Hmo Vs Ppo: Choose Best Health Plan

When it comes to choosing a health insurance plan, two of the most popular options are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). Both types of plans have their advantages and disadvantages, and the best choice for you will depend on your individual needs and circumstances. In this article, we will delve into the details of HMO and PPO plans, exploring their differences, benefits, and drawbacks, to help you make an informed decision.

Understanding HMO Plans

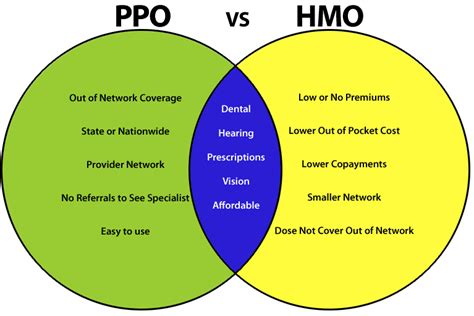

HMO plans are a type of health insurance that provides coverage for medical services within a specific network of providers. These plans are designed to provide comprehensive care at a lower cost, with an emphasis on preventive care. HMO plans typically require you to choose a primary care physician (PCP) who will coordinate your care and refer you to specialists within the network when necessary.

One of the key benefits of HMO plans is their cost-effectiveness. HMO plans often have lower premiums and out-of-pocket costs compared to PPO plans. Additionally, HMO plans tend to have a stronger focus on preventive care, which can help you avoid costly medical procedures down the line. However, HMO plans also have some limitations. For example, you may need to obtain a referral from your PCP to see a specialist, which can sometimes delay treatment. Furthermore, HMO plans often have a narrower network of providers, which may limit your access to certain specialists or medical facilities.

Understanding PPO Plans

PPO plans, on the other hand, offer more flexibility and freedom when it comes to choosing healthcare providers. With a PPO plan, you can see any healthcare provider you choose, both in-network and out-of-network, without needing a referral from a primary care physician. PPO plans also tend to have a larger network of providers, which can be beneficial if you need to see a specialist or receive care from a specific hospital.

One of the primary advantages of PPO plans is their flexibility. With a PPO plan, you have the freedom to choose any healthcare provider you prefer, which can be especially beneficial if you have a pre-existing condition or require specialized care. Additionally, PPO plans often have a wider range of coverage options, including dental and vision care. However, PPO plans also tend to be more expensive than HMO plans, with higher premiums and out-of-pocket costs. Moreover, PPO plans may have higher deductibles and copays, which can increase your costs.

Key Differences Between HMO and PPO Plans

When deciding between an HMO and a PPO plan, there are several key differences to consider:

- Network: HMO plans have a narrower network of providers, while PPO plans have a larger network.

- Referrals: HMO plans often require referrals from a primary care physician to see a specialist, while PPO plans do not.

- Cost: HMO plans tend to be less expensive, with lower premiums and out-of-pocket costs.

- Flexibility: PPO plans offer more flexibility and freedom when it comes to choosing healthcare providers.

Which Plan is Right for You?

Ultimately, the choice between an HMO and a PPO plan will depend on your individual needs and circumstances. If you prioritize cost-effectiveness and are willing to work within a narrower network of providers, an HMO plan may be the best choice for you. On the other hand, if you value flexibility and freedom when it comes to choosing healthcare providers, a PPO plan may be a better fit.

To help you make a more informed decision, consider the following questions:

- What is your budget for health insurance? If you are on a tight budget, an HMO plan may be more affordable.

- Do you have a pre-existing condition or require specialized care? If so, a PPO plan may be a better choice, as it offers more flexibility and freedom when it comes to choosing healthcare providers.

- How important is preventive care to you? If you prioritize preventive care, an HMO plan may be a better fit, as it tends to have a stronger focus on preventive care.

In conclusion, both HMO and PPO plans have their advantages and disadvantages. By understanding the differences between these two types of plans and considering your individual needs and circumstances, you can make an informed decision and choose the best health plan for you.

FAQ Section:

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of flexibility and freedom when it comes to choosing healthcare providers. HMO plans have a narrower network of providers and often require referrals from a primary care physician, while PPO plans have a larger network and do not require referrals.

Which plan is more cost-effective?

+HMO plans tend to be more cost-effective, with lower premiums and out-of-pocket costs. However, PPO plans may offer more comprehensive coverage and flexibility, which can be beneficial for individuals with specific healthcare needs.

Can I switch from an HMO to a PPO plan?

+Yes, you can switch from an HMO to a PPO plan, but it may depend on your specific circumstances and the rules of your insurance provider. It’s essential to review your policy and consult with your insurance provider to determine the best course of action.