Family Medical Insurance: Affordable Coverage Solutions

In today’s fast-paced world, ensuring the health and wellbeing of your family is of paramount importance. Medical emergencies can arise unexpectedly, and the financial burden of hospital bills, treatments, and medications can be overwhelming. This is where family medical insurance comes into play, providing a safety net that protects your loved ones from the exorbitant costs associated with medical care. With the numerous options available in the market, it’s essential to understand the nuances of family medical insurance and explore affordable coverage solutions that cater to your unique needs.

Understanding Family Medical Insurance

Family medical insurance is a type of health insurance that covers the medical expenses of all family members under a single policy. This comprehensive coverage includes hospitalization, doctor visits, surgeries, diagnostic tests, and prescription medications. The primary objective of family medical insurance is to provide financial protection against unforeseen medical expenses, ensuring that you and your loved ones receive the necessary medical care without compromising your financial stability.

Benefits of Family Medical Insurance

The benefits of family medical insurance are multifaceted. Firstly, it provides peace of mind, knowing that your family is protected against medical uncertainties. Secondly, it helps in reducing out-of-pocket expenses, which can be crippling in the event of a medical emergency. Additionally, family medical insurance encourages preventive care, as policyholders are more likely to undergo regular check-ups and screenings, thereby detecting health issues at an early stage. This, in turn, can lead to better health outcomes and reduced healthcare costs in the long run.

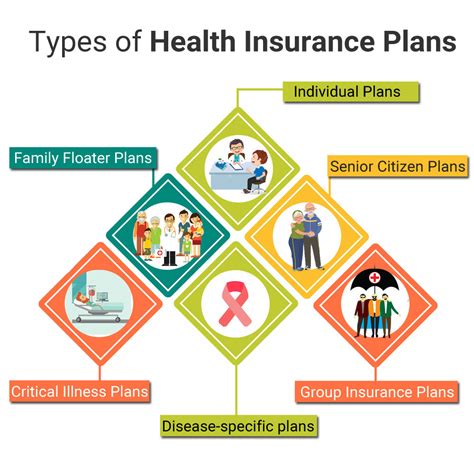

Types of Family Medical Insurance

There are several types of family medical insurance policies available, each with its unique features and benefits. Some of the most common types include:

- Individual and Family Floater Plans: These plans provide coverage for individual family members, with the option to increase the coverage amount as needed.

- Family Floater Plans: These plans offer a single coverage amount that can be used by all family members, providing a cost-effective solution for large families.

- Unit-Linked Health Insurance Plans: These plans combine health insurance with investment, providing a unique opportunity to grow your wealth while ensuring your family’s health.

Key Factors to Consider When Choosing Family Medical Insurance

When selecting a family medical insurance policy, there are several key factors to consider. These include:

- Coverage Amount: Ensure that the coverage amount is sufficient to meet your family’s medical needs.

- Premium Costs: Compare premium costs across different policies to find an affordable solution.

- Network Hospitals: Check the list of network hospitals and ensure that they are conveniently located and reputable.

- Pre-Existing Conditions: If any family members have pre-existing conditions, ensure that the policy provides adequate coverage.

- Claim Settlement Ratio: Opt for a policy with a high claim settlement ratio, indicating the insurer’s reliability in settling claims.

Affordable Coverage Solutions

In recent years, the insurance industry has witnessed a significant shift towards affordable coverage solutions. Some of the innovative solutions include:

- Micro-Insurance Plans: These plans offer limited coverage at an affordable premium, catering to low-income households.

- Group Health Insurance Plans: These plans provide coverage to groups of people, often at a lower premium cost than individual plans.

- Telemedicine Services: Some insurers offer telemedicine services, enabling policyholders to consult doctors remotely, reducing the need for hospital visits.

Mitigating Risks with Family Medical Insurance

Family medical insurance is an essential risk mitigation strategy, providing financial protection against unforeseen medical expenses. By opting for a comprehensive family medical insurance policy, you can ensure that your loved ones receive the necessary medical care without compromising your financial stability. Additionally, family medical insurance encourages preventive care, which can help in reducing healthcare costs and improving health outcomes.

Overcoming Common Challenges

Despite the numerous benefits of family medical insurance, there are several common challenges that policyholders face. These include:

- Complex Policy Terms: Insurance policies often come with complex terms and conditions, making it challenging for policyholders to understand their coverage.

- Claim Rejection: Claim rejection is a common issue, often due to incomplete documentation or non-disclosure of pre-existing conditions.

- Lack of Transparency: Insurers often lack transparency in their policies, making it difficult for policyholders to make informed decisions.

Future of Family Medical Insurance

The future of family medical insurance looks promising, with the industry witnessing significant innovations and advancements. Some of the emerging trends include:

- Personalized Insurance Plans: Insurers are now offering personalized insurance plans, tailored to individual needs and preferences.

- Artificial Intelligence: AI is being increasingly used in the insurance industry to improve claims processing, policy administration, and customer service.

- Digital Platforms: Digital platforms are revolutionizing the insurance industry, enabling policyholders to purchase and manage their policies online.

Real-Life Scenarios

Family medical insurance can be a lifesaver in real-life scenarios. Consider the example of John, a 35-year-old father of two, who recently purchased a family medical insurance policy. When his daughter was diagnosed with a rare illness, the policy covered the majority of the medical expenses, including hospitalization, surgeries, and medications. Without the policy, John would have struggled to pay the exorbitant medical bills, putting his family’s financial stability at risk.

FAQ Section

What is family medical insurance, and how does it work?

+Family medical insurance is a type of health insurance that covers the medical expenses of all family members under a single policy. The policyholder pays a premium, and in return, the insurer provides financial protection against unforeseen medical expenses.

What are the benefits of family medical insurance?

+The benefits of family medical insurance include financial protection against medical emergencies, reduced out-of-pocket expenses, and encouragement of preventive care. Additionally, family medical insurance provides peace of mind, knowing that your loved ones are protected against medical uncertainties.

How do I choose the right family medical insurance policy for my family?

+When choosing a family medical insurance policy, consider factors such as coverage amount, premium costs, network hospitals, pre-existing conditions, and claim settlement ratio. It's essential to compare different policies and opt for one that meets your family's unique needs and budget.

Can I customize my family medical insurance policy to meet my specific needs?

+Yes, many insurers offer customization options for family medical insurance policies. You can choose to add or remove coverage features, increase or decrease the coverage amount, and select from various add-ons and riders to tailor the policy to your specific needs.

What is the future of family medical insurance, and how will it evolve in the coming years?

+The future of family medical insurance looks promising, with emerging trends such as personalized insurance plans, artificial intelligence, and digital platforms. Insurers are expected to offer more innovative and customer-centric products, improving the overall insurance experience and providing better value to policyholders.

In conclusion, family medical insurance is a vital component of any family’s financial planning. By understanding the nuances of family medical insurance and exploring affordable coverage solutions, you can ensure that your loved ones receive the necessary medical care without compromising your financial stability. Remember to consider factors such as coverage amount, premium costs, network hospitals, pre-existing conditions, and claim settlement ratio when choosing a policy. With the numerous options available in the market, it’s essential to do your research, compare different policies, and opt for one that meets your family’s unique needs and budget.