Hmo: Your Path To Affordable Healthcare

The quest for affordable healthcare is a pressing concern for many individuals and families worldwide. With the rising costs of medical services and treatments, it’s becoming increasingly difficult for people to access quality healthcare without breaking the bank. However, there is a viable solution that has been gaining popularity in recent years: Health Maintenance Organizations (HMOs). In this comprehensive guide, we’ll delve into the world of HMOs, exploring their benefits, drawbacks, and everything in between.

Introduction to HMOs

A Health Maintenance Organization (HMO) is a type of health insurance plan that provides comprehensive medical coverage to its members at a fixed monthly fee. HMOs operate on a network-based model, where members are required to receive medical care from a specific group of healthcare providers who have contracted with the HMO. This network-based approach allows HMOs to negotiate lower rates with healthcare providers, resulting in cost savings for members.

How HMOs Work

HMOs work by pooling the resources of their members to negotiate better rates with healthcare providers. In exchange for a monthly premium, members receive access to a range of medical services, including doctor visits, hospital stays, and prescription medications. HMOs often have a primary care physician (PCP) coordinate the member’s care, ensuring that they receive the necessary treatments and referrals to specialists when needed.

Benefits of HMOs

HMOs offer several benefits that make them an attractive option for individuals and families seeking affordable healthcare. Some of the advantages of HMOs include:

- Cost Savings: HMOs are often more affordable than traditional health insurance plans, with lower premiums and out-of-pocket costs.

- Comprehensive Coverage: HMOs typically offer a wide range of medical services, including preventive care, diagnostic testing, and treatment for chronic conditions.

- Access to Specialty Care: HMOs often have a network of specialist providers who can provide members with advanced medical care.

- Preventive Care: HMOs emphasize preventive care, providing members with access to routine check-ups, screenings, and vaccinations.

Drawbacks of HMOs

While HMOs offer several benefits, they also have some drawbacks that members should be aware of. Some of the limitations of HMOs include:

- Limited Provider Network: HMOs have a restricted network of healthcare providers, which may limit members’ access to certain specialists or hospitals.

- Referral Requirements: HMOs often require members to obtain a referral from their PCP before seeing a specialist, which can be time-consuming and frustrating.

- Out-of-Network Costs: Members who receive medical care from providers outside the HMO’s network may be responsible for higher out-of-pocket costs or even the entire bill.

Types of HMOs

There are several types of HMOs, each with its own unique features and benefits. Some of the most common types of HMOs include:

- Staff Model HMO: In this type of HMO, the organization employs its own healthcare providers, who work exclusively for the HMO.

- Group Model HMO: This type of HMO contracts with a group of independent healthcare providers, who agree to provide medical services to HMO members at a discounted rate.

- Network Model HMO: This type of HMO contracts with a network of healthcare providers, who agree to provide medical services to HMO members at a discounted rate.

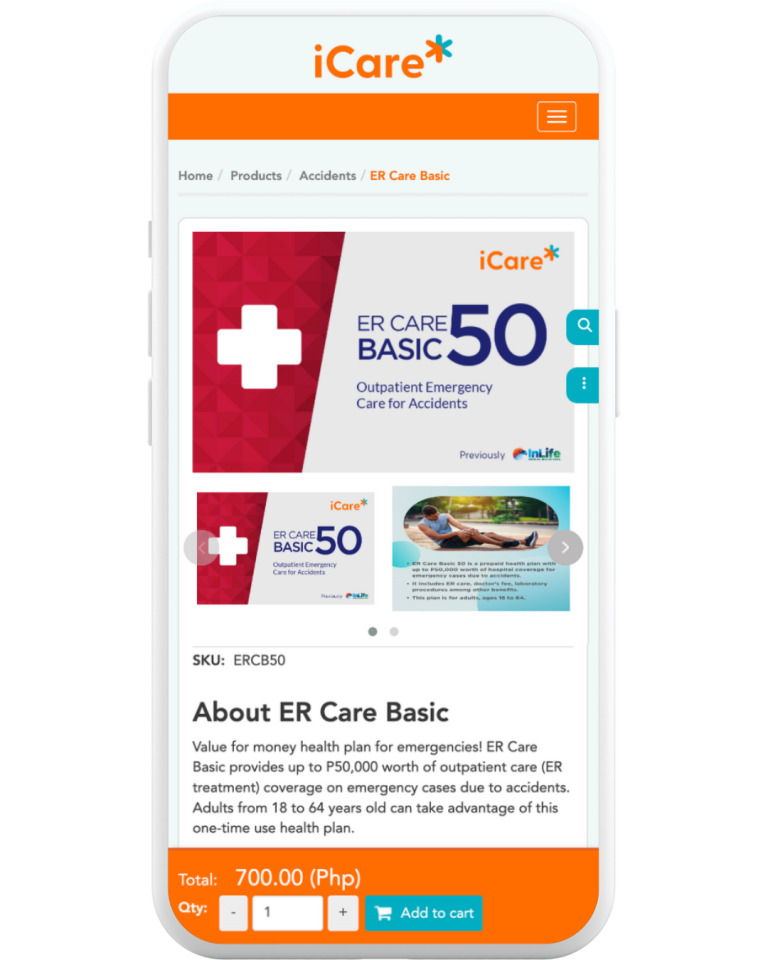

Choosing the Right HMO

With so many HMOs available, choosing the right one can be a daunting task. Here are some factors to consider when selecting an HMO:

- Provider Network: Consider the size and quality of the HMO’s provider network, including the number of primary care physicians, specialists, and hospitals.

- Cost: Compare the costs of different HMOs, including premiums, copays, and deductibles.

- Coverage: Evaluate the range of medical services covered by the HMO, including preventive care, diagnostic testing, and treatment for chronic conditions.

- Customer Service: Assess the HMO’s customer service, including the ease of obtaining referrals, resolving billing issues, and accessing medical records.

HMOs and Preventive Care

HMOs place a strong emphasis on preventive care, recognizing that early intervention and treatment can help prevent more severe and costly medical conditions from developing. Some of the preventive care services typically covered by HMOs include:

- Routine Check-Ups: Regular health check-ups with a primary care physician to monitor overall health and detect potential health issues early.

- Screenings and Vaccinations: Routine screenings for diseases such as cancer, diabetes, and hypertension, as well as vaccinations against infectious diseases like flu and pneumonia.

- Health Education: Education and counseling on healthy lifestyle choices, such as nutrition, exercise, and stress management.

HMOs and Chronic Condition Management

HMOs often have specialized programs and services to help members manage chronic conditions, such as diabetes, heart disease, and asthma. These programs may include:

- Disease Management: Coordinated care and treatment plans to help members manage their chronic conditions and prevent complications.

- Case Management: One-on-one support and guidance from a dedicated case manager to help members navigate the healthcare system and access necessary services.

- Patient Education: Education and counseling on self-management techniques, such as medication adherence, nutrition, and lifestyle modifications.

The Future of HMOs

As the healthcare landscape continues to evolve, HMOs are likely to play an increasingly important role in providing affordable and comprehensive medical care to individuals and families. Some of the trends shaping the future of HMOs include:

- Telemedicine: The integration of telemedicine services, which enable members to access medical care remotely through phone or video consultations.

- Personalized Medicine: The use of advanced data analytics and genomics to provide personalized treatment plans and targeted interventions.

- Value-Based Care: The shift towards value-based care models, which incentivize healthcare providers to deliver high-quality, cost-effective care that prioritizes patient outcomes and satisfaction.

Conclusion

HMOs offer a viable solution for individuals and families seeking affordable and comprehensive healthcare. By understanding the benefits and drawbacks of HMOs, as well as the different types of HMOs available, members can make informed decisions about their healthcare and choose the best HMO for their needs. As the healthcare landscape continues to evolve, HMOs are likely to play an increasingly important role in providing high-quality, cost-effective medical care that prioritizes patient outcomes and satisfaction.

What is the main advantage of an HMO?

+The main advantage of an HMO is its ability to provide comprehensive medical coverage at a lower cost than traditional health insurance plans. HMOs achieve this by negotiating lower rates with healthcare providers and emphasizing preventive care to reduce the need for costly medical interventions.

How do HMOs differ from traditional health insurance plans?

+HMOs differ from traditional health insurance plans in several key ways. HMOs have a restricted network of healthcare providers, which may limit members' access to certain specialists or hospitals. HMOs also often require members to obtain a referral from their primary care physician before seeing a specialist. In contrast, traditional health insurance plans typically offer more flexibility in terms of provider choice and do not require referrals for specialist care.

What types of preventive care services are typically covered by HMOs?

+HMOs typically cover a range of preventive care services, including routine check-ups, screenings, and vaccinations. These services are designed to help members stay healthy and prevent more severe medical conditions from developing. Examples of preventive care services covered by HMOs include flu shots, mammograms, and colon cancer screenings.

Can I see any doctor I want with an HMO?

+No, with an HMO, you are generally required to receive medical care from a healthcare provider within the HMO's network. If you see a provider outside of the network, you may be responsible for a higher copayment or even the entire bill. However, some HMOs may offer out-of-network benefits or provide exceptions for emergency care or specialty services.

How do I choose the right HMO for my needs?

+To choose the right HMO for your needs, consider factors such as the size and quality of the HMO's provider network, the cost of premiums and copays, and the range of medical services covered. You should also assess the HMO's customer service and reputation, as well as its accreditation status and quality ratings.

By understanding the ins and outs of HMOs, individuals and families can make informed decisions about their healthcare and choose the best HMO for their needs. Whether you’re looking for affordable medical coverage, comprehensive preventive care, or specialized services for chronic condition management, an HMO may be the right choice for you.