Fsa Hsa Eligible

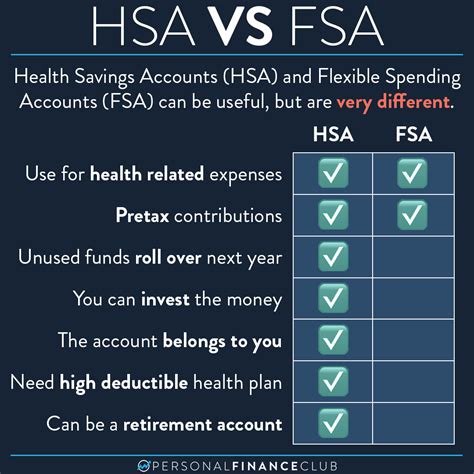

Understanding the nuances of Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) is crucial for individuals seeking to optimize their healthcare spending while navigating the complexities of tax-advantaged savings options. Both FSAs and HSAs offer unique benefits, but they also come with distinct eligibility criteria, contribution limits, and usage guidelines. Let’s delve into the details of what makes expenses eligible for reimbursement under these accounts, focusing on how individuals can maximize their benefits while ensuring compliance with regulatory requirements.

Eligibility for FSAs and HSAs

To begin with, it’s essential to understand who is eligible for these accounts. FSAs are typically offered by employers as part of their benefits package, and eligibility is usually determined by the employer. On the other hand, HSAs are available to individuals who have a High Deductible Health Plan (HDHP) and are not covered by another health insurance plan that is not an HDHP, among other criteria.

FSA Eligibility: Generally, any employee whose employer offers an FSA can participate, provided they do not have an HSA (with some exceptions). This makes FSAs a more accessible option for many workers since they are tied to employment rather than specific health insurance plans.

HSA Eligibility: For an individual to be eligible for an HSA, they must have an HDHP, cannot be enrolled in any other health plan (with some exceptions for certain types of insurance), cannot be claimed as a dependent on someone else’s tax return, and must not be eligible for Medicare.

Eligible Expenses

Both FSAs and HSAs allow account holders to use their funds for a wide range of medical expenses, but it’s crucial to understand what constitutes an “eligible expense.” The IRS provides a list of eligible medical expenses in Publication 502, which includes items such as doctor visits, prescription medications, glasses, and dental care.

FSA Eligible Expenses: FSAs can be used for medical expenses, dental expenses, vision care, and even some over-the-counter (OTC) medications and supplies, provided they are prescribed by a physician or qualify under specific IRS guidelines. It’s worth noting that some FSAs, particularly those designed for childcare or dependent care, have different eligibility criteria and are used for expenses related to caring for dependents while the account holder works or seeks employment.

HSA Eligible Expenses: HSAs are more strictly limited to medical expenses, as defined by the IRS. This includes a broad range of services and items, from health insurance deductibles and copays to prescription drugs and medical equipment. Similar to FSAs, some expenses may require a physician’s prescription or letter of medical necessity to be eligible for reimbursement.

Comparison and Strategic Use

When deciding between FSAs and HSAs, individuals should consider their health care needs, insurance coverage, and financial situation. Here are a few points to consider:

Use It or Lose It vs. Rollover: FSAs traditionally have a “use it or lose it” rule at the end of the plan year, though some plans offer limited rollover or grace period options. HSAs, on the other hand, allow unused funds to roll over year after year, making them a more flexible long-term savings option.

Portability: HSAs are more portable since they are tied to the individual rather than their employment. If you change jobs, your HSA goes with you, whereas FSA funds are typically tied to your employment and may be subject to COBRA continuation or other limited options if you leave your job.

Investment Options: HSAs often offer investment options for account balances above a certain threshold, allowing individuals to grow their savings over time in a tax-advantaged environment. FSAs typically do not offer investment options and are designed more for immediate expense reimbursement.

Best Practices for Maximizing Benefits

Understand Your Plan: Familiarize yourself with the specifics of your FSA or HSA, including contribution limits, eligibility criteria, and the process for submitting claims.

Plan Ahead: If possible, anticipate your medical expenses for the year to maximize your contributions to these accounts.

Keep Receipts: Organize and keep all receipts for medical expenses, as these will be necessary for reimbursement.

Stay Informed: Regularly check the IRS website for updates on eligible expenses and any changes to the rules governing FSAs and HSAs.

Consult a Professional: If you’re unsure about specific expenses or the tax implications of your FSA or HSA, consult with a financial advisor or tax professional.

Conclusion

FSAs and HSAs are powerful tools for managing healthcare costs while also providing tax benefits. By understanding the eligibility criteria, eligible expenses, and strategic uses of these accounts, individuals can make informed decisions about their healthcare spending and savings. Whether you’re navigating the complexities of FSAs, HSAs, or both, the key to maximizing their benefits lies in thorough understanding, careful planning, and ongoing management of your accounts.

What is the main difference between an FSA and an HSA?

+The main difference between an FSA (Flexible Spending Account) and an HSA (Health Savings Account) is their eligibility criteria, portability, and rollover rules. FSAs are offered by employers and have a "use it or lose it" rule at the end of the plan year, whereas HSAs are available to individuals with High Deductible Health Plans (HDHPs), are portable, and allow rollover of unused funds.

Can I have both an FSA and an HSA?

+Generally, you cannot have both an FSA and an HSA for the same type of expenses (e.g., medical) at the same time. However, there are exceptions and specific combinations like a Limited Purpose FSA that can coexist with an HSA for dental and vision expenses.

What are some common eligible expenses for FSAs and HSAs?

+Common eligible expenses include doctor visit copays, prescription medications, glasses, dental care, and certain over-the-counter medications with a prescription. It's essential to check the IRS's list of eligible medical expenses and your specific plan's guidelines for the most accurate information.

In navigating the landscape of FSAs and HSAs, individuals can not only optimize their healthcare spending but also contribute to their long-term financial well-being. By understanding the nuances of these accounts and utilizing them effectively, individuals can make the most of their healthcare dollars while also planning for the future.