Hmo And Ppo: Compare Benefits And Save

When it comes to health insurance, two of the most popular options are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Both types of plans have their own set of benefits and drawbacks, and understanding the differences between them can help you make an informed decision about which type of plan is best for you.

What is an HMO?

A Health Maintenance Organization (HMO) is a type of health insurance plan that provides coverage for a fixed monthly fee. In an HMO, you typically choose a primary care physician from a network of providers, and this doctor will coordinate your care and refer you to specialists as needed. HMOs often have lower premiums than other types of plans, but they can also have more restrictions on the care you receive.

What is a PPO?

A Preferred Provider Organization (PPO) is a type of health insurance plan that offers more flexibility than an HMO. In a PPO, you can see any doctor you choose, both in and out of network, without needing a referral from a primary care physician. PPOs often have higher premiums than HMOs, but they can also provide more comprehensive coverage and greater freedom to choose your own healthcare providers.

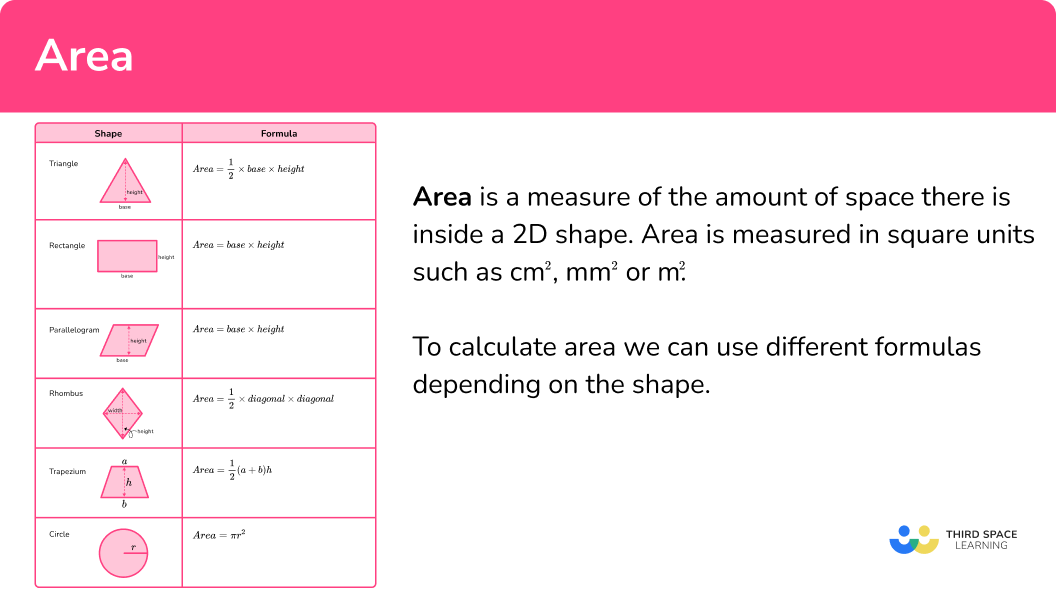

Comparison of HMO and PPO Benefits

Here are some key benefits of HMOs and PPOs to consider:

- Network Size: HMOs typically have smaller networks of providers than PPOs, which can limit your choice of doctors and hospitals. PPOs, on the other hand, often have larger networks and may even cover care from out-of-network providers.

- Referrals: In an HMO, you typically need to get a referral from your primary care physician to see a specialist. In a PPO, you can usually see a specialist without a referral.

- Cost: HMOs often have lower premiums than PPOs, but you may have to pay more out-of-pocket for care. PPOs can be more expensive, but they may also provide more comprehensive coverage.

- Flexibility: PPOs offer more flexibility than HMOs, allowing you to see any doctor you choose and receive care from out-of-network providers.

When deciding between an HMO and a PPO, it's essential to consider your individual needs and circumstances. If you have a chronic condition or need to see a specialist regularly, a PPO may be a better choice. However, if you're relatively healthy and want to save money on premiums, an HMO could be a good option.

How to Save Money on HMO and PPO Plans

Here are some tips for saving money on HMO and PPO plans:

- Shop Around: Compare prices and benefits from different insurance companies to find the best deal.

- Choose a Higher Deductible: If you’re willing to pay more out-of-pocket for care, you may be able to lower your premiums.

- Consider a Health Savings Account (HSA): An HSA can help you save money on healthcare expenses and reduce your taxable income.

- Take Advantage of Preventive Care: Many HMO and PPO plans cover preventive care services, such as annual physicals and screenings, at no additional cost.

- Use Generic Medications: Generic medications can be significantly cheaper than brand-name medications, and many insurance plans cover them at a lower copayment.

| Plan Type | Premiums | Out-of-Pocket Costs | Network Size |

|---|---|---|---|

| HMO | Lower | Higher | Smaller |

| PPO | Higher | Lower | Larger |

Common Misconceptions About HMOs and PPOs

Here are some common misconceptions about HMOs and PPOs:

- Myth: HMOs are always cheaper than PPOs.

- Reality: While HMOs often have lower premiums, they can also have higher out-of-pocket costs and more restrictive networks.

- Myth: PPOs always provide better coverage than HMOs.

- Reality: While PPOs can provide more comprehensive coverage, they can also be more expensive and may have higher deductibles and copayments.

Pros and Cons of HMOs and PPOs

HMOs:

- Lower premiums

- Preventive care services often covered at no additional cost

- Coordinate care through primary care physician

PPOs:

- More flexibility in choosing healthcare providers

- Comprehensive coverage for in-network and out-of-network care

- No referrals needed to see specialists

Frequently Asked Questions

Here are some frequently asked questions about HMOs and PPOs:

What is the main difference between an HMO and a PPO?

+The main difference between an HMO and a PPO is the level of flexibility in choosing healthcare providers. In an HMO, you typically choose a primary care physician from a network of providers, while in a PPO, you can see any doctor you choose, both in and out of network.

Which type of plan is better for people with chronic conditions?

+A PPO may be a better choice for people with chronic conditions, as it provides more flexibility in choosing healthcare providers and may cover care from out-of-network specialists.

Can I change from an HMO to a PPO or vice versa?

+Yes, you can change from an HMO to a PPO or vice versa during open enrollment or if you experience a qualifying life event, such as a change in employment or the birth of a child.

In conclusion, both HMOs and PPOs have their own set of benefits and drawbacks, and the best type of plan for you will depend on your individual needs and circumstances. By understanding the differences between HMOs and PPOs, you can make an informed decision about which type of plan is best for you and save money on your healthcare expenses.