Pay Stub Excel Template

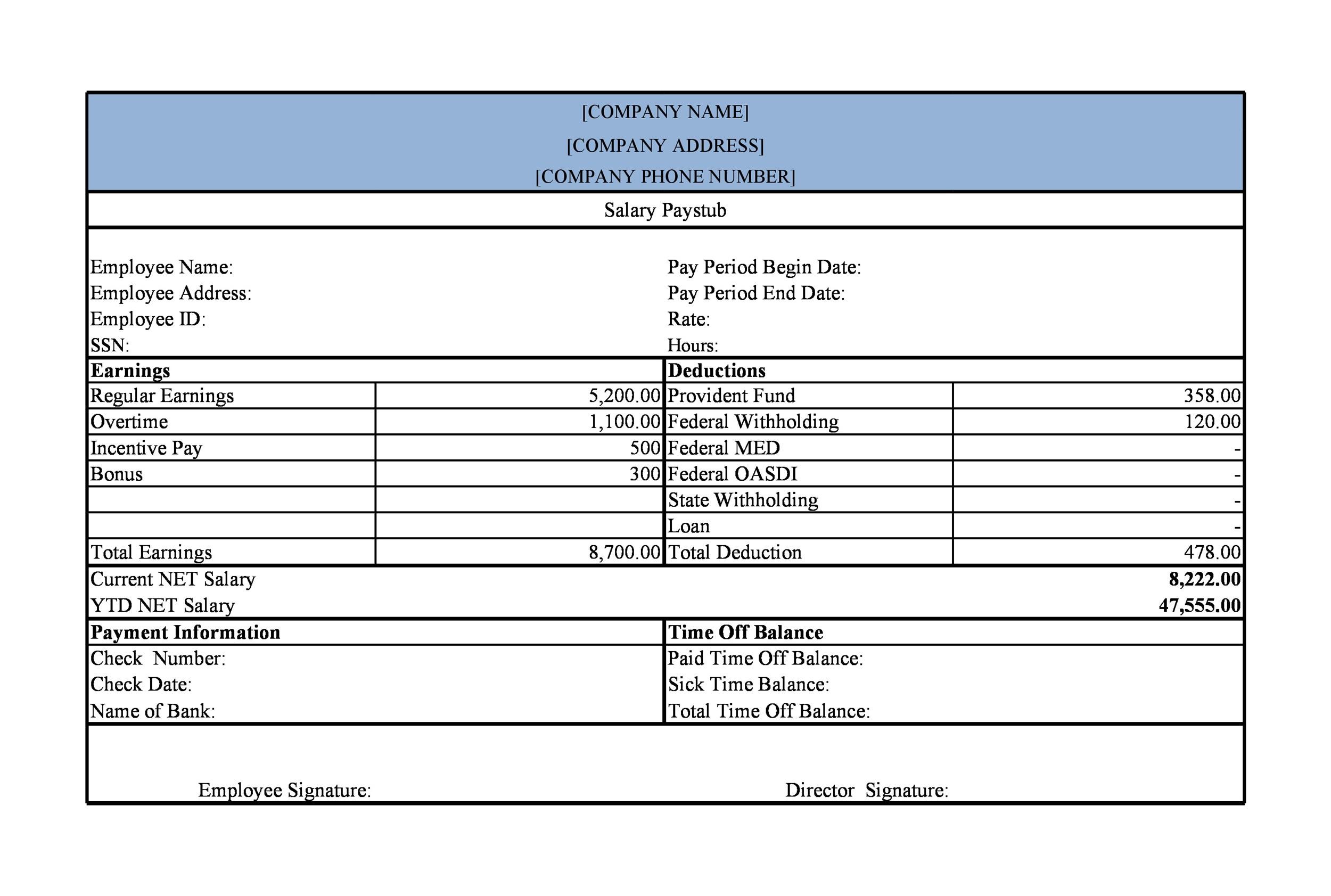

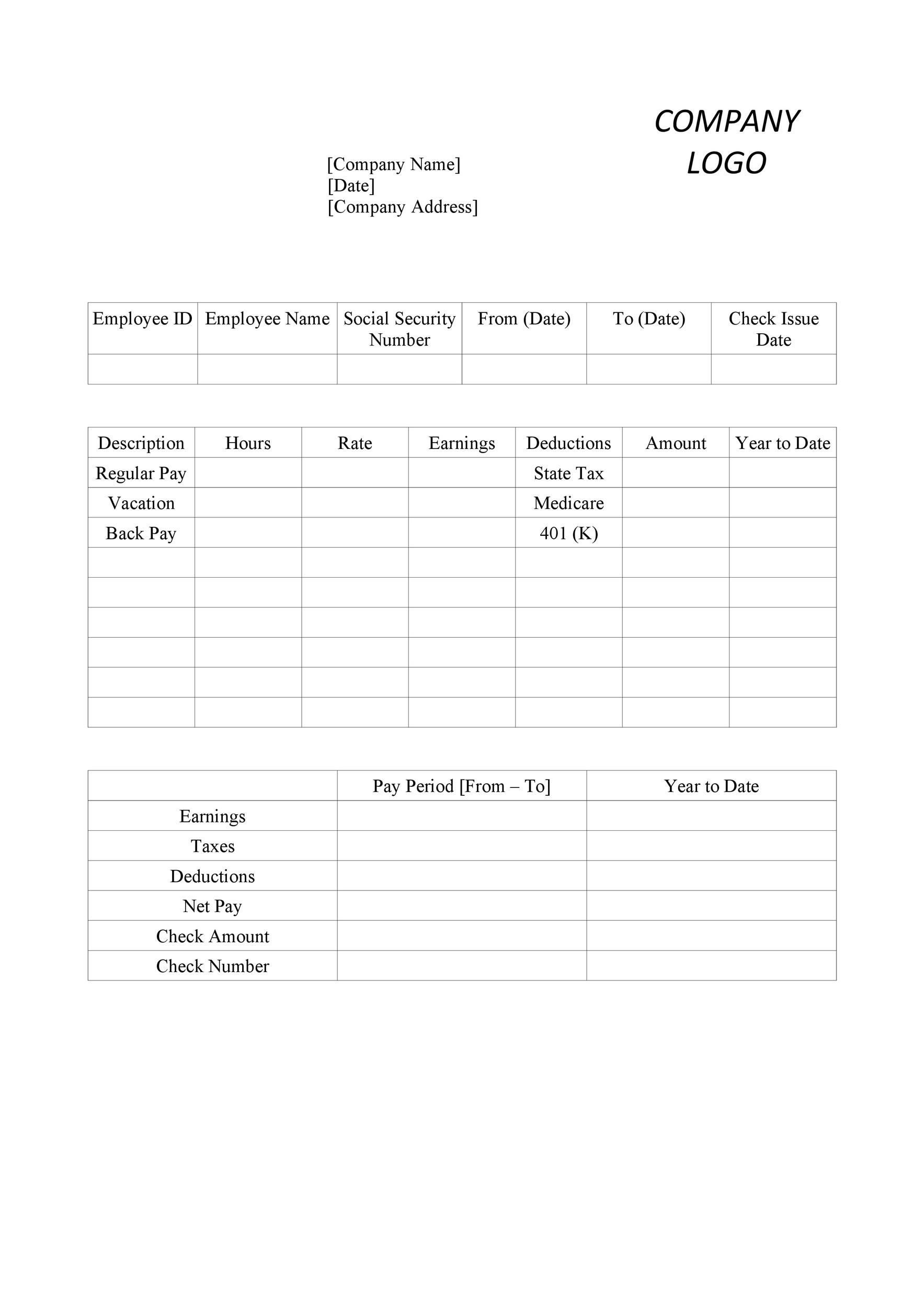

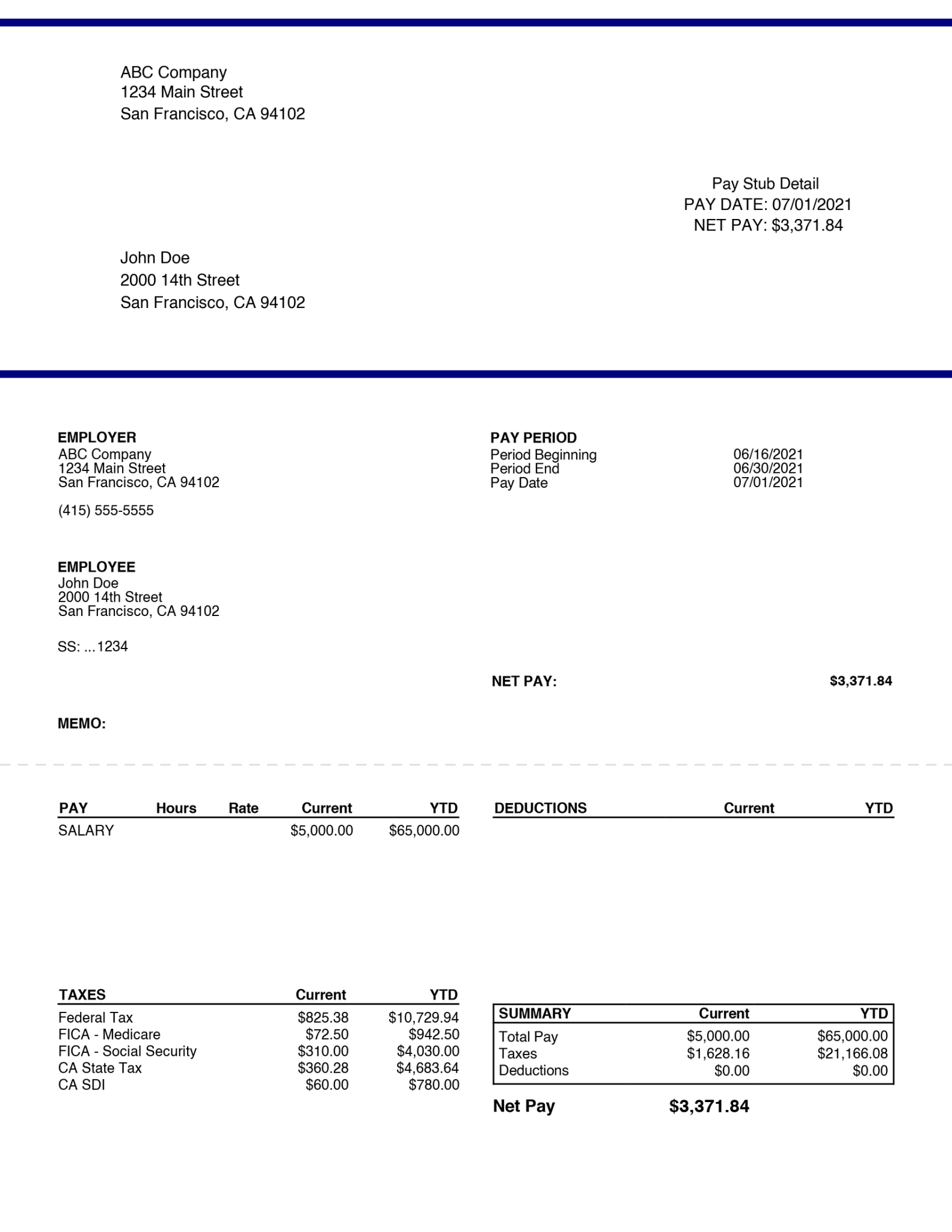

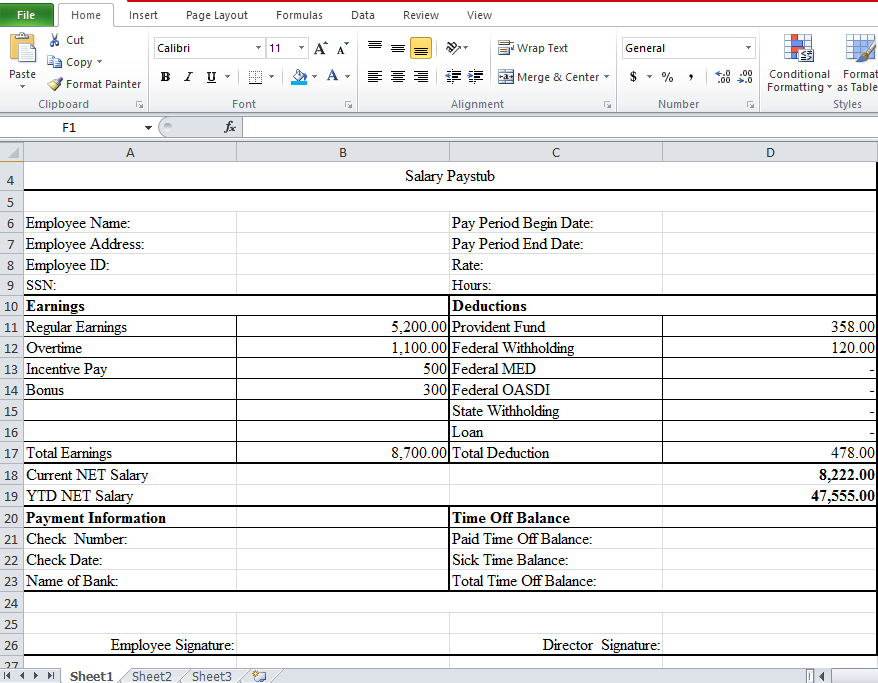

Pay Stub Excel Template - Web a pay stub, also known as a paycheck stub or earnings statement, is an itemized document that summarizes an employee’s compensation. However, if you want a free pay stub template with a calculator then select the ms excel version as it will calculate the totals for you. Web download free payroll templates for excel, word, and pdf. Therefore, this document is essential as it helps the employer maintain accurate and complete payroll records for the employees. Web this paystub excel template provides details of their pay from the pay period.

This template will include spaces for company and employee information, the pay period, and. There are different templates available to suit other job groups and tax brackets. Web getting people paid on time is a big job, but you're more than up to the task with the help of these payroll templates. What is a pay stub? This payslip template includes very distinct sections. The templates vary in design and function, but they are all ready to use for any professional need. Web this paystub excel template provides details of their pay from the pay period.

15 Free Pay Stub Templates [Word, Excel, PDF] TemplateLab

Web pay stub templates & examples in microsoft excel. Pay stub template with pto. Download and use these pay stub templates for free. Written by john word templates. The layouts are equipped with a timesheet.

15 Free Pay Stub Templates [Word, Excel, PDF] TemplateLab

Google sheets template | microsoft excel template. These printable templates are legally binding, easy to use, and fully customizable. Web creating pay stubs in excel is a simple and effective way to manage your payroll.

25 Great Pay Stub / Paycheck Stub Templates

Web business pay stubs. The templates vary in design and function, but they are all ready to use for any professional need. Employers can either give check stubs personally or through email to their employees..

25 Great Pay Stub / Paycheck Stub Templates

The layouts are equipped with a timesheet template, sample payroll register, and employee payroll calculator that accounts for income tax, payroll tax, and other deductions. Payslips detail the amount of pay given before tax, as.

25 Great Pay Stub / Paycheck Stub Templates

Web paystub template in excel. There are different templates available to suit other job groups and tax brackets. Pay stub template with overtime and pto. Word • excel • pdf. Employers can either give check.

Pay Stub Template Excel Template Business

Pay stub template with pto. Of those, eleven states require employers to provide a physical copy of a pay stub, instead of a digital one. It’s essentially a snapshot of how much they take home,.

Free Pay Stub Template with Calculator No Watermark Download Sample

Web employee pay stub excel template. Web in this tutorial, we’ll be creating a pay stub template in excel that can be reused each time you need to generate a new one. Web paystub template.

Sample Pay Stub Templates Mr Pay Stubs

This payslip template includes very distinct sections. These excel templates can be adjusted to reflect hourly rates and overtime, salaries, taxes and withholdings that apply to your business. Download and use these pay stub templates.

100 Free Employee Pay Stub Template Excel Excel TMP

Word • excel • pdf. Web 8 free pay stub templates that you can download, customize, and send out to your employees right away. Download and use these pay stub templates for free. Construct a.

25 Great Pay Stub / Paycheck Stub Templates

Finally, it will state the amount the employee receives after these withholdings. Web creating pay stubs in excel is a simple and effective way to manage your payroll process. Streamline your payroll process with our.

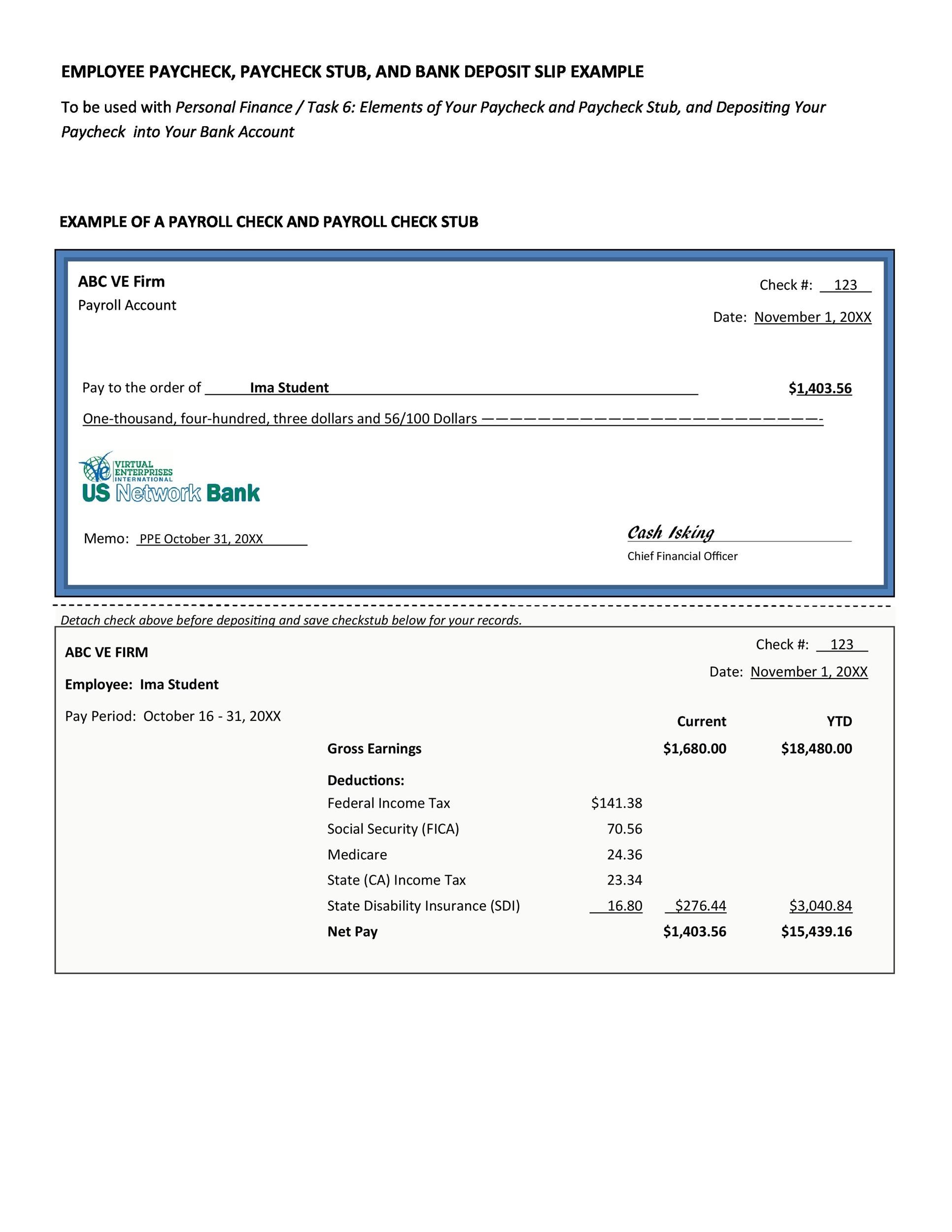

Pay Stub Excel Template A pay stub is a document presented regularly to an employee by an employer detailing the employee’s earnings and wages over a specific period. Google sheets template | microsoft excel template. Web a payslip, also known as a salary slip or pay stub, is a document given to an employee by their employer. Payslips detail the amount of pay given before tax, as well as the tax, insurance and other company schemes including pensions, that have been deducted. It includes information concerning to a payment mode.

![15 Free Pay Stub Templates [Word, Excel, PDF] TemplateLab](https://templatelab.com/wp-content/uploads/2023/06/Year-to-Date-Pay-Stub-Template-TemplateLab.com_.jpg)

![15 Free Pay Stub Templates [Word, Excel, PDF] TemplateLab](https://templatelab.com/wp-content/uploads/2023/06/Simple-Pay-Stub-Template-TemplateLab.com_.jpg)