Hmo Vs Ppo: Choose Best Coverage

In the complex landscape of health insurance, two popular options often stand out for their comprehensive coverage and flexibility: Health Maintenance Organization (HMO) plans and Preferred Provider Organization (PPO) plans. Both HMOs and PPOs have their unique set of benefits and drawbacks, catering to different needs and preferences. Understanding the intricacies of each can help individuals and families make informed decisions about their health coverage.

Introduction to HMOs

HMO plans are designed to provide comprehensive health care services to their members at a lower cost than traditional health insurance. The key characteristic of an HMO is that it contracts with a specific network of healthcare providers to offer services to its members. Members typically need to receive medical care and services from these in-network providers to have their care covered, except in emergency situations. This restrictive network is a trade-off for the lower premiums and out-of-pocket costs associated with HMOs.

Introduction to PPOs

PPO plans offer more flexibility than HMOs by allowing policyholders to see any healthcare provider they wish, both in-network and out-of-network. While seeing an in-network provider results in lower costs for the patient, PPOs also cover care received from out-of-network providers, albeit at a higher cost to the patient. This flexibility, combined with the freedom to see specialists without needing a referral, makes PPOs appealing to those who value choice and are willing to pay a bit more for it.

Comparative Analysis

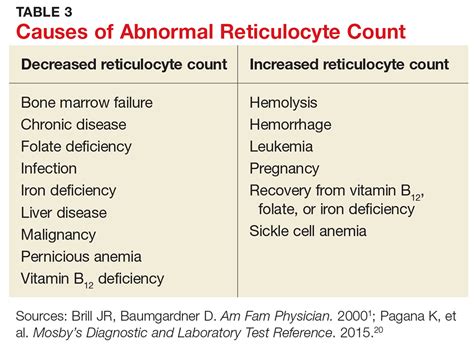

When deciding between HMO and PPO plans, several factors come into play:

Network and Provider Choice: PPOs offer greater flexibility with a larger network of providers and the option to see out-of-network doctors. HMOs, on the other hand, have a more limited network but often at a lower cost.

Cost: Generally, HMOs are less expensive than PPOs, with lower premiums, deductibles, and co-payments. However, the cost savings come with restrictions on provider choice.

Referrals: In HMO plans, members often need a referral from their primary care physician to see a specialist. PPO plans usually do not require referrals to see specialists.

Out-of-Pocket Maximums: Both HMOs and PPOs have out-of-pocket maximums, but PPOs can have higher maximums, especially when including out-of-network care.

Emergency Care: Both types of plans cover emergency care, including out-of-network emergency services.

Decision Framework

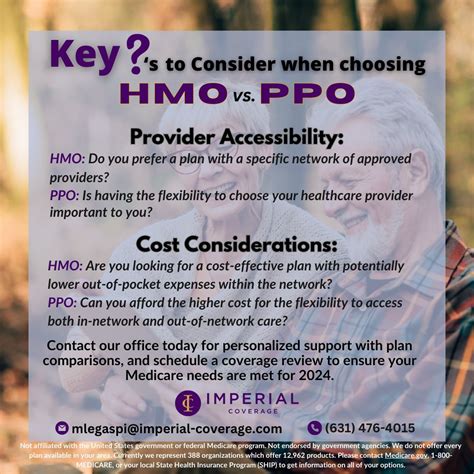

To choose the best coverage between HMO and PPO plans, consider the following criteria:

- Budget: If cost is a significant factor, HMOs might offer more affordable premiums and lower out-of-pocket expenses.

- Health Needs: Individuals with ongoing health issues or those who prefer to have the freedom to choose their healthcare providers might find PPOs more suitable.

- Provider Network: If your current healthcare providers are part of an HMO network, staying within that network could be beneficial. However, if you prefer the flexibility to see any doctor, a PPO might be a better choice.

- Travel Frequency: Frequent travelers might prefer PPOs for their broader coverage, including out-of-network care.

Key Takeaways

- HMOs are ideal for those looking for affordable healthcare with lower premiums and are comfortable with a restricted provider network.

- PPOs are better suited for individuals who value flexibility and are willing to pay more for the freedom to choose any healthcare provider.

Step-by-Step Guide to Choosing

- Assess Your Health Needs: Consider your current health status and any anticipated medical needs.

- Evaluate Your Budget: Determine how much you can afford for premiums, deductibles, and out-of-pocket expenses.

- Research Networks: Check which healthcare providers are included in the HMO and PPO networks you’re considering.

- Compare Plans: Look at the specifics of each plan, including coverage, cost, and any additional benefits like dental or vision care.

- Read Reviews and Ask Questions: Look for feedback from current members and ask about any concerns you have with the insurance provider.

FAQ Section

What is the main difference between HMO and PPO health insurance plans?

+The primary difference lies in the flexibility and cost. HMOs offer lower costs but restrict care to in-network providers (except in emergencies), while PPOs provide more flexibility to see any healthcare provider, both in-network and out-of-network, at a higher cost.

Do HMO and PPO plans cover emergency care?

+Yes, both HMO and PPO plans cover emergency care, including services received from out-of-network providers in emergency situations.

How do I decide between an HMO and a PPO plan for my family?

+Consider your family's health needs, budget, and preferences regarding provider choice and flexibility. If cost is a significant concern and you're comfortable with a restricted network, an HMO might be suitable. If you prefer more flexibility in choosing healthcare providers and are willing to pay more, a PPO could be a better option.

In conclusion, the choice between HMO and PPO health insurance plans depends on individual and family preferences, health needs, and budget considerations. By weighing the benefits and drawbacks of each type of plan and considering personal circumstances, individuals can make informed decisions that ensure they have the right health coverage for their unique situation.