Kaiser Health Ins: Affordable Coverage Options

The pursuit of affordable health insurance has been a longstanding challenge for many individuals and families in the United States. With the ever-rising costs of medical care and the complexity of health insurance plans, it can be overwhelming to navigate the system and find coverage that fits within one’s budget. Kaiser Health Insurance, a renowned non-profit health plan provider, has been at the forefront of offering affordable coverage options to its members. In this comprehensive overview, we will delve into the world of Kaiser Health Insurance, exploring its history, coverage options, and the benefits that set it apart from other health insurance providers.

History of Kaiser Health Insurance

Kaiser Health Insurance has a rich history that dates back to the 1940s, when Henry J. Kaiser, an industrialist, and Dr. Sidney Garfield, a physician, joined forces to provide health care to Kaiser’s shipyard workers during World War II. This innovative approach to health care, which emphasized preventive care and comprehensive coverage, laid the foundation for the modern health maintenance organization (HMO) model. Over the years, Kaiser Health Insurance has continued to evolve, expanding its services and coverage options to cater to the diverse needs of its members.

Coverage Options

Kaiser Health Insurance offers a wide range of coverage options, designed to meet the unique needs of individuals, families, and groups. From traditional HMO plans to more flexible preferred provider organization (PPO) plans, Kaiser’s coverage options are tailored to provide affordable and comprehensive care. Some of the key features of Kaiser’s coverage options include:

- Preventive care: Kaiser Health Insurance places a strong emphasis on preventive care, covering routine check-ups, screenings, and immunizations to help members stay healthy and detect potential health issues early.

- Comprehensive coverage: Kaiser’s plans often include comprehensive coverage for doctor visits, hospital stays, prescription medications, and other medical services, providing members with peace of mind and financial protection.

- Network of providers: Kaiser Health Insurance boasts an extensive network of providers, including primary care physicians, specialists, and hospitals, ensuring that members have access to high-quality care when they need it.

Benefits of Kaiser Health Insurance

So, what sets Kaiser Health Insurance apart from other health insurance providers? Here are some of the key benefits that make Kaiser an attractive option for individuals and families seeking affordable coverage:

- Affordability: Kaiser Health Insurance is committed to providing affordable coverage options, with plans designed to fit a range of budgets and income levels.

- Comprehensive coverage: Kaiser’s plans often include comprehensive coverage for a wide range of medical services, providing members with financial protection and peace of mind.

- Emphasis on preventive care: Kaiser’s focus on preventive care helps members stay healthy and detect potential health issues early, reducing the risk of costly medical interventions down the line.

- Extensive network of providers: Kaiser’s network of providers is one of the largest and most comprehensive in the industry, ensuring that members have access to high-quality care when they need it.

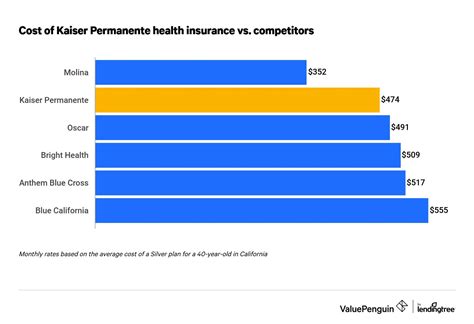

Comparative Analysis: Kaiser Health Insurance vs. Other Providers

When it comes to choosing a health insurance provider, it’s essential to consider the options carefully. Here’s a comparative analysis of Kaiser Health Insurance and other providers:

| Provider | Coverage Options | Network of Providers | Emphasis on Preventive Care |

|---|---|---|---|

| Kaiser Health Insurance | Traditional HMO, PPO, and POS plans | Extensive network of providers | Strong emphasis on preventive care |

| UnitedHealthcare | HMO, PPO, and POS plans | Large network of providers | Moderate emphasis on preventive care |

| Blue Cross Blue Shield | HMO, PPO, and POS plans | Extensive network of providers | Moderate emphasis on preventive care |

| Aetna | HMO, PPO, and POS plans | Large network of providers | Limited emphasis on preventive care |

As this comparison illustrates, Kaiser Health Insurance stands out for its comprehensive coverage options, extensive network of providers, and strong emphasis on preventive care.

Decision Framework: Choosing the Right Kaiser Health Insurance Plan

With so many coverage options available, choosing the right Kaiser Health Insurance plan can be overwhelming. Here’s a decision framework to help you make an informed choice:

- Assess your health care needs: Consider your medical history, current health status, and anticipated health care needs.

- Evaluate your budget: Determine how much you can afford to pay for health insurance each month.

- Research coverage options: Explore Kaiser’s coverage options, including traditional HMO, PPO, and POS plans.

- Compare plans: Use Kaiser’s plan comparison tool to evaluate the features and benefits of each plan.

- Seek advice: Consult with a licensed health insurance agent or broker to get personalized advice and guidance.

FAQ Section

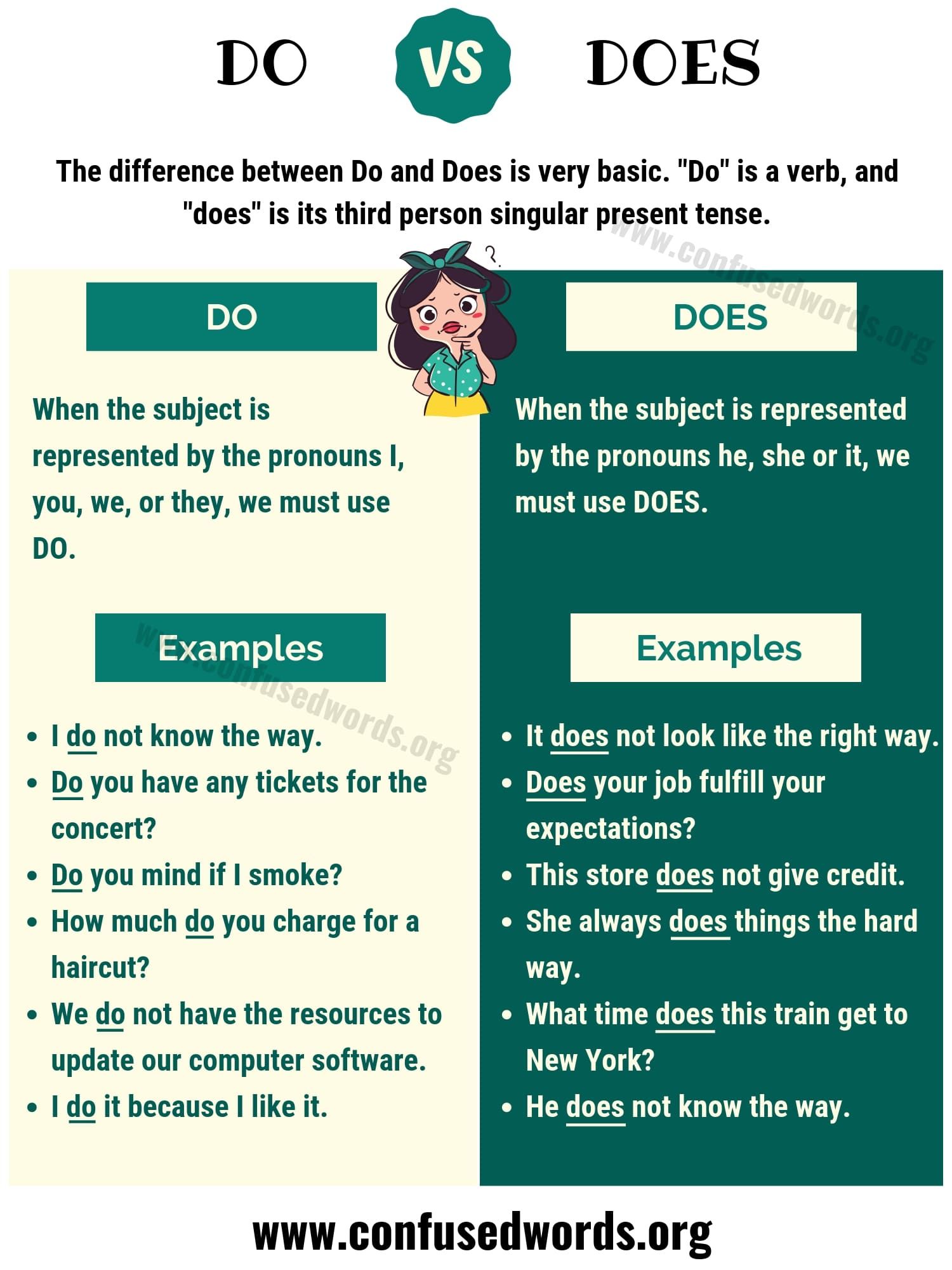

What is the difference between an HMO and a PPO plan?

+An HMO (Health Maintenance Organization) plan requires you to receive medical care from a specific network of providers, while a PPO (Preferred Provider Organization) plan offers more flexibility, allowing you to see any healthcare provider, both in-network and out-of-network, although out-of-network care typically costs more.

How do I enroll in a Kaiser Health Insurance plan?

+You can enroll in a Kaiser Health Insurance plan through the Kaiser website, by phone, or in-person at a Kaiser facility. You can also consult with a licensed health insurance agent or broker for personalized guidance.

What is the cost of a Kaiser Health Insurance plan?

+The cost of a Kaiser Health Insurance plan varies depending on the specific plan, your age, location, and other factors. You can get a quote on the Kaiser website or by contacting a licensed health insurance agent or broker.

In conclusion, Kaiser Health Insurance offers a range of affordable coverage options, designed to meet the unique needs of individuals, families, and groups. With its emphasis on preventive care, comprehensive coverage, and extensive network of providers, Kaiser Health Insurance is an attractive option for those seeking high-quality, affordable health insurance. By understanding the benefits and features of Kaiser’s coverage options and using the decision framework outlined above, you can make an informed choice and find the right plan to meet your health care needs.