10+ Ppo Benefits To Save You Money

When it comes to health insurance, one of the most popular options is a Preferred Provider Organization (PPO) plan. A PPO plan offers a unique combination of flexibility and cost savings, making it an attractive choice for many individuals and families. In this article, we’ll explore 10+ PPO benefits that can help you save money on your healthcare expenses.

First, let’s define what a PPO plan is. A PPO plan is a type of health insurance that allows you to receive medical care from a network of preferred providers. These providers have agreed to offer discounted services to plan members, which can help reduce your out-of-pocket costs. With a PPO plan, you can choose to see any healthcare provider you want, both in-network and out-of-network, although you’ll typically pay more for out-of-network care.

Now, let’s dive into the top PPO benefits that can help you save money:

Network Discounts: One of the primary benefits of a PPO plan is the network discount. When you see an in-network provider, you’ll receive a discounted rate for their services. This can result in significant savings, especially for routine exams, tests, and procedures.

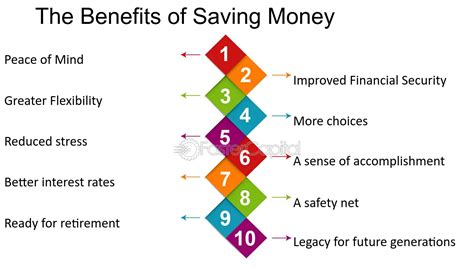

Lower Out-of-Pocket Costs: PPO plans often have lower out-of-pocket costs compared to other types of health insurance plans. This means you’ll pay less for deductibles, copays, and coinsurance, which can help reduce your overall healthcare expenses.

No Referrals Needed: With a PPO plan, you don’t need a referral to see a specialist. This can save you time and money, as you won’t need to visit a primary care physician before seeing a specialist.

Freedom to Choose: PPO plans offer more flexibility than other types of health insurance plans. You can choose to see any healthcare provider you want, both in-network and out-of-network, which gives you more control over your healthcare decisions.

Preventive Care Coverage: Most PPO plans cover preventive care services, such as annual physicals, vaccinations, and screenings, without requiring a copay or coinsurance. This can help you stay healthy and avoid more costly medical procedures down the line.

Prescription Drug Coverage: PPO plans often include prescription drug coverage, which can help you save money on medications. You may have a copay or coinsurance for prescription drugs, but this can be more cost-effective than paying full price.

Mental Health and Substance Abuse Coverage: Many PPO plans cover mental health and substance abuse services, which can be essential for maintaining your overall well-being. These services may include counseling, therapy, and treatment programs.

Dental and Vision Coverage: Some PPO plans include dental and vision coverage, which can help you save money on routine exams, glasses, and dental procedures.

Fitness and Wellness Programs: Some PPO plans offer fitness and wellness programs, which can help you stay healthy and active. These programs may include gym memberships, fitness classes, and healthy lifestyle coaching.

Telemedicine Services: Many PPO plans now offer telemedicine services, which allow you to receive medical care remotely. This can be a convenient and cost-effective way to receive medical care, especially for routine exams and consultations.

Discounts on Healthy Activities: Some PPO plans offer discounts on healthy activities, such as gym memberships, fitness classes, and healthy food programs. These discounts can help you save money while maintaining a healthy lifestyle.

Case Management Services: Some PPO plans offer case management services, which can help you navigate the healthcare system and receive the care you need. Case managers can help you coordinate medical appointments, manage chronic conditions, and access community resources.

In conclusion, PPO plans offer a wide range of benefits that can help you save money on your healthcare expenses. From network discounts and lower out-of-pocket costs to preventive care coverage and telemedicine services, a PPO plan can provide you with the flexibility and cost savings you need to maintain your health and well-being.

What is a PPO plan, and how does it work?

+A PPO plan is a type of health insurance that allows you to receive medical care from a network of preferred providers. These providers have agreed to offer discounted services to plan members, which can help reduce your out-of-pocket costs. With a PPO plan, you can choose to see any healthcare provider you want, both in-network and out-of-network, although you'll typically pay more for out-of-network care.

How do I choose a PPO plan that's right for me?

+When choosing a PPO plan, consider your healthcare needs, budget, and preferred providers. Look for a plan that covers your essential health benefits, has a reasonable deductible and out-of-pocket costs, and includes your preferred healthcare providers in its network.

Can I see any doctor I want with a PPO plan?

+Yes, with a PPO plan, you can see any healthcare provider you want, both in-network and out-of-network. However, you'll typically pay more for out-of-network care, so it's essential to check your plan's network and costs before seeking medical care.

Ultimately, a PPO plan can provide you with the flexibility, cost savings, and comprehensive coverage you need to maintain your health and well-being. By understanding the benefits of a PPO plan and choosing a plan that’s right for you, you can save money on your healthcare expenses and enjoy peace of mind knowing you’re protected in case of unexpected medical needs.