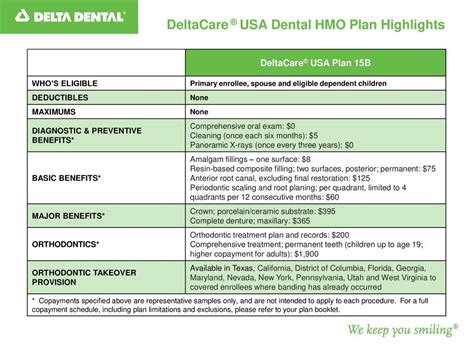

Delta Dental Hmo Benefits Guide

Understanding the intricacies of dental insurance can be a daunting task, especially when navigating the specifics of a Dental Health Maintenance Organization (DHMO) plan like Delta Dental’s HMO benefits. In this comprehensive guide, we will delve into the world of Delta Dental HMO benefits, exploring the ins and outs of what this plan offers, its advantages, and how it can serve as a vital component of your overall health insurance portfolio.

Introduction to Delta Dental HMO

Delta Dental, one of the leading dental insurance providers in the United States, offers a range of plans designed to meet the diverse needs of its clientele. Among its offerings, the DHMO plan stands out as a unique option that combines comprehensive dental care with a network of participating dentists. This plan operates on a prepaid basis, where members pay a fixed monthly fee to access dental services from providers within the Delta Dental network.

Key Benefits of Delta Dental HMO

Cost Savings: One of the most appealing aspects of a DHMO plan is the potential for cost savings. By agreeing to receive care from within the network, members can enjoy lower out-of-pocket expenses compared to traditional indemnity plans or even some Preferred Provider Organization (PPO) plans.

Comprehensive Coverage: Delta Dental’s HMO benefits often include a wide range of dental services, from routine check-ups and cleanings to more complex procedures like crowns and dentures. This comprehensive approach ensures that members have access to the care they need without breaking the bank.

Preventive Care Emphasis: DHMO plans, including those from Delta Dental, typically emphasize preventive care. Regular check-ups, fluoride treatments, and sealants are often covered at little to no cost to the member, reflecting the plan’s focus on preventing dental issues before they become major problems.

Network of Providers: Delta Dental boasts an extensive network of participating dentists and specialists. This network ensures that members have access to quality care in their area, making it easier to find a dentist who fits their needs and schedule.

Ease of Use: Navigating the world of dental insurance can be complicated, but Delta Dental’s HMO plan is designed to be user-friendly. With clear guidelines on what is covered and how to access care, members can focus on their dental health without unnecessary stress.

How Delta Dental HMO Works

To reap the benefits of a Delta Dental HMO plan, it’s essential to understand how the system works:

Selection of a Primary Care Dentist (PCD): Upon enrollment, members typically select a primary care dentist from within the Delta Dental network. This PCD serves as the first point of contact for dental care needs and can refer members to specialists within the network if necessary.

Referrals and Authorization: For visits to specialists, members often need a referral from their PCD. This process helps ensure that care is coordinated and that members receive the appropriate level of treatment.

Out-of-Network Care: One of the key considerations with a DHMO plan is that care received from dentists outside the network is usually not covered, except in emergency situations. Members should always verify that their dentist is part of the Delta Dental network to ensure they are covered.

Costs and Fees: Members pay a monthly premium for their DHMO plan, and in return, they have access to covered services with little to no additional out-of-pocket costs for many procedures.

Pros and Cons of Delta Dental HMO

As with any insurance plan, there are advantages and disadvantages to consider:

Pros: - Cost-Effective: DHMO plans can be more budget-friendly than other types of dental insurance. - Comprehensive Coverage: Many necessary dental services are covered. - Ease of Use: The plan is designed to be straightforward, with a focus on preventive care.

Cons: - Limited Provider Choice: Members must receive care from within the network, which might limit their choice of dentists. - Referral Requirements: The need for referrals to see specialists can sometimes delay care. - Out-of-Network Restrictions: Care outside the network is typically not covered, which can be a drawback in certain situations.

Conclusion

Delta Dental’s HMO benefits offer a unique approach to dental insurance, combining affordability with comprehensive care. By understanding the ins and outs of this plan, individuals can make informed decisions about their dental health coverage. Whether you’re looking for cost savings, ease of use, or a focus on preventive care, the Delta Dental HMO plan is worth considering as part of your overall health insurance strategy.

Frequently Asked Questions

What is the main difference between a DHMO and a PPO dental plan?

+The primary difference lies in the network and cost structure. DHMO plans offer more affordable rates but require members to receive care from within the specified network, except in emergency cases. PPO plans, on the other hand, offer more flexibility in choosing dentists, both in and out of network, but often at a higher cost.

How do I find a dentist who participates in the Delta Dental HMO network?

+Delta Dental provides an online directory and customer service resources to help members find participating dentists in their area. Members can visit the Delta Dental website or call their customer service number to get a list of nearby providers.

Are all dental services covered under the Delta Dental HMO plan?

+Most necessary and preventive dental services are covered, but the extent of coverage can vary. Routine cleanings, fillings, and crowns are typically covered, but cosmetic services or certain specialized treatments might not be included or might have limitations. It’s essential to review the plan’s coverage details to understand what is and isn’t included.

Can I change my primary care dentist under the Delta Dental HMO plan?

+Yes, members can typically change their primary care dentist, but the process and any associated limitations can vary. It’s often possible to make changes at the start of a new coverage period or with approval from Delta Dental. Members should contact Delta Dental directly to understand the specific procedures and timing for making such changes.

How does the Delta Dental HMO plan handle emergency dental care when traveling?

+In emergency situations, members may receive necessary care from any available dentist. However, reimbursement may vary, and members should contact Delta Dental as soon as possible to report the emergency care and understand the coverage and reimbursement process.