Kaiser Insurance Plans: Choose Your Best Fit

Introduction to Kaiser Permanente’s Insurance Plans

Kaiser Permanente is renowned for its integrated managed care system, offering a comprehensive range of health insurance plans tailored to meet the diverse needs of its members. With a focus on preventive care, cutting-edge technology, and a commitment to excellence, Kaiser Permanente has established itself as a leader in the healthcare industry. This article delves into the intricacies of Kaiser Permanente’s insurance plans, guiding you through the process of choosing the best fit for your unique circumstances.

Understanding Kaiser Permanente’s Approach to Healthcare

At the heart of Kaiser Permanente’s success lies its innovative approach to healthcare delivery. By integrating insurance, medical care, and health education under one umbrella, Kaiser Permanente ensures that its members receive seamless, high-quality care. This integrated system not only enhances patient outcomes but also contributes to a more efficient and cost-effective healthcare experience.

Types of Insurance Plans Offered by Kaiser Permanente

Kaiser Permanente offers a variety of insurance plans, each designed to cater to different needs and lifestyles. These plans can be broadly categorized into individual and family plans, group plans for employers, and Medicare plans for seniors and individuals with disabilities.

Individual and Family Plans: These plans are ideal for those not covered by their employer or who prefer the flexibility of choosing their own healthcare provider. They range from bronze to platinum, offering varying levels of coverage and premium costs.

Group Plans: Designed for businesses, these plans provide comprehensive health coverage to employees and their families. They can be tailored to meet the specific needs of the company, offering a range of benefits and deductible options.

Medicare Plans: For seniors and individuals with disabilities, Kaiser Permanente offers Medicare Advantage plans that combine the benefits of Original Medicare with additional coverage options, such as prescription drugs, dental, and vision care.

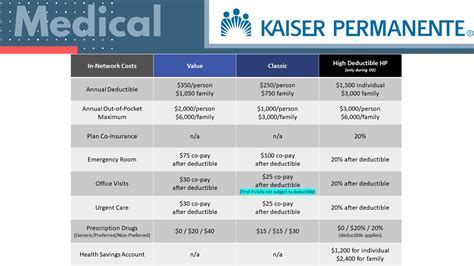

Comparative Analysis of Kaiser Permanente Plans

When choosing a Kaiser Permanente plan, it’s essential to compare the different options based on several factors, including premium costs, deductible amounts, copays or coinsurance rates, and the network of healthcare providers.

| Plan Type | Premium | Deductible | Copay/Coinsurance | Network |

|---|---|---|---|---|

| Bronze | Lower | Higher | Higher | Limited |

| Silver | Moderate | Moderate | Moderate | Standard |

| Gold | Higher | Lower | Lower | Extensive |

| Platinum | Highest | Lowest | Lowest | Comprehensive |

Expert Insights: Navigating the Selection Process

Selecting the right health insurance plan can be daunting, given the numerous options available. According to healthcare experts, the key to making an informed decision lies in understanding your healthcare needs and budget. Here are some expert insights to guide you through the process:

Assess Your Healthcare Needs: Consider the health status of you and your family, including any pre-existing conditions or ongoing treatments. This will help you determine the level of coverage you require.

Evaluate Your Budget: Beyond the premium costs, factor in deductibles, copays, and coinsurance rates to understand the total out-of-pocket expenses associated with each plan.

Research the Network: Ensure that your preferred healthcare providers are part of the plan’s network to avoid out-of-network charges.

Review Additional Benefits: Some plans offer additional benefits such as wellness programs, mental health services, or travel coverage, which may be important to you.

Decision Framework: Choosing Your Best Fit

To make a decision that aligns with your needs and preferences, follow this step-by-step framework:

- Identify Your Priorities: List your healthcare needs, budget constraints, and any specific benefits you’re looking for in a plan.

- Compare Plans: Use the comparative analysis table to evaluate how each plan aligns with your priorities.

- Consider Expert Advice: Reflect on the expert insights provided to ensure you’re considering all relevant factors.

- Evaluate Your Network and Additional Benefits: Confirm that your healthcare providers are within the plan’s network and review any additional benefits that may sway your decision.

- Finalize Your Choice: Based on your evaluation, select the plan that best meets your needs and budget.

Thought Experiment: Projecting Future Healthcare Needs

As you navigate the complex world of health insurance, it’s crucial to project your future healthcare needs. Consider the following thought experiment:

Imagine yourself five years from now. Have your healthcare needs changed due to aging, new health conditions, or changes in family dynamics? How might your insurance needs evolve? By projecting your future needs, you can make a more informed decision about your current insurance plan, ensuring it has the flexibility to adapt to your changing healthcare landscape.

FAQ Section

What is the difference between Kaiser Permanente's bronze and platinum plans?

+Kaiser Permanente's bronze plan offers lower premiums but higher deductibles and out-of-pocket costs. In contrast, the platinum plan has higher premiums but lower deductibles and out-of-pocket expenses, providing more comprehensive coverage.

Can I change my Kaiser Permanente plan after enrollment?

+Yes, you can change your plan during the annual open enrollment period or under certain special enrollment circumstances, such as a change in family status or moving to a new area.

How do I find healthcare providers within Kaiser Permanente's network?

+You can find healthcare providers within Kaiser Permanente's network by visiting their official website and using their provider directory tool. You can search by name, specialty, or location to find providers that meet your needs.

Conclusion

Choosing the right Kaiser Permanente insurance plan is a personal decision that requires careful consideration of your healthcare needs, budget, and preferences. By understanding the different types of plans available, comparing their features, and considering expert insights, you can make an informed decision that provides you with the coverage and peace of mind you deserve. Remember, your health insurance plan is not just about covering medical expenses; it’s about investing in your well-being and future.