How Kaiser Permanente Insurance Works? Simplified Guide

For many individuals and families, navigating the complex world of health insurance can be a daunting task. Among the myriad options available, Kaiser Permanente stands out as a comprehensive health plan that integrates care and coverage. But how does Kaiser Permanente insurance work, and is it the right choice for you? Let’s delve into a simplified guide to understand its mechanics, benefits, and how it might fit your healthcare needs.

Introduction to Kaiser Permanente

Kaiser Permanente is more than just an insurance provider; it’s a health system that combines medical care with insurance coverage. Founded in the 1940s by Henry J. Kaiser and Dr. Sidney Garfield, it was designed to provide high-quality, affordable healthcare to Kaiser’s construction workers. Over the years, it has grown into one of the largest and most respected healthcare systems in the United States, known for its emphasis on preventive care, patient-centered approach, and integrated delivery system.

How Kaiser Permanente Insurance Works

At its core, Kaiser Permanente’s insurance model is based on a prepaid, group practice prepayment plan. Here’s a simplified breakdown of how it operates:

Membership Model: When you enroll in a Kaiser Permanente plan, you essentially become a member. Your monthly premium payments give you access to a comprehensive range of healthcare services.

Integrated Care: Unlike traditional insurance plans where you might receive care from various unaffiliated providers, Kaiser Permanente delivers care through its own network of hospitals, medical offices, and healthcare professionals. This integrated approach is designed to provide seamless, coordinated care.

Preventive Care Focus: A key aspect of Kaiser Permanente’s philosophy is a strong emphasis on preventive care. Members are encouraged to take an active role in their health through regular check-ups, screenings, and healthy lifestyle choices. The goal is to prevent illnesses from developing in the first place, which can also help control healthcare costs.

Appointment and Referral Process: To see a specialist, you typically start with a primary care physician (PCP) who assesses your condition and refers you to a specialist if necessary. This gatekeeper model helps ensure that you receive the right level of care and can also streamline the healthcare process.

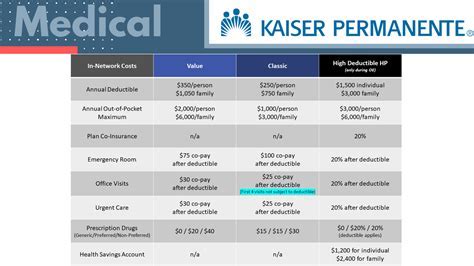

Coverage Options: Kaiser Permanente offers a variety of plans for individuals, families, and businesses, including Medicare and Medicaid programs. The coverage options can vary by region and include different levels of deductibles, copays, and out-of-pocket maximums to fit various budgets and healthcare needs.

Benefits of Kaiser Permanente Insurance

- Comprehensive Care: Members have access to a broad range of healthcare services, from primary care and specialty care to hospital and emergency services.

- Preventive Focus: The emphasis on preventive care can lead to better health outcomes and lower costs over time.

- Integrated System: The fact that care and coverage are integrated can simplify the healthcare experience, reducing administrative hassles and costs.

- Quality and Reputation: Kaiser Permanente is consistently ranked among the top health plans and medical groups in the country for quality, patient satisfaction, and innovation.

Drawbacks and Considerations

While Kaiser Permanente offers many benefits, it’s not without its drawbacks:

- Limited Network: To receive full benefits, you must use Kaiser Permanente facilities and providers, which might limit flexibility for those who prefer a broader choice of healthcare providers.

- Referral Requirements: The need for a referral from a PCP to see a specialist can sometimes be seen as a barrier to care, although it’s intended to ensure that care is coordinated and appropriate.

- Regional Availability: Kaiser Permanente’s coverage and availability vary significantly by region. It’s more prominent in certain areas like California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and the District of Columbia.

Conclusion

Kaiser Permanente insurance represents a unique approach to healthcare, focusing on integrated care, preventive medicine, and a patient-centered philosophy. Its model can offer comprehensive, high-quality care with the potential for better health outcomes and cost control. However, the decision to enroll in a Kaiser Permanente plan should be based on a careful consideration of your individual healthcare needs, preferences, and the specific options available in your area. As with any significant decision regarding your health insurance, it’s crucial to weigh the benefits and potential drawbacks, and possibly consult with a healthcare expert or insurance advisor to make an informed choice.

Frequently Asked Questions

What is Kaiser Permanente, and how is it different from other health insurance providers?

+Kaiser Permanente is a health plan that integrates care and coverage, offering a unique approach by providing both the insurance and the medical care through its own facilities and staff. This model is designed to promote preventive care, coordinated treatment, and patient satisfaction.

How do I choose the right Kaiser Permanente plan for my needs?

+Choosing the right plan involves considering your health needs, budget, and personal preferences. Kaiser Permanente offers various plans with different levels of coverage, deductibles, copays, and out-of-pocket maximums. It’s recommended to review each plan’s details, consider consulting with a licensed insurance agent, and use online tools provided by Kaiser Permanente to find the plan that best fits your situation.

Can I see any doctor I want with Kaiser Permanente insurance?

+To receive full benefits, you must use Kaiser Permanente facilities and providers. However, in emergencies, you can receive care from any provider, and Kaiser Permanente will cover it. For non-emergency care outside of the Kaiser Permanente network, coverage may be limited or not available, depending on your specific plan.

How does Kaiser Permanente’s focus on preventive care impact my healthcare experience?

+Kaiser Permanente’s emphasis on preventive care means that members are encouraged to take an active role in maintaining their health through regular check-ups, health screenings, and healthy lifestyle choices. This approach can lead to earlier detection and treatment of health issues, potentially improving outcomes and reducing the need for more costly interventions down the line.

Is Kaiser Permanente available in my area, and how can I find out more about the plans and services offered?

+Kaiser Permanente operates in several regions across the United States, including California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and the District of Columbia. To find out if Kaiser Permanente is available in your area and to learn more about the specific plans and services offered, you can visit their official website or contact them directly. They can provide detailed information about coverage, network providers, and how to enroll.