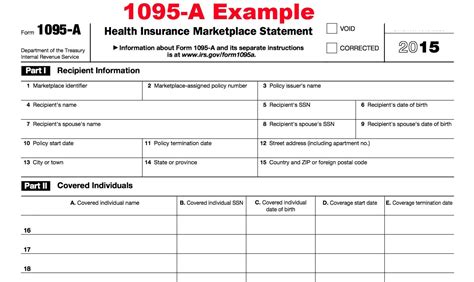

The Medical 1095-A form, also known as the Health Insurance Marketplace Statement, plays a crucial role in the United States healthcare system, particularly for individuals and families who have obtained health coverage through the Health Insurance Marketplace. This form is essential for tax filing purposes, as it provides critical information about the health insurance coverage that an individual or family had during the previous tax year.

Understanding the Purpose of the 1095-A

The primary purpose of the 1095-A form is to report certain information to the IRS about the health insurance coverage that was offered to an individual or family through the Health Insurance Marketplace. This information includes the months of coverage, the premium amount for the second-lowest cost Silver Plan (also known as the benchmark plan), and any advance payments of the premium tax credit (APTC) that were made on behalf of the covered individual or family.

Contents of the 1095-A Form

The 1095-A form typically includes several pieces of key information:

- Policy Number and Issuer: Details about the health insurance policy, including the policy number and the name of the insurance issuer.

- Enrollee Information: The name and Social Security number or individual taxpayer identification number (ITIN) of the enrollee and any covered family members.

- Coverage Months: The months during which the individual or family had health insurance coverage through the Marketplace plan.

- Premium Amount: The total monthly premium for the health plan.

- Second-Lowest Cost Silver Plan (SLCSP) Premium: The premium for the second-lowest cost Silver Plan, which is used to calculate the amount of the premium tax credit.

- Advance Payment of Premium Tax Credit (APTC): Any advance payments made towards the premium.

Importance for Tax Filings

The information provided on the 1095-A form is crucial for completing Form 8962, Premium Tax Credit (PTC), which is filed with the individual’s tax return (Form 1040). The 8962 form calculates the premium tax credit based on the household income and the cost of the health insurance plan. If an individual or family received APTC, they must file Form 8962 to reconcile the amount of APTC they received with the actual premium tax credit they are eligible for based on their final income for the year.

Receiving and Using the 1095-A

Individuals who had health coverage through the Health Insurance Marketplace can expect to receive a 1095-A form by early February of each year, reflecting the coverage for the previous tax year. It is essential to review the form for accuracy, as any discrepancies could affect the calculation of the premium tax credit. If there are any errors or missing information, the individual should contact the Marketplace or the health insurance issuer to request a corrected form.

Conclusion

The Medical 1095-A form is a vital document for taxpayers who have obtained health insurance coverage through the Marketplace. It provides the necessary information for calculating and reporting the premium tax credit on the tax return, which can significantly impact an individual’s or family’s tax liability. By understanding the purpose, contents, and importance of the 1095-A form, individuals can better navigate the tax filing process and ensure they receive the correct amount of premium tax credit they are eligible for.