Epo Insurance: Protect Your Assets

In today’s fast-paced world, uncertainties are an inherent part of life. No matter how meticulously we plan, unforeseen events can quickly unravel even the most solid foundations. For individuals and businesses alike, safeguarding assets is not just a prudent measure but an essential strategy to mitigate potential risks. Among the various insurance options available, EPO (Exclusive Provider Organization) insurance stands out for its unique blend of flexibility and cost-effectiveness. This article delves into the realm of EPO insurance, exploring its nuances, benefits, and how it can serve as a formidable shield for your assets.

Understanding EPO Insurance

At its core, EPO insurance operates on a principle of exclusivity, where policyholders are required to receive medical care from providers within a specified network, except in emergency situations. This setup is designed to control costs and streamline health care services, making it an attractive option for those seeking comprehensive coverage without the inflated price tag often associated with more traditional insurance plans.

Key Characteristics:

- Network Limitations: Policyholders must use healthcare providers within the EPO’s network for non-emergency care. This can sometimes limit access to certain specialists or facilities outside the network.

- Cost Savings: By negotiating rates with in-network providers, EPOs can offer more affordable premiums compared to other types of insurance plans.

- Emergency Care: Out-of-network emergency care is typically covered, ensuring that policyholders receive necessary treatment regardless of the provider.

The Benefits of EPO Insurance

EPO insurance is not just about cost savings; it offers a multitude of benefits that can significantly enhance your peace of mind and protect your assets from the financial pitfalls associated with unexpected medical expenses.

Comprehensive Coverage:

EPO plans often include a wide range of services, from routine check-ups and prescriptions to major surgeries and hospital stays. This comprehensive approach ensures that you’re covered for both minor and major medical needs.

Predictable Costs:

With an EPO, you know exactly what you’re paying for, thanks to the negotiated rates within the network. This predictability can be a significant advantage for budgeting and financial planning.

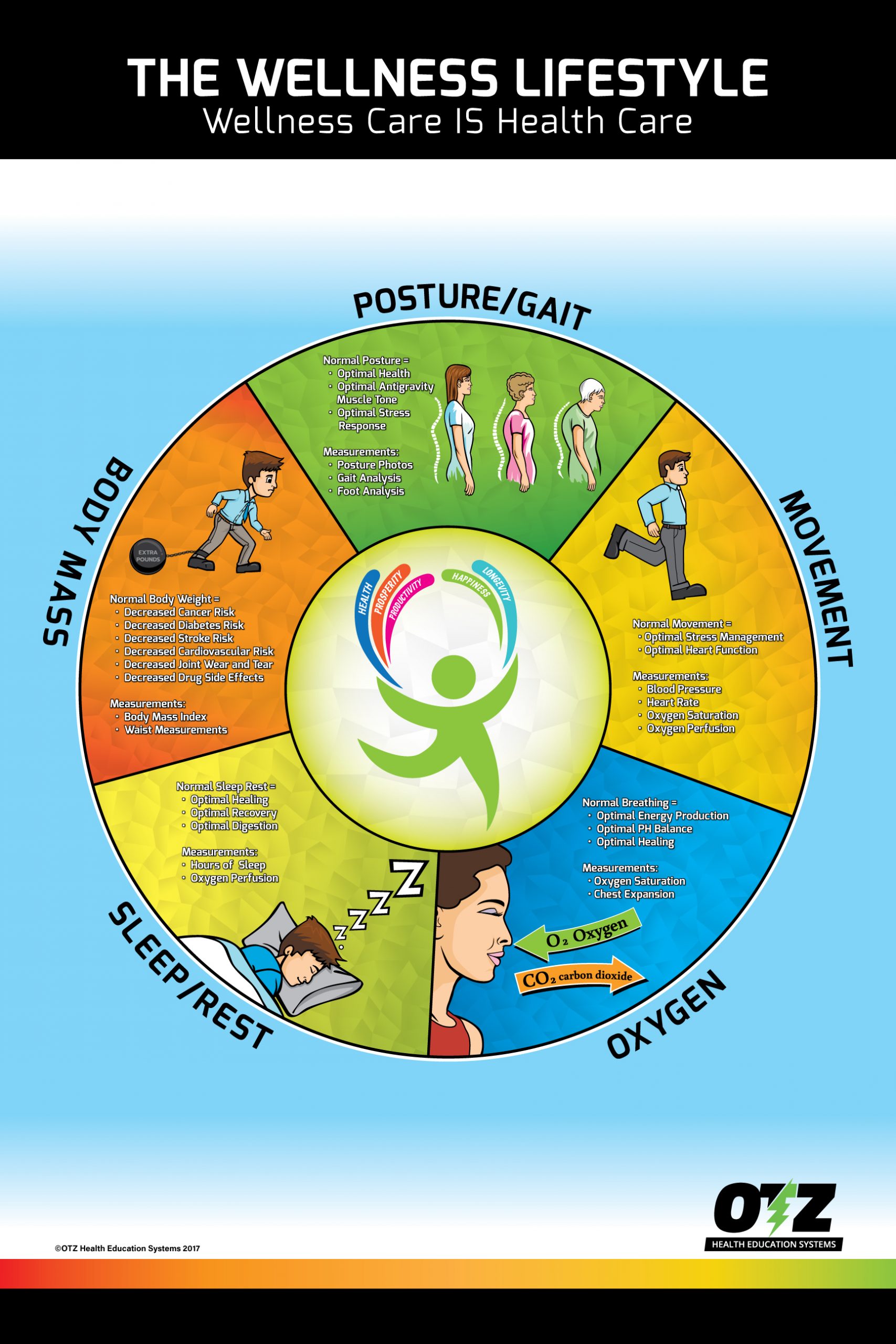

Preventive Care:

Many EPO plans place a strong emphasis on preventive care, covering services like vaccinations, screenings, and wellness visits. This proactive approach can help detect issues early, reducing the likelihood of more severe (and costly) problems down the line.

Navigating the EPO Insurance Landscape

While EPO insurance offers numerous advantages, navigating its specifics can be daunting, especially for those new to the world of health insurance. Understanding your options and what each plan entails is crucial for making an informed decision.

Researching Providers:

Before selecting an EPO, research the network of providers. Ensure that your primary care physician and any specialists you see are part of the network. This step can save you from out-of-pocket expenses for out-of-network care.

Policy Details:

Carefully review the policy’s terms, including deductibles, copays, and coinsurance rates. Some EPOs might have higher deductibles but lower premiums, which could be beneficial depending on your health care needs and financial situation.

Customer Support:

Look for an EPO with robust customer support. Being able to easily get questions answered and issues resolved can significantly impact your satisfaction with the plan.

Case Study: Applying EPO Insurance in Real-World Scenarios

To illustrate the practical implications of EPO insurance, let’s consider a hypothetical scenario:

Scenario: Emily, a 30-year-old freelance writer, decides to enroll in an EPO plan. She chooses this option because it offers a balance between affordability and comprehensive coverage. Emily’s network includes her current primary care physician and a reputable hospital near her residence.

Outcome: Over the course of the year, Emily visits her in-network doctor for check-ups and receives necessary care without incurring unexpected out-of-network costs. When she needs specialist care, she is able to find a suitable provider within her network, further containing her expenses.

Future Trends in EPO Insurance

As the healthcare landscape continues to evolve, EPO insurance is likely to adapt, incorporating new technologies and strategies to improve both the quality and accessibility of care.

Telehealth Integration:

Expect to see more EPO plans embracing telehealth services, allowing for remote consultations and expanding access to care, especially for those in rural or underserved areas.

Personalized Medicine:

The future may hold more personalized health plans, tailored to individual needs and genetic profiles, offering a more precise and effective approach to health care.

Data-Driven Insights:

The use of data analytics will become more prevalent, helping insurers refine their networks, improve patient outcomes, and reduce costs by identifying the most effective treatments and providers.

Conclusion

EPO insurance represents a significant step forward in health care coverage, combining the benefits of cost control with the reassurance of comprehensive protection. By understanding the intricacies of EPO plans and how they can be tailored to meet individual or business needs, you can make informed decisions about safeguarding your assets against the unpredictable nature of health care expenses. As the health insurance market continues to evolve, embracing innovative models like EPO insurance can be a strategic move towards securing your financial well-being and ensuring access to quality health care services.

FAQ Section

What are the primary advantages of EPO insurance over other health insurance plans?

+The primary advantages include cost savings through negotiated network rates, comprehensive coverage for in-network care, and the predictability of healthcare expenses. EPO plans also often cover preventive care services, which can help in early detection and treatment of health issues.

How do I choose the right EPO insurance plan for my needs?

+To choose the right EPO plan, consider factors such as the network of providers, the services covered, deductibles, copays, and coinsurance rates. It's also crucial to assess your current and potential future health care needs and ensure that the plan's network includes your preferred healthcare providers.

Can I see any doctor I want with an EPO plan, or are there restrictions?

+With an EPO plan, you are generally required to receive care from providers within the specified network, except in emergency situations. Out-of-network care is typically not covered, except for emergencies, so it's essential to choose a plan with a network that includes your preferred providers.

By demystifying EPO insurance and exploring its nuances, individuals and businesses can better navigate the complex healthcare landscape, ultimately finding a balance between affordability, accessibility, and comprehensive protection for their assets.