Individual Medical Insurance

In the complex and ever-evolving landscape of healthcare, individual medical insurance stands as a crucial component for ensuring that individuals and families have access to necessary medical care without facing financial ruin. The importance of having a comprehensive health insurance plan cannot be overstated, given the unpredictable nature of health expenses and the significant costs associated with medical treatments, hospital stays, and prescription medications.

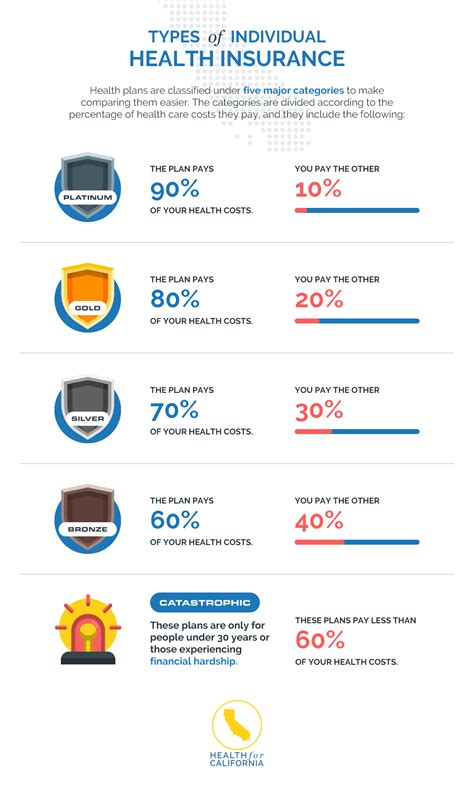

Understanding the intricacies of individual medical insurance begins with recognizing the various types of plans available, each designed to cater to different needs and budgets. At the forefront are major medical plans, which offer comprehensive coverage for a wide range of health services, including preventive care, diagnostic tests, treatments, and hospitalizations. These plans are often structured around a network of healthcare providers, with participants benefiting from negotiated rates when they receive care within the network.

Beyond major medical plans, there are supplemental insurance options, such as accidental injury plans, critical illness insurance, and hospital indemnity plans. These supplements are designed to provide additional financial protection against specific types of health-related expenses that may not be fully covered under a primary health insurance plan. For instance, critical illness insurance pays a lump sum if the policyholder is diagnosed with a serious illness, such as cancer or a heart attack, helping to offset the costs of treatment and living expenses.

The decision to purchase individual medical insurance should be informed by several key factors, including the individual’s or family’s health status, budget, and specific healthcare needs. For those with pre-existing conditions, plans that offer guaranteed issue and do not impose pre-existing condition exclusions are particularly important. The Affordable Care Act (ACA), also known as Obamacare, has been instrumental in expanding access to health insurance for individuals with pre-existing conditions, prohibiting insurers from denying coverage based on health status.

Navigating the marketplace for individual medical insurance can be daunting, with numerous insurers offering a wide array of plans. One of the primary considerations for those seeking coverage is the distinction between on-marketplace and off-marketplace plans. On-marketplace plans are sold through government-run exchanges and are the only plans eligible for premium subsidies and cost-sharing reductions for those who qualify based on income. Off-marketplace plans, while sometimes offering more flexible plan designs or lower premiums for healthier individuals, do not qualify for these subsidies.

For individuals and families who struggle to afford health insurance premiums, several assistance programs are available. The Advanced Premium Tax Credits (APTCs) reduce the monthly premium cost for eligible individuals who purchase coverage through the health insurance marketplace. Additionally, Cost-Sharing Reductions (CSRs) can lower out-of-pocket costs for deductibles, copayments, and coinsurance for those who qualify.

Key Considerations for Individual Medical Insurance

- Network and Provider Access: Consider whether your current healthcare providers are included in the plan’s network, as receiving care from in-network providers typically results in lower out-of-pocket costs.

- Deductible and Out-of-Pocket Maximum: Evaluate the deductible amount you must pay before insurance coverage kicks in, as well as the out-of-pocket maximum, which is the highest amount you’ll pay for healthcare expenses within a calendar year.

- Premium Costs: Assess the monthly premium in relation to your budget and healthcare needs. While lower premiums may be attractive, they can sometimes come with higher deductibles or less comprehensive coverage.

- Preventive Care: Look for plans that cover preventive services without additional cost, such as annual physicals, screenings, and vaccinations, which can help prevent more serious health issues.

- Prescription Drug Coverage: If you regularly take prescription medications, ensure the plan’s formulary (list of covered drugs) includes your medications and understand any associated copays or coinsurance.

The Future of Individual Medical Insurance

As the healthcare landscape continues to evolve, driven by technological advancements, policy changes, and shifting consumer needs, the future of individual medical insurance will likely be marked by increased focus on personalized care, preventive services, and digital health solutions. Insurers are already incorporating telehealth services into their plans, expanding access to care, especially for those in rural or underserved areas. Additionally, there is a growing emphasis on wellness and preventive care, with many plans now offering incentives for healthy behaviors and outcomes.

FAQ Section

What is the difference between an HMO and a PPO health insurance plan?

+A Health Maintenance Organization (HMO) plan typically requires you to receive medical care and services from providers within a specific network, except in emergency situations. A Preferred Provider Organization (PPO) plan, on the other hand, offers more flexibility, allowing you to see any healthcare provider, both in-network and out-of-network, though out-of-network care usually comes with higher costs.

<div class="faq-item">

<div class="faq-question">

<h3>Can I buy individual medical insurance outside of the open enrollment period?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Generally, you can only buy individual health insurance during the annual open enrollment period, unless you qualify for a special enrollment period (SEP). Special enrollment periods are triggered by certain life events, such as losing job-based coverage, getting married, having a baby, or moving to a new area that offers different health plan options.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does the Affordable Care Act (ACA) impact individual medical insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The ACA, also known as Obamacare, has expanded access to health insurance for millions of Americans. Key provisions include prohibiting insurance companies from denying coverage due to pre-existing conditions, allowing young adults to stay on their parents' insurance until age 26, and providing subsidies to make health insurance more affordable for lower-income individuals and families.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What factors should I consider when choosing an individual medical insurance plan?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When selecting an individual medical insurance plan, consider your health needs, budget, the plan's network of providers, deductible and out-of-pocket costs, coverage for prescription medications, and any additional benefits such as dental or vision care. It's also important to review the plan's summary of benefits and coverage to understand what is included and what is not.</p>

</div>

</div>

</div>

In conclusion, navigating the complex world of individual medical insurance requires careful consideration of numerous factors, including plan types, costs, provider networks, and personal health needs. As the healthcare system continues to evolve, staying informed about changes in policy, technology, and best practices will be essential for making the most of your health insurance coverage.