Kaiser Medical Insurance: Affordable Health Plans

The quest for affordable health insurance is a pressing concern for many individuals and families. With the rising costs of medical care, it’s essential to find a health plan that balances affordability with comprehensive coverage. Kaiser Medical Insurance, also known as Kaiser Permanente, is a well-established health insurance provider that offers a range of affordable health plans to suit different needs and budgets.

Understanding Kaiser Medical Insurance

Kaiser Permanente is a non-profit health insurance organization that has been providing medical coverage to its members for over 75 years. With a strong focus on preventive care, Kaiser Medical Insurance offers a unique approach to healthcare that emphasizes wellness, disease prevention, and coordinated care. By integrating healthcare delivery and financing, Kaiser Permanente aims to provide high-quality, affordable healthcare to its members.

Affordable Health Plans from Kaiser Medical Insurance

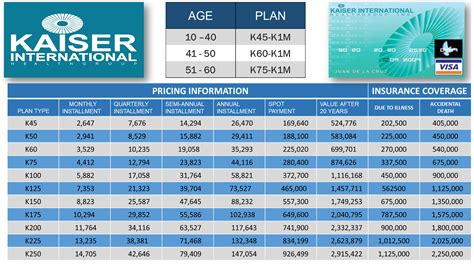

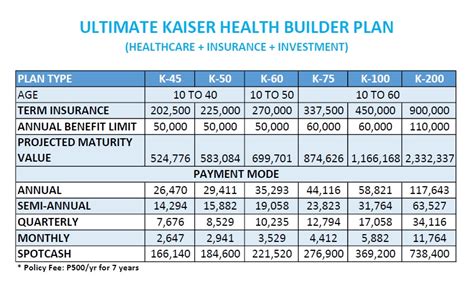

Kaiser Medical Insurance offers a variety of health plans that cater to different demographics, including individuals, families, and employer groups. Some of the affordable health plans offered by Kaiser Permanente include:

- Kaiser Permanente Individual and Family Plans: These plans are designed for individuals and families who are not covered by their employer. They offer a range of deductible options, copays, and coinsurance levels to suit different budgets.

- Kaiser Permanente Medicare Plans: For seniors and people with disabilities, Kaiser Permanente offers Medicare Advantage plans that combine medical, hospital, and prescription drug coverage.

- Kaiser Permanente Group Plans: Employers can offer Kaiser Permanente health plans to their employees, providing comprehensive coverage and competitive rates.

Key Features of Kaiser Medical Insurance Plans

Kaiser Medical Insurance plans come with a range of features that make them attractive to those seeking affordable health insurance. Some of the key features include:

- Preventive Care: Kaiser Permanente emphasizes preventive care, with many services covered at no additional cost, such as routine check-ups, vaccinations, and health screenings.

- Coordinated Care: Kaiser Permanente’s integrated care model ensures that members receive coordinated care from a team of healthcare professionals, including primary care physicians, specialists, and hospitals.

- Pharmacy Benefits: Kaiser Permanente offers competitive pharmacy benefits, with many generic medications available at a low copay.

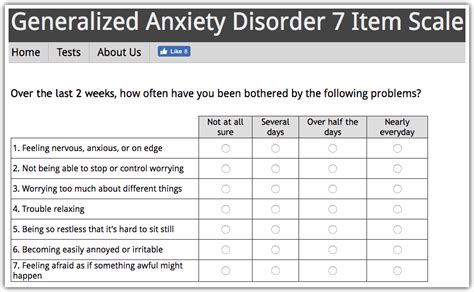

- Mental Health and Wellness: Kaiser Permanente recognizes the importance of mental health and wellness, with many plans covering mental health services, including therapy sessions and medication management.

When selecting a health insurance plan, it's essential to consider your individual needs and budget. Kaiser Medical Insurance offers a range of affordable health plans, but it's crucial to weigh the pros and cons of each plan, including deductible levels, copays, and coinsurance rates.

Pros and Cons of Kaiser Medical Insurance Plans

Like any health insurance provider, Kaiser Medical Insurance has its advantages and disadvantages. Some of the pros of Kaiser Medical Insurance plans include:

- Comprehensive Coverage: Kaiser Permanente offers comprehensive coverage, including medical, hospital, and prescription drug benefits.

- Affordable Rates: Kaiser Permanente plans are often priced competitively, making them an attractive option for those seeking affordable health insurance.

- Preventive Care Focus: Kaiser Permanente’s emphasis on preventive care can help members stay healthy and avoid costly medical bills.

However, some of the cons of Kaiser Medical Insurance plans include:

- Limited Provider Network: Kaiser Permanente has a limited provider network, which may not be suitable for those who prefer to see a specific doctor or specialist.

- Higher Out-of-Pocket Costs: Some Kaiser Permanente plans may have higher out-of-pocket costs, including deductibles, copays, and coinsurance rates.

- Geographic Restrictions: Kaiser Permanente plans are only available in certain regions, which may limit accessibility for those living outside of these areas.

Pros and Cons of Kaiser Medical Insurance Plans

| Pros | Cons |

|---|---|

| Comprehensive Coverage | Limited Provider Network |

| Affordable Rates | Higher Out-of-Pocket Costs |

| Preventive Care Focus | Geographic Restrictions |

Frequently Asked Questions

What is the difference between Kaiser Permanente and other health insurance providers?

+Kaiser Permanente is a non-profit health insurance organization that integrates healthcare delivery and financing, emphasizing preventive care and coordinated care. This approach sets it apart from other health insurance providers.

Are Kaiser Permanente plans available in all states?

+No, Kaiser Permanente plans are only available in certain regions, including California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, and Washington.

Can I see any doctor I want with a Kaiser Permanente plan?

+No, Kaiser Permanente has a limited provider network, which means you'll need to see a doctor or specialist within the network to receive coverage.

Conclusion

Kaiser Medical Insurance offers a range of affordable health plans that cater to different needs and budgets. With a focus on preventive care and coordinated care, Kaiser Permanente’s integrated care model can help members stay healthy and avoid costly medical bills. While there are pros and cons to consider, Kaiser Medical Insurance plans are a viable option for those seeking comprehensive coverage at an affordable rate. By weighing the advantages and disadvantages, individuals and families can make an informed decision about whether Kaiser Medical Insurance is the right choice for their healthcare needs.