Kaiser Permanente Billing

Understanding the intricacies of medical billing can be a daunting task, especially when navigating the complex systems of a large healthcare provider like Kaiser Permanente. As one of the largest and most renowned not-for-profit health plans in the United States, Kaiser Permanente serves millions of members across several states, offering a wide range of medical services, from primary care to specialized treatments. The billing process for Kaiser Permanente is designed to be efficient and patient-centered, but it can still be overwhelming for those unfamiliar with medical billing terminology and procedures.

Introduction to Kaiser Permanente Billing

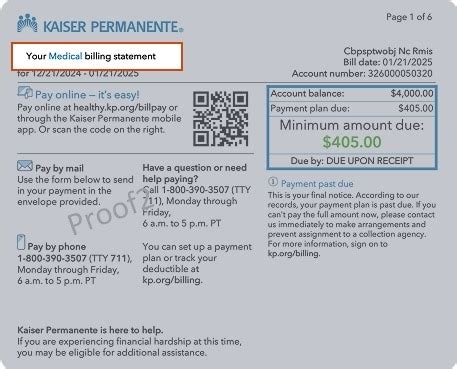

Kaiser Permanente’s billing system is integrated with its comprehensive healthcare services, ensuring that members receive transparent and detailed invoices for the care they receive. The organization emphasizes preventive care, chronic disease management, and evidence-based medical practices, all of which are reflected in its billing processes. Members typically receive a single bill that combines charges for physician services, hospital care, and any additional services like lab tests or pharmacy prescriptions, simplifying the payment process.

How Kaiser Permanente Billing Works

The billing process at Kaiser Permanente is streamlined for ease of use. After receiving medical care, members can expect to receive a bill that outlines the services provided, the charges for those services, and any applicable copays or deductibles. This billing statement will also include information on how to pay the bill, options for payment plans if needed, and contact information for the billing department in case of questions or concerns.

Key Components of a Kaiser Permanente Bill

- Service Date and Description: Each bill will detail the date of service and a description of what was provided, whether it was a doctor’s visit, a surgical procedure, or medication.

- Charges and Payments: The total charge for the service, any payments already made (such as copays at the time of service), and the balance due will be clearly listed.

- Insurance Coverage: For members with insurance coverage through Kaiser Permanente, the bill will show the portion of the charges covered by the insurance plan and the member’s responsibility.

- Payment Instructions: Detailed instructions on how to pay the bill, including online payment options, mail-in payments, and phone payments, are provided.

Managing Your Kaiser Permanente Bill

Kaiser Permanente offers several tools and resources to help members manage their bills effectively. The organization’s website and mobile app allow members to view their billing statements online, make payments, and even set up payment plans if they are unable to pay their balance in full by the due date. Additionally, members can contact the Kaiser Permanente billing department directly for assistance with understanding their bill, inquiring about financial assistance programs, or requesting a payment arrangement.

Payment Options

- Online Payments: Members can pay their bills online through the Kaiser Permanente website or mobile app, using a credit card, debit card, or checking account.

- Mail-in Payments: Payments can be mailed to the address listed on the billing statement.

- Phone Payments: Members can also make payments over the phone by calling the billing department.

- Payment Plans: For members who need more time to pay their bill, Kaiser Permanente may offer payment plans that allow the balance to be paid in installments.

Financial Assistance and Support

Kaiser Permanente recognizes that medical expenses can sometimes be burdensome, even with insurance coverage. As such, the organization offers financial assistance programs for eligible members who are struggling to pay their medical bills. These programs can significantly reduce the financial burden of medical care, making it more accessible to those in need.

Eligibility for Financial Assistance

Eligibility for financial assistance programs through Kaiser Permanente is typically based on family size and income level, with sliding scale discounts available for those who qualify. Members can apply for these programs by contacting the billing department or by submitting an application online. The application process may require documentation of income and family size to determine eligibility and the level of assistance available.

Common Questions About Kaiser Permanente Billing

How do I pay my Kaiser Permanente bill online?

+To pay your Kaiser Permanente bill online, visit the Kaiser Permanente website, log in to your account, and navigate to the billing section. From there, you can enter your payment information and submit your payment. You can also use the Kaiser Permanente mobile app for a more convenient payment experience.

What if I am having trouble paying my bill?

+If you are having trouble paying your bill, contact the Kaiser Permanente billing department as soon as possible. They can help you understand your payment options, including setting up a payment plan that fits your financial situation. Additionally, you may be eligible for financial assistance programs that can help reduce your medical expenses.

How do I apply for financial assistance?

+To apply for financial assistance, visit the Kaiser Permanente website and look for the section on financial assistance programs. You can download and complete the application, which will ask for information about your income and family size. Once completed, submit the application to the address provided, and a representative will contact you regarding your eligibility and the next steps.

Conclusion

Navigating the billing process at Kaiser Permanente can seem complex at first, but the organization provides numerous resources and tools to help members understand and manage their medical bills. From online payment options to financial assistance programs, Kaiser Permanente is committed to making healthcare accessible and affordable for its members. By taking advantage of these resources and reaching out to the billing department when needed, members can ensure a smooth and stress-free experience when it comes to paying for their medical care.