the npv function in microsoft excel. 'loop through cells in excel file. Copy the values to follow the example. Web this net present value template.

Npv Excel Spreadsheet Template —

Net present value is the current value of a future stream of cash flows discounted back to the present. It is used in capital budgeting and investment planning to determine whether a project or investment.

Net Present Value Formula Examples With Excel Template

To calculate npv, we estimate the cashflows (outflows and inflows) to be generated from a. Paste the values directly into your sheet. Web npv is a financial metric used to evaluate the potential profitability of.

Npv Template In Excel Npv(rate,value1,[value2],.) the npv function syntax has the following arguments: To calculate npv, we estimate the cashflows (outflows and inflows) to be generated from a. =npv(rate, value1, [value2],.) the above formula takes the following arguments: It is used in capital budgeting and investment planning to determine whether a project or investment is worth pursuing. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value.