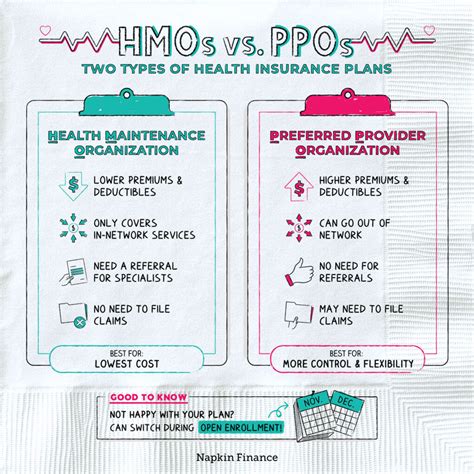

When it comes to healthcare, two of the most popular types of health insurance plans are Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. Both have their own unique features, advantages, and disadvantages. Understanding the differences between HMO and PPO plans can help you make an informed decision and save money on healthcare.

HMO Plans:

HMO plans are a type of health insurance that requires you to receive medical care from a specific network of providers. These plans are designed to provide comprehensive healthcare services to their members at a lower cost. HMO plans typically have the following characteristics:

- Network of Providers: HMO plans have a network of healthcare providers, including primary care physicians, specialists, and hospitals, who have agreed to provide care to plan members at a discounted rate.

- Primary Care Physician (PCP): HMO plans require you to choose a primary care physician from the plan’s network, who will coordinate your medical care and refer you to specialists if needed.

- Referrals: To see a specialist, you typically need a referral from your PCP, although some HMO plans may allow you to self-refer to certain specialists.

- Out-of-Network Care: HMO plans usually do not cover out-of-network care, except in emergency situations.

PPO Plans:

PPO plans are another type of health insurance that offers more flexibility than HMO plans. PPO plans allow you to receive medical care from any healthcare provider, both in-network and out-of-network. PPO plans typically have the following characteristics:

- Network of Providers: PPO plans also have a network of healthcare providers, but you are not required to receive care from these providers.

- No PCP Required: PPO plans do not require you to choose a primary care physician, and you can see any healthcare provider without a referral.

- Out-of-Network Care: PPO plans cover out-of-network care, but at a higher cost to you.

- Higher Premiums: PPO plans typically have higher premiums than HMO plans, due to the greater flexibility and freedom to choose your healthcare providers.

Key Differences:

Here are the key differences between HMO and PPO plans:

- Network Restrictions: HMO plans have stricter network restrictions, requiring you to receive care from within the plan’s network, while PPO plans allow you to receive care from any healthcare provider.

- Referrals: HMO plans typically require referrals from your PCP to see a specialist, while PPO plans do not require referrals.

- Out-of-Network Care: HMO plans usually do not cover out-of-network care, except in emergency situations, while PPO plans cover out-of-network care at a higher cost to you.

- Premiums: HMO plans typically have lower premiums than PPO plans, due to the network restrictions and referral requirements.

Choosing Between HMO and PPO Plans:

When choosing between HMO and PPO plans, consider the following factors:

- Healthcare Needs: If you have ongoing healthcare needs, an HMO plan may be more suitable, as you will have a primary care physician to coordinate your care.

- Flexibility: If you want more flexibility to choose your healthcare providers, a PPO plan may be more suitable.

- Budget: If you are on a tight budget, an HMO plan may be more affordable, with lower premiums and out-of-pocket costs.

- Provider Network: Check the provider network of both HMO and PPO plans to ensure that your preferred healthcare providers are included.

In conclusion, HMO and PPO plans have their own unique features and advantages. By understanding the differences between these plans and considering your healthcare needs, budget, and provider network, you can make an informed decision and save money on healthcare.

What are the main differences between HMO and PPO plans?

+The main differences between HMO and PPO plans are network restrictions, referrals, out-of-network care, and premiums. HMO plans have stricter network restrictions, require referrals to see specialists, and usually do not cover out-of-network care, except in emergency situations. PPO plans, on the other hand, have more flexibility, allow self-referrals to specialists, and cover out-of-network care at a higher cost.

Which plan is more suitable for people with ongoing healthcare needs?

+An HMO plan may be more suitable for people with ongoing healthcare needs, as it provides a primary care physician to coordinate their care and ensures that they receive comprehensive healthcare services from a network of providers.

By carefully evaluating your options and considering your unique healthcare needs, you can choose the plan that best fits your needs and budget, saving you money on healthcare in the long run.