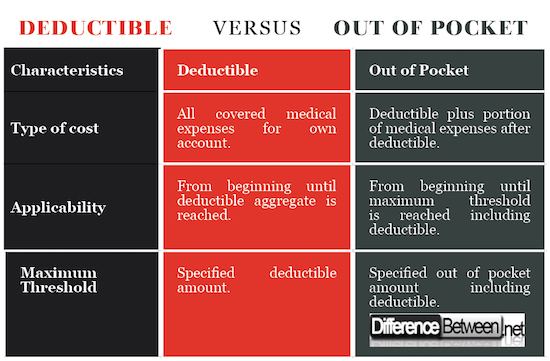

Deductible Vs Out Of Pocket

When navigating the complex world of health insurance, two terms that often cause confusion are “deductible” and “out of pocket.” While they are related, they serve distinct purposes within the framework of your insurance plan. Understanding the difference between them is crucial for making informed decisions about your healthcare and budgeting for the associated costs.

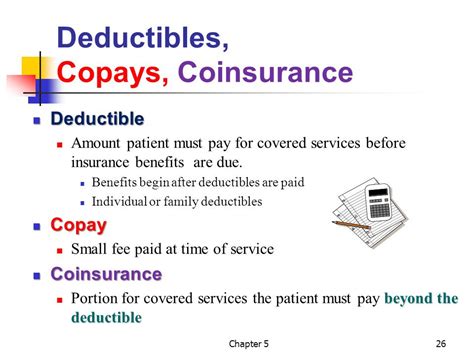

Deductible: The Initial Barrier

A deductible is the amount you must pay out of your own pocket for healthcare expenses before your insurance plan starts to cover the costs. It’s essentially the initial barrier that you must overcome before your insurance kicks in. For example, if your deductible is 1,000, you will need to pay the first 1,000 of your medical expenses out of your own pocket. After reaching this threshold, your insurance plan will begin to cover a portion of your expenses, according to the terms of your policy.

Deductibles can vary widely, depending on the type of insurance plan you have. Some plans may have a low deductible, such as 500, while others may have a much higher deductible, such as 5,000 or more. Generally, plans with lower deductibles tend to have higher premiums, while plans with higher deductibles often have lower premiums.

Out of Pocket: The Maximum You’ll Pay

Out of pocket (OOP) refers to the maximum amount you will pay for healthcare expenses within a given period, usually a calendar year. This includes your deductible, copayments, and coinsurance, but does not include premiums. Once you reach your out-of-pocket maximum, your insurance plan will cover 100% of eligible expenses for the remainder of the year.

For instance, let’s say your out-of-pocket maximum is 5,000. Throughout the year, you pay your deductible (1,000), copayments for doctor visits (500), and coinsurance for hospital stays (1,500). If your total expenses reach $5,000, you won’t have to pay any more for eligible medical care for the rest of the year. Your insurance will cover all additional costs, providing you with financial protection against catastrophic medical expenses.

Key Differences

While both deductibles and out-of-pocket maximums deal with the financial aspects of healthcare, the key differences lie in their purposes and the way they affect your expenses:

Trigger Point: The deductible is the trigger point that activates your insurance coverage. In contrast, the out-of-pocket maximum is the ceiling beyond which you are no longer responsible for paying for healthcare services.

Coverage Scope: The deductible only applies to the initial costs of healthcare services, whereas the out-of-pocket maximum encompasses a broader range of expenses, including deductibles, copays, and coinsurance.

Financial Protection: The out-of-pocket maximum provides a higher level of financial protection by capping your total healthcare expenditures for the year. This safeguard is crucial for preventing medical bills from becoming financially devastating.

Scenario-Based Examples

To illustrate the difference, let’s consider two scenarios:

Scenario 1: Sarah has a health insurance plan with a 2,000 deductible and a 6,000 out-of-pocket maximum. She incurs 8,000 in medical expenses throughout the year. Initially, Sarah pays the first 2,000 (deductible), and then, for the remaining 6,000, she pays a portion as per her plan's coinsurance, which amounts to 2,000. At this point, Sarah has paid 4,000 (2,000 deductible + $2,000 coinsurance), reaching her out-of-pocket maximum. For the rest of the year, her insurance covers all eligible expenses.

Scenario 2: Mark has a plan with a 1,000 deductible and a 4,000 out-of-pocket maximum. His total medical expenses for the year are 3,500. Mark pays the first 1,000 (deductible) and then a 20% coinsurance for the remaining 2,500, which amounts to 500 (20% of 2,500). So, Mark pays a total of 1,500 (1,000 deductible + 500 coinsurance) and does not reach his out-of-pocket maximum.

Future Trends Projection

As the healthcare landscape continues to evolve, there is a growing emphasis on transparency and consumer choice. Patients are increasingly expected to be active participants in their healthcare decisions, including navigating the complexities of health insurance. In response, insurance plans may incorporate more flexible deductible and out-of-pocket structures, as well as innovative tools and resources to help individuals better understand and manage their healthcare costs.

Technical Breakdown

Breaking down the technical aspects of deductibles and out-of-pocket maximums reveals the intricate balance between providing comprehensive healthcare coverage and managing costs. The deductible acts as a cost-sharing mechanism, ensuring that individuals have a financial stake in their healthcare decisions. Meanwhile, the out-of-pocket maximum serves as a protective cap, safeguarding against the financial risks associated with unforeseen medical expenses.

Decision Framework

When selecting a health insurance plan, it’s essential to weigh the deductible and out-of-pocket maximum as part of your overall decision-making process. Consider the following factors:

Healthcare Needs: Assess your typical annual healthcare expenses and the likelihood of needing extensive medical care.

Financial Situation: Evaluate your ability to cover the deductible and out-of-pocket expenses.

Premium Costs: Balance the appeal of lower premiums with the potential risks of higher deductibles and out-of-pocket maximums.

Plan Benefits: Consider the comprehensiveness of the plan, including covered services, provider networks, and maximum out-of-pocket limits.

Alternative Options: Explore available alternatives, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), which can help offset deductibles and other healthcare expenses.

Step-by-Step Guide to Choosing the Right Plan

- Assess your healthcare needs and expenses.

- Evaluate your financial situation and ability to pay deductibles and out-of-pocket costs.

- Research and compare different health insurance plans, considering premiums, deductibles, and out-of-pocket maximums.

- Consider alternative options for managing healthcare expenses, such as HSAs or FSAs.

- Choose a plan that balances your healthcare needs with your financial capabilities and preferences.

FAQ Section

What is the main difference between a deductible and an out-of-pocket maximum?

+The deductible is the amount you must pay before your insurance coverage kicks in, while the out-of-pocket maximum is the total amount you will pay for healthcare expenses within a given period, after which your insurance covers all eligible expenses.

How do I choose the right deductible and out-of-pocket maximum for my health insurance plan?

+Consider your healthcare needs, financial situation, and premium costs. It's also essential to evaluate the plan's benefits, including covered services and provider networks, and explore alternative options like HSAs or FSAs.

Can I change my deductible or out-of-pocket maximum after enrolling in a health insurance plan?

+Typically, you can only make changes to your deductible or out-of-pocket maximum during the annual open enrollment period or under special circumstances, such as a qualifying life event. It's crucial to review your plan and make any necessary adjustments during these windows to ensure the best coverage for your needs.

In conclusion, deductibles and out-of-pocket maximums are integral components of health insurance plans, serving as mechanisms for cost-sharing and financial protection. By understanding how these elements work and making informed decisions based on your healthcare needs and financial situation, you can navigate the complexities of health insurance more effectively and ensure that you have the right coverage for your well-being.