Hmo Vs Ppo

When it comes to navigating the complex world of health insurance, two of the most common types of plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). Understanding the differences between these two can be crucial in making an informed decision about which plan best suits your needs and budget.

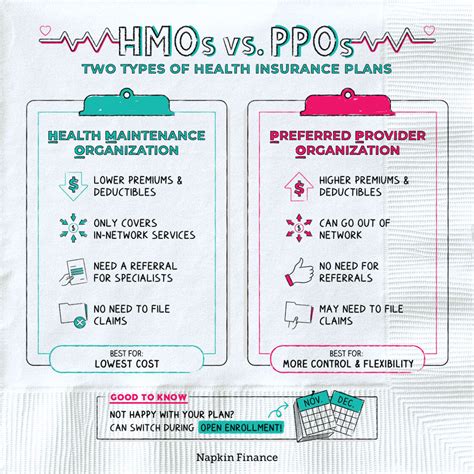

To begin with, let’s delve into the core characteristics of each. An HMO is designed to provide health care services to its members at a lower cost than traditional health insurance. HMOs achieve this by creating a network of healthcare providers who contract with the HMO to offer services to members at negotiated rates. The key aspect of HMO plans is that they generally cover only care received from providers within the HMO’s network, except in emergency situations. This means that if you see a doctor or visit a hospital that is not part of your HMO’s network, you may have to pay the full cost out-of-pocket, unless it’s an emergency.

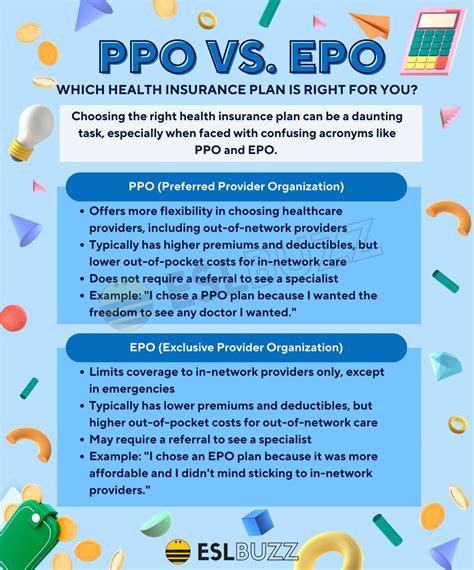

On the other hand, a PPO plan offers more flexibility than an HMO. PPOs also have a network of healthcare providers, but unlike HMOs, they allow you to see any healthcare provider, both in and out of the network, without needing a referral. While seeing providers within the PPO network will typically cost you less, you still have the option to go outside of the network for care, albeit at a higher cost to you. This flexibility makes PPOs attractive to individuals who value having a wide range of healthcare options or who have healthcare needs that cannot be met within a single network.

Another critical aspect to consider when deciding between HMO and PPO plans is the cost. Generally, HMO plans are less expensive than PPO plans due to their more restrictive network and referral requirements. However, this cost savings comes at the price of less flexibility in your healthcare choices. PPO plans, while potentially more expensive in terms of premiums and out-of-pocket costs, offer the advantage of being able to see any healthcare provider you wish, albeit with varying levels of coverage and cost-sharing.

In terms of navigating these plans, understanding your network and the costs associated with in-network versus out-of-network care is crucial. For those with HMO plans, being aware of the process for getting referrals and the potential consequences of seeking out-of-network care without an emergency can help avoid unexpected medical bills. For PPO plan holders, keeping track of your out-of-pocket expenses and understanding how your plan’s deductible, copays, and coinsurance work both in and out of network can help manage your healthcare spending.

In conclusion, the choice between HMO and PPO health insurance plans depends on a variety of factors, including your health needs, budget, and personal preferences regarding healthcare flexibility. Both types of plans have their advantages and disadvantages, and what works best for one person may not be ideal for another. By understanding the fundamental differences between HMO and PPO plans and considering your individual circumstances, you can make an informed decision that meets your healthcare needs while also being mindful of your financial situation.

Frequently Asked Questions

What is the primary difference between HMO and PPO health insurance plans?

+The primary difference lies in the flexibility and network restrictions. HMO plans are more restrictive, requiring you to receive care from within the network except in emergencies, while PPO plans offer more flexibility by allowing you to see any healthcare provider, both in and out of the network, albeit at different costs.

Do HMO plans require a primary care physician (PCP)?

+Yes, many HMO plans require you to choose a PCP from within the network, who then coordinates your care, including referrals to specialists. This is not typically a requirement for PPO plans.

Which type of plan is generally less expensive?

+HMO plans are generally less expensive than PPO plans due to their more restrictive network and referral requirements. However, the cost savings must be weighed against the potential benefits of having greater flexibility in your healthcare choices with a PPO plan.

Can I see any doctor I want with a PPO plan?

+Yes, one of the key benefits of a PPO plan is the flexibility to see any healthcare provider, both in and out of the network, without needing a referral. However, seeing providers outside of the network will typically cost more than staying within the network.

By carefully considering these factors and understanding the nuances of both HMO and PPO plans, you can make an informed decision that best meets your healthcare needs and financial situation. Remember, the key to choosing the right health insurance plan is balancing your need for flexibility and choice with your budget and healthcare requirements.