Hi State Refund

Navigating the complexities of state refunds can be a daunting task, especially considering the varied regulations and eligibility criteria that differ from one state to another. For individuals and businesses alike, understanding the process and requirements for claiming a state refund is crucial for maximizing financial returns and ensuring compliance with state laws.

Overview of State Refunds

State refunds can arise from various sources, including income tax returns, sales tax payments, and property tax assessments. Each state has its own set of rules and deadlines governing these refunds, making it essential to consult the specific guidelines applicable to your situation. For instance, some states offer refunds for certain types of purchases, such as energy-efficient appliances or educational materials, as part of their economic incentive programs.

Types of State Refunds

Income Tax Refunds:These are perhaps the most common type of state refund. When an individual or business overpays their state income taxes, they are eligible for a refund. The process typically involves filing an amended tax return or claiming the refund through the original tax return, depending on the state’s procedures.

Sales Tax Refunds:Some states allow for the refund of sales taxes under specific circumstances, such as for items purchased for resale, manufacturing, or certain exemptions like agricultural equipment. The eligibility and application process can be complex and varies by state.

Property Tax Refunds:Homeowners and businesses may be eligible for property tax refunds due to overpayment, incorrect assessment, or as part of state programs aimed at reducing the tax burden on certain groups, like seniors or veterans.

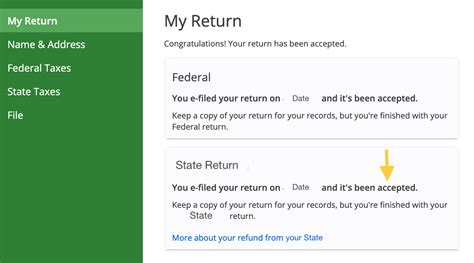

How to Claim a State Refund

Claiming a state refund involves several steps, including:

- Gather Necessary Documents: Ensure you have all relevant receipts, tax returns, and identification documents required by your state.

- Check Eligibility: Visit your state’s official website or consult with a tax professional to confirm your eligibility for a refund.

- Fill Out the Appropriate Form: Each state has specific forms for refund claims. Make sure to fill out the correct form accurately and completely.

- Submit Your Claim: Follow the state’s guidelines for submitting your refund claim. This could be online, by mail, or in person, depending on the state’s policies.

- Follow Up: If you haven’t received your refund within the expected timeframe, contact your state’s tax authority to inquire about the status of your claim.

Common Challenges and Solutions

- Delays in Refund Processing: If your refund is delayed, it may be due to incomplete applications or audits. Keeping detailed records and ensuring all information is accurate can help avoid these issues.

- Eligibility Issues: Understanding the eligibility criteria thoroughly can prevent disappointment. If you’ve been denied a refund, reviewing the state’s regulations and possibly consulting a tax advisor can help clarify your options.

- Complexity of State Laws: The complexity of state tax laws can make navigating the refund process challenging. Utilizing tax software or consulting a tax professional can provide guidance and ensure compliance with all regulations.

Conclusion

State refunds are an essential aspect of managing your finances, whether you’re an individual or a business. By understanding the types of refunds available, the process for claiming them, and how to overcome common challenges, you can maximize your financial benefits and ensure compliance with state tax laws. Remember, each state has its unique set of rules and regulations, so staying informed and seeking professional advice when needed can make the process smoother and more successful.

What are the most common types of state refunds?

+The most common types of state refunds include income tax refunds, sales tax refunds, and property tax refunds. Each type has specific eligibility criteria and application processes.

How do I check if I am eligible for a state refund?

+To check your eligibility, visit your state's official website or consult with a tax professional. They can guide you through the eligibility criteria and application process for the specific type of refund you're interested in.

What documents do I need to claim a state refund?

+The documents required can vary depending on the type of refund. Generally, you'll need identification, receipts for purchases (for sales tax refunds), and possibly amended tax returns or specific claim forms provided by your state.

In navigating the world of state refunds, remember that knowledge is power. Staying informed about the regulations, deadlines, and required documents can significantly simplify the process. Whether you’re seeking to reclaim overpaid taxes or take advantage of state incentive programs, understanding how state refunds work can lead to significant financial benefits. Always consider consulting with tax professionals or utilizing reputable tax software to ensure you’re making the most of the opportunities available to you.