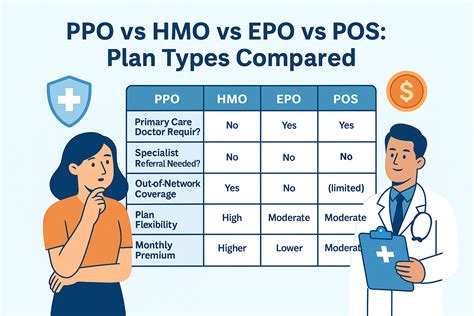

10 Hmo Ppo Difference Tips For Better Coverage

Understanding the nuances between HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans is crucial for making informed decisions about your health insurance coverage. Both types of plans have their advantages and disadvantages, and choosing the right one depends on your personal health needs, budget, and preferences. Here’s a comprehensive guide to help you navigate the differences and make the best choice for your situation.

1. Network Coverage

- HMOs typically have a narrower network of healthcare providers. You must choose a primary care physician (PCP) from within the network, and this doctor will coordinate your care, including referrals to specialists. Out-of-network care is usually covered only in emergency situations.

- PPOs, on the other hand, offer a broader network of providers and more flexibility. You don’t need to select a PCP, and you can see any healthcare provider, both in-network and out-of-network, without a referral. However, seeing an out-of-network provider will cost more.

2. Cost

- HMOs are generally more affordable in terms of premiums and out-of-pocket costs. They often have lower deductibles and copays compared to PPOs. However, the trade-off is less flexibility in choosing healthcare providers.

- PPOs tend to be more expensive due to the greater flexibility they offer. You have the freedom to choose any doctor or hospital, but this convenience comes at a higher cost, including higher premiums and out-of-pocket expenses.

3. Referrals

- HMOs require referrals from your primary care physician to see a specialist within the network. This can sometimes delay care if you need to see a specialist promptly.

- PPOs do not require referrals to see specialists, offering more direct access to the care you need without the need for a primary care physician’s approval.

4. Out-of-Network Coverage

- HMOs usually do not cover out-of-network care except in emergencies. If you see a doctor outside of your network, you may have to pay the full cost of the visit.

- PPOs offer coverage for out-of-network care, although at a higher cost to you. This means you can still receive some reimbursement for seeing a doctor or hospital that is not part of the network, but you’ll pay more out of pocket.

5. Preventive Care

- Both HMOs and PPOs must cover certain preventive services without charging a copayment or coinsurance, even if you haven’t met your deductible. This includes services like annual physicals, screenings, and vaccinations.

6. Maximum Out-of-Pocket (MOOP) Limits

- Both types of plans have a maximum out-of-pocket limit, which is the maximum amount you’ll pay for healthcare expenses in a year. After you reach this limit, the insurance plan pays 100% of covered services.

7. Deductibles and Copays

- HMOs often have lower deductibles and copays for in-network care, making them more budget-friendly for routine and preventive care.

- PPOs may have higher deductibles and copays, both for in-network and out-of-network care, due to the added flexibility and broader network of providers.

8. Travel Considerations

- If you travel frequently, a PPO might be a better option because it covers out-of-network care, which could be beneficial if you need medical attention while traveling outside your network area.

- HMOs are less ideal for frequent travelers unless you’re sure you’ll have access to in-network providers where you’re going.

9. Small Business and Family Considerations

- For small businesses or families, HMOs can be more cost-effective, providing comprehensive coverage at lower premiums. However, if flexibility and the ability to choose any provider are priorities, a PPO might be more suitable, despite the higher costs.

10. Personal Health Needs

- If you have complex or ongoing health issues that require seeing specialists frequently, a PPO might offer more convenience and flexibility, even if it’s at a higher cost.

- For those with minimal health needs or who prefer a more managed approach to healthcare, an HMO could provide sufficient coverage at a lower cost.

Conclusion

Choosing between an HMO and a PPO depends on your healthcare needs, financial situation, and personal preferences regarding flexibility and network size. Understanding the differences and considering your unique circumstances can help you make an informed decision that provides the best possible coverage for you and your family.

FAQ Section

What is the main difference between HMO and PPO health insurance plans?

+The primary difference lies in the flexibility and cost. HMOs offer a narrower network of providers at a lower cost but require a primary care physician and referrals for specialists. PPOs provide a broader network, including out-of-network coverage, at a higher cost and without the need for referrals or a primary care physician.

Do HMOs cover out-of-network care?

+HMOs typically do not cover out-of-network care except in emergency situations. If you see a doctor outside of your network, you may have to pay the full cost of the visit.

Which type of plan is better for someone who travels frequently?

+A PPO might be a better option for frequent travelers because it covers out-of-network care, which could be beneficial if you need medical attention while traveling outside your network area.

How do deductibles and copays differ between HMOs and PPOs?

+HMOs often have lower deductibles and copays for in-network care, making them more budget-friendly for routine and preventive care. PPOs may have higher deductibles and copays, both for in-network and out-of-network care, due to the added flexibility and broader network of providers.

Are preventive services covered by both HMOs and PPOs?

+Yes, both HMOs and PPOs must cover certain preventive services without charging a copayment or coinsurance, even if you haven’t met your deductible. This includes services like annual physicals, screenings, and vaccinations.

By carefully evaluating these factors and considering your individual needs, you can choose between an HMO and a PPO that offers the best balance of coverage, flexibility, and cost for your unique situation. Remember, the key to making the most out of your health insurance is understanding the details of your plan and utilizing its benefits wisely.