High Deductible Health Plan

The world of health insurance can be complex and overwhelming, especially when it comes to navigating the various types of plans available. One type of plan that has gained popularity in recent years is the High Deductible Health Plan (HDHP). But what exactly is an HDHP, and how does it work? In this comprehensive guide, we’ll delve into the details of HDHPs, exploring their benefits and drawbacks, and helping you determine if this type of plan is right for you.

What is a High Deductible Health Plan?

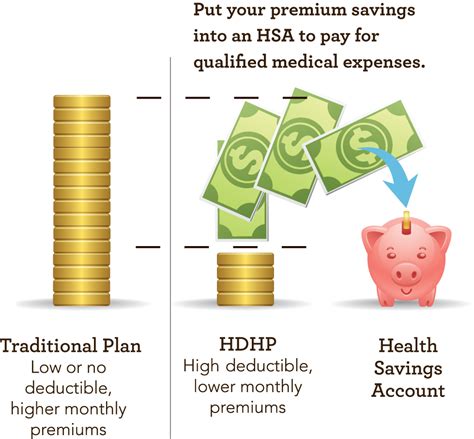

A High Deductible Health Plan is a type of health insurance plan that requires you to pay a higher deductible than traditional health plans before the insurance company starts paying its share of the costs. The deductible is the amount you must pay out-of-pocket for medical expenses before your insurance kicks in. For example, if your plan has a 3,000 deductible, you'll need to pay the first 3,000 of your medical expenses before your insurance company starts covering costs.

How Do HDHPs Work?

HDHPs are designed to be more cost-effective than traditional health plans, with lower monthly premiums in exchange for higher deductibles. Here’s a step-by-step breakdown of how HDHPs work:

- You pay the deductible: You’re responsible for paying the full deductible amount before your insurance company starts covering costs.

- You pay coinsurance: After meeting the deductible, you’ll typically pay a percentage of the medical costs (coinsurance) for services like doctor visits, hospital stays, and prescriptions.

- You reach the out-of-pocket maximum: Once you’ve paid the deductible and coinsurance, you’ll reach the out-of-pocket maximum, which is the maximum amount you’ll pay for medical expenses in a given year.

- The insurance company pays: After reaching the out-of-pocket maximum, your insurance company will cover 100% of eligible medical expenses for the remainder of the year.

Benefits of High Deductible Health Plans

HDHPs offer several benefits, including:

- Lower premiums: HDHPs often have lower monthly premiums compared to traditional health plans, making them more affordable for individuals and families.

- Health Savings Account (HSA) eligibility: HDHPs are eligible for Health Savings Accounts (HSAs), which allow you to set aside pre-tax dollars for medical expenses, reducing your taxable income.

- Increased cost transparency: With an HDHP, you’re more likely to be aware of the costs associated with medical services, which can help you make more informed decisions about your care.

- Improved health outcomes: By being more invested in your healthcare costs, you may be more likely to prioritize preventive care and make healthier lifestyle choices.

Drawbacks of High Deductible Health Plans

While HDHPs offer several benefits, there are also some drawbacks to consider:

- Higher upfront costs: The high deductible can be a significant burden, especially for individuals or families with limited financial resources.

- Confusion and complexity: HDHPs can be complex, making it difficult to understand how the plan works and what’s covered.

- Limited provider networks: Some HDHPs may have limited provider networks, which can restrict your access to certain doctors and hospitals.

- Financial risk: With an HDHP, you may be at risk of financial hardship if you experience unexpected medical expenses.

Is a High Deductible Health Plan Right for You?

Whether an HDHP is right for you depends on your individual circumstances, including your health status, financial situation, and personal preferences. Consider the following factors when deciding:

- Your health status: If you’re relatively healthy and don’t anticipate significant medical expenses, an HDHP might be a good choice.

- Your financial situation: If you have a stable income and can afford the higher deductible, an HDHP could be a cost-effective option.

- Your provider preferences: If you have a preferred provider or hospital, ensure they’re part of the HDHP’s network.

When evaluating an HDHP, it's essential to consider your overall financial situation and health status. If you're unsure about whether an HDHP is right for you, consult with a licensed insurance professional or financial advisor for personalized guidance.

Frequently Asked Questions

What is the difference between an HDHP and a traditional health plan?

+The primary difference between an HDHP and a traditional health plan is the deductible amount. HDHPs have higher deductibles, which can range from $1,000 to $7,000 or more, whereas traditional plans typically have lower deductibles.

Can I use an HSA with an HDHP?

+Yes, HDHPs are eligible for Health Savings Accounts (HSAs). An HSA allows you to set aside pre-tax dollars for medical expenses, reducing your taxable income.

How do I choose the right HDHP for my needs?

+When selecting an HDHP, consider factors such as the deductible amount, coinsurance, out-of-pocket maximum, and provider network. It's essential to evaluate your individual circumstances, including your health status and financial situation, to determine the best plan for your needs.

Conclusion

High Deductible Health Plans can be a cost-effective option for individuals and families, offering lower premiums and the potential for tax savings through HSAs. However, it’s crucial to carefully consider your individual circumstances, including your health status and financial situation, to determine if an HDHP is right for you. By understanding the benefits and drawbacks of HDHPs and evaluating your options, you can make an informed decision and choose a plan that meets your unique needs.

Ultimately, the key to navigating the complex world of health insurance is to educate yourself on the available options and carefully consider your individual circumstances. By doing so, you can make informed decisions and select a plan that provides the right balance of affordability, coverage, and financial protection for you and your loved ones.