12 Ppo Stand Definitions For Easy Understanding

Understanding PPO (Preferred Provider Organization) plans can be a daunting task, especially with the multitude of definitions and terms associated with them. To simplify the process, let’s break down 12 key PPO stand definitions that are essential for easy understanding:

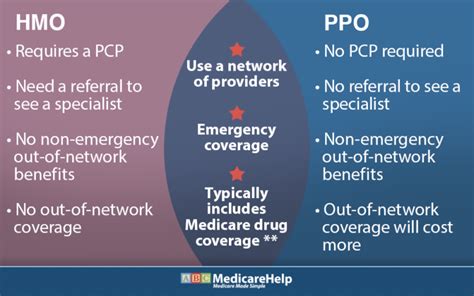

Preferred Provider Organization (PPO): A type of health insurance plan that allows you to see any healthcare provider you choose, but offers better coverage and lower costs when you use providers within the plan’s network.

Network Provider: A healthcare provider who has a contract with the insurance company to provide services to plan members at a negotiated rate. Using network providers can significantly reduce your out-of-pocket costs.

Out-of-Network Provider: A healthcare provider who does not have a contract with the insurance company. While you can still receive care from out-of-network providers, your costs will typically be higher.

Premium: The amount you pay each month for your health insurance coverage. Premiums are a key component of any health insurance plan, including PPOs.

Deductible: The amount you must pay out-of-pocket for healthcare expenses before your insurance plan begins to pay its share of costs. PPO plans often have annual deductibles that must be met before full coverage kicks in.

Co-pay (Co-payment): A fixed amount you pay for a specific healthcare service after you’ve met your deductible. Co-pays are common for doctor visits, prescriptions, and other services.

Co-insurance: The percentage of healthcare costs you pay after meeting your deductible. For example, if your plan has a 20% co-insurance, you’ll pay 20% of the costs, and your insurance will cover the remaining 80%.

Out-of-Pocket Maximum (OOPM): The maximum amount you’ll pay for healthcare expenses in a given year. After reaching the OOPM, your insurance plan covers 100% of eligible expenses, providing significant financial protection.

Preventive Care: Routine healthcare services like annual check-ups, vaccinations, and screenings that are designed to prevent illnesses and detect health problems early. Many PPO plans cover preventive care services at no additional cost to you.

Pre-authorization: The process of getting approval from your insurance company before receiving certain healthcare services or treatments. Pre-authorization is sometimes required for non-emergency services to ensure they are medically necessary.

Referral: A recommendation from your primary care physician to see a specialist. While PPO plans often do not require referrals to see specialists, having one can help ensure that the services you receive are covered under your plan.

Explanation of Benefits (EOB): A statement sent by your insurance company explaining what medical treatments and/or services were paid for on your behalf. The EOB will show the amount billed by the provider, the amount covered by your plan, and any balance you owe.

Understanding these definitions and terms is crucial for navigating PPO plans effectively, ensuring you get the most out of your health insurance coverage while minimizing out-of-pocket expenses.

What is the primary advantage of using network providers in a PPO plan?

+The primary advantage is lower costs. Network providers have negotiated rates with the insurance company, which means you'll typically pay less for services compared to using out-of-network providers.

How does meeting the deductible affect my PPO plan coverage?

+After meeting your deductible, your insurance plan starts to pay its share of costs for covered services. This can significantly reduce your out-of-pocket expenses for healthcare services throughout the year.

What happens after I reach my Out-of-Pocket Maximum (OOPM) in a PPO plan?

+Once you've reached your OOPM, your insurance plan covers 100% of eligible expenses for the remainder of the year. This provides substantial financial protection against high healthcare costs.

By grasping these fundamental concepts and terms, you’ll be better equipped to make informed decisions about your healthcare coverage and maximize the benefits of your PPO plan. Whether you’re navigating the complexities of health insurance for yourself or helping others understand their options, having a solid foundation in PPO stand definitions is key.