Hdhp Guide: Maximize Health Coverage

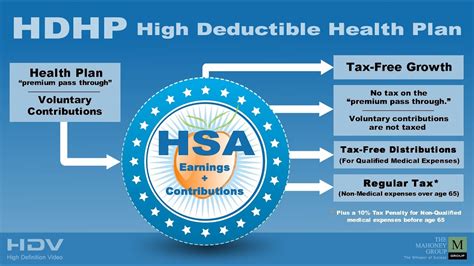

In the realm of health insurance, High-Deductible Health Plans (HDHPs) have emerged as a popular option for individuals and families seeking to balance comprehensive coverage with affordable premiums. At the heart of an HDHP’s appeal lies its unique structure: a higher deductible in exchange for lower monthly premiums, coupled with the potential for tax-advantaged savings through a Health Savings Account (HSA). However, navigating the landscape of HDHPs can be daunting, given the myriad of choices and considerations involved. This comprehensive guide is designed to help you maximize your health coverage under an HDHP, ensuring you reap the benefits while mitigating potential drawbacks.

Understanding HDHPs: The Basics

Before diving into the intricacies of maximizing your HDHP, it’s essential to grasp the fundamental components of these plans. HDHPs are characterized by their higher deductibles compared to traditional health insurance plans. For the 2023 plan year, the IRS defines an HDHP as a plan with a deductible of at least 1,500 for individual coverage and 3,000 for family coverage. In return for accepting this higher upfront cost, policyholders typically enjoy significantly lower premiums. Moreover, HDHPs often come with out-of-pocket maximums that are higher than other health plans, which means your total medical expenses for the year are capped once you meet this threshold.

Leveraging Health Savings Accounts (HSAs)

One of the most significant advantages of HDHPs is their eligibility for Health Savings Accounts (HSAs). An HSA allows you to set aside pre-tax dollars in a savings account specifically for medical expenses. Contributions to an HSA are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are tax-free. For 2023, the contribution limits for HSAs are 3,850 for individuals and 7,750 for families, with an additional $1,000 catch-up contribution allowed for those 55 and older. By maximizing your HSA contributions, you can accumulate a substantial fund over time to cover your deductible, copays, coinsurance, and other medical expenses, thereby enhancing your overall health coverage.

Navigating Preventive Care

HDHPs, like all health insurance plans, cover certain preventive care services without requiring you to meet your deductible first. These services, as mandated by the Affordable Care Act (ACA), include annual physicals, vaccinations, screenings for diseases like diabetes and certain types of cancer, and contraceptive services, among others. Understanding what preventive care is covered can help you maintain your health and catch potential issues early, all without incurring additional out-of-pocket expenses.

Strategic Use of Out-of-Network Benefits

While HDHPs often incentivize the use of in-network providers by offering more favorable copays and coinsurance rates, knowing when and how to utilize out-of-network benefits can be crucial. Sometimes, the best specialist for your condition might be out-of-network, or you might find yourself in need of emergency care while travelling. Familiarize yourself with your HDHP’s out-of-network provisions, including any differences in copays, coinsurance, and deductibles. In some cases, negotiating directly with out-of-network providers can lead to significant savings.

Maximizing Your HDHP: Tips and Strategies

- Contribute to Your HSA Aggressively: Max out your annual HSA contributions to build a robust fund for medical expenses.

- Shop Around for Care: Prices for medical services can vary significantly. Websites and tools that compare prices can help you find affordable, high-quality care.

- Utilize Telemedicine: Many HDHPs now cover telemedicine services, which can be a cost-effective way to address minor health concerns without leaving your home.

- Understand Your Plan’s Network: Know which providers are in-network to minimize out-of-pocket costs for non-preventive care.

- Review and Adjust Annually: As your health needs and financial situation change, reassess your HDHP and HSA strategy annually during open enrollment.

Case Study: Applying HDHP Strategies in Real Life

Consider the example of a 35-year-old individual, Sarah, who chooses an HDHP with a 2,000 deductible and a 6,000 out-of-pocket maximum. She contributes the maximum allowed to her HSA and uses it to cover her preventive care services and other medical expenses throughout the year. By doing so, Sarah minimizes her taxable income, grows her HSA fund over time, and ensures comprehensive health coverage at a lower premium cost. When she needs unexpected care, her HSA funds are available to cover her deductible and other expenses, reducing her financial burden.

Looking Forward: Future Trends in HDHPs

As the healthcare landscape continues to evolve, HDHPs are likely to play an increasingly significant role. With advancements in healthcare technology and the growing focus on preventive care, policyholders can expect more integrated and holistic health coverage options. Furthermore, the rise of personalized medicine and genetic testing may lead to more tailored health plans, with HDHPs potentially offering more flexibility and choice in coverage.

FAQ Section

What are the primary advantages of High-Deductible Health Plans (HDHPs)?

+The primary advantages of HDHPs include lower premiums, eligibility for a Health Savings Account (HSA), and potential tax benefits through HSA contributions and growth. These aspects can make HDHPs an attractive option for those seeking to manage their health insurance costs.

Can I use my HSA for expenses other than medical care?

+While HSAs are designed for medical expenses, you can use your HSA funds for non-medical expenses after age 65 without penalty, though you'll pay income tax on these withdrawals. However, using HSA funds for non-medical expenses before age 65 will result in a 20% penalty, in addition to income tax on the withdrawal.

How do I choose the right HDHP for my needs?

+Choosing the right HDHP involves considering your health care needs, financial situation, and the specifics of the plan, including the deductible, out-of-pocket maximum, copays, coinsurance, and network providers. It's also crucial to assess the plan's HSA compatibility and contribution limits.

By embracing the strategies and insights outlined in this guide, you can navigate the complexities of HDHPs with confidence, ensuring that you maximize your health coverage while minimizing your costs. Whether you’re a seasoned HDHP policyholder or considering this option for the first time, understanding the nuances of these plans and leveraging their benefits can lead to a more affordable, effective, and personalized approach to your health care.