10+ Ppo Secrets For Better Coverage

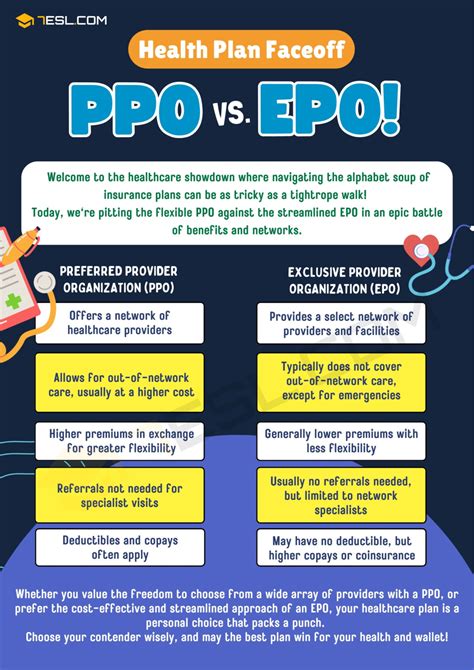

In the realm of health insurance, Preferred Provider Organizations (PPOs) stand out as a popular choice among individuals and families due to their flexibility and comprehensive coverage. Unlike Health Maintenance Organizations (HMOs) that restrict care to a specific network of providers, PPOs offer the freedom to seek medical attention from any healthcare provider, both in and out of network, albeit often at different cost levels. However, navigating the intricacies of PPOs can be daunting, and making the most of their benefits requires understanding some secrets that can enhance your coverage experience. Here’s a deep dive into more than 10 PPO secrets to help you achieve better coverage:

1. Understanding Network and Out-of-Network Coverage

PPOs operate on a network basis, where healthcare providers agree to offer discounted services to plan members. However, one of the significant advantages of PPOs is the ability to see any doctor or visit any hospital, even if they’re not part of the network, though at a higher cost. Understanding how in-network and out-of-network coverage works is crucial for maximizing your benefits without incurring unnecessary expenses.

2. Deductibles and Coinsurance

Before your insurance plan starts paying, you usually have to meet a deductible. After that, you may have to pay a percentage of costs (coinsurance) for services. For example, your plan might require you to pay 20% of the cost of a doctor’s visit after meeting your deductible. Knowing these figures helps in planning your healthcare expenses and can significantly impact your out-of-pocket costs.

3. Choosing Primary Care Physicians Wisely

Even though PPOs offer more flexibility than HMOs and don’t require you to choose a primary care physician (PCP), selecting a PCP can still be beneficial. A PCP can provide coordinated care, referrals, and prevent unnecessary visits to specialists, potentially reducing costs. They can also offer guidance on navigating the healthcare system and help manage chronic conditions, improving overall health outcomes.

4. Preventive Care Services

Many health insurance plans, including PPOs, cover preventive care services at no additional cost to you. These services can include annual physicals, screenings for diseases, and vaccinations. Utilizing these services not only benefits your health but can also help identify and manage health issues early, reducing the need for more costly interventions down the line.

5. Maximizing Out-of-Pocket Maximums

The out-of-pocket maximum is the most you’ll pay for healthcare expenses in a year. Once you’ve met this maximum, your insurance plan typically covers 100% of eligible expenses. Understanding and planning around your out-of-pocket maximum can help minimize financial strain and ensure you get the care you need without breaking the bank.

6. Considering High-Deductible Plans

For those who are relatively healthy and don’t anticipate high medical expenses, high-deductible PPO plans can be a cost-effective option. These plans have lower premiums but higher deductibles. They can also be paired with Health Savings Accounts (HSAs), allowing you to set aside pre-tax dollars for medical expenses, which can be a significant tax advantage.

7. Utilizing Telemedicine

Telemedicine, or virtual healthcare, has become increasingly popular and is often covered by PPO plans. It offers a convenient way to consult with healthcare professionals from the comfort of your own home, potentially saving you time and money. Telemedicine can be particularly beneficial for minor conditions or follow-up visits, helping to reduce healthcare costs and improve access to care.

8. Understanding Pre-Authorization Requirements

Some medical services and treatments require pre-authorization from your insurance provider before they can be covered. Knowing which services need pre-authorization can help avoid unexpected denials of claims and financial surprises. Always check with your insurance company before undergoing non-emergency procedures to ensure you comply with any pre-authorization requirements.

9. Appealing Claim Denials

If your insurance company denies a claim, you have the right to appeal. Understanding the appeals process and preparing a solid case with medical records and justification can help overturn denial decisions. Being proactive and advocating for yourself can make a significant difference in getting the coverage you deserve.

10. Staying Informed About Plan Changes

Insurance plans, including PPOs, can change annually. Staying informed about these changes, such as alterations in coverage, network providers, deductibles, and copays, is essential for managing your healthcare expenses effectively. Regularly review plan documents and updates from your insurer to ensure you’re prepared for any changes that might affect your coverage.

11. Leveraging Health and Wellness Programs

Many PPO plans offer health and wellness programs, such as fitness discounts, nutrition counseling, and disease management programs, designed to promote healthy behaviors and prevent illnesses. Participating in these programs can not only improve your health but also potentially lower your healthcare costs over time by reducing the risk of chronic conditions.

12. Navigating Pharmacy Benefits

PPO plans often include pharmacy benefits, which cover prescription medications. Understanding how your pharmacy benefits work, including any copays, coinsurance, and deductibles for medications, can help manage pharmaceutical costs. Additionally, knowing about any preferred pharmacies or mail-order options can help reduce expenses.

In conclusion, maximizing the benefits of a PPO plan requires a deep understanding of its intricacies, from network coverage and out-of-pocket expenses to preventive care services and potential plan changes. By leveraging these secrets, individuals can navigate the healthcare system more effectively, reducing costs and improving health outcomes. Whether you’re a seasoned healthcare consumer or new to the world of PPOs, empowering yourself with knowledge is the first step to achieving better coverage and a healthier you.

What is the main advantage of choosing a PPO plan over other types of health insurance?

+The main advantage of a PPO plan is its flexibility, allowing policyholders to receive medical care from any healthcare provider, in or out of network, albeit at different cost levels. This flexibility is particularly beneficial for those who value the freedom to choose their healthcare providers without strict network restrictions.

How can I find out which healthcare providers are part of my PPO network?

+To find out which healthcare providers are part of your PPO network, you can visit your insurance company’s website and use their provider directory tool. Many insurance companies also offer mobile apps or customer service numbers where you can inquire about in-network providers. Always verify a provider’s network status before receiving care to ensure you’re getting the best rates.

Can I change my PPO plan during the year if I’m not satisfied with the coverage?

+Generally, you can only change your health insurance plan, including PPOs, during the annual open enrollment period or if you experience a qualifying life event, such as marriage, divorce, or the birth of a child. However, it’s essential to review your plan annually during open enrollment to ensure it still meets your health and financial needs. If you’re unhappy with your current plan, this is the time to make changes or switch to a different plan that better suits you.