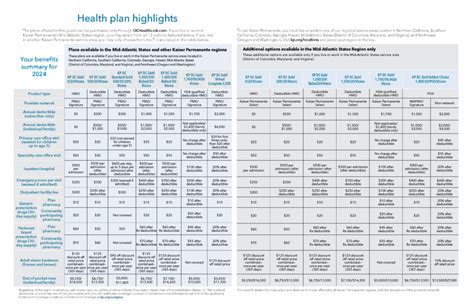

Kaiser Permanente California Plans Uncovered

In the realm of healthcare, navigating the complexities of insurance plans can be a daunting task, especially for those seeking comprehensive coverage in California. Kaiser Permanente, one of the nation’s largest not-for-profit health plans, offers a myriad of options tailored to meet the diverse needs of California residents. This article aims to delve into the specifics of Kaiser Permanente California plans, exploring their features, benefits, and what sets them apart in the healthcare landscape.

Introduction to Kaiser Permanente

Before diving into the plans themselves, it’s essential to understand the foundation of Kaiser Permanente. Founded in 1945 by Henry J. Kaiser and Sidney Garfield, Kaiser Permanente is built on the principle of providing high-quality, affordable healthcare to its members. This integrated health system combines healthcare delivery, health plan coverage, and a commitment to improving community health. Kaiser Permanente’s model emphasizes preventive care, wellness, and member engagement, setting it apart from traditional insurance providers.

Kaiser Permanente California Plans Overview

Kaiser Permanente offers a variety of plans in California, each designed to cater to different demographics, health needs, and budgets. These plans can be broadly categorized into several groups:

- Individual and Family Plans: Designed for those not covered by employer-sponsored plans, these offer a range of coverage options, including bronze, silver, gold, and platinum levels, each varying in deductible, copays, and coinsurance.

- Group Plans: For small and large businesses, these plans provide employers with a way to offer comprehensive health coverage to their employees, often with more flexible plan options and employer contributions.

- Medicare Plans: For seniors and those with disabilities, Kaiser Permanente’s Medicare plans (including Medicare Advantage and Medicare Supplement plans) offer coverage that complements or replaces original Medicare, often with additional benefits like dental and vision care.

- Dental and Vision Plans: Standalone plans that focus on dental and vision care, available for both individuals and groups, providing coverage for routine check-ups, procedures, and corrective devices.

Key Features and Benefits

Kaiser Permanente plans in California come with a multitude of features and benefits, including:

- Integrated Care: Members have access to a comprehensive network of physicians, hospitals, and medical facilities, all working together under the same system.

- Preventive Care: Emphasis on preventive services like routine check-ups, screenings, and vaccinations, often covered at no additional cost.

- Wellness Programs: Many plans include access to wellness programs focused on nutrition, fitness, and stress management, helping members maintain their health.

- Telehealth Services: Convenient access to healthcare through phone, video, or email consultations, ideal for non-emergency situations.

- Pharmacy Services: Members can fill prescriptions at Kaiser Permanente pharmacies, often with competitive pricing and convenient refill options.

Enrollment and Eligibility

Enrolling in a Kaiser Permanente plan in California involves understanding eligibility periods and requirements. For individual and family plans, enrollment is typically allowed during the annual Open Enrollment period or through Special Enrollment periods for those experiencing qualifying life events. Group plans can be enrolled in at any time, dependent on the employer’s plan. Medicare plans have their own enrollment periods, including an Initial Enrollment Period and annual Election Periods.

Costs and Financial Assistance

The cost of Kaiser Permanente plans in California varies widely depending on the plan chosen, age, location, and family size. Financial assistance, such as subsidies for individual and family plans or Medicare Extra Help for Part D prescription drug coverage, may be available to eligible individuals, helping to reduce premiums and out-of-pocket costs.

Conclusion

Navigating the healthcare landscape, especially in a state as populous and diverse as California, requires careful consideration of one’s health needs, budget, and the complexities of insurance plans. Kaiser Permanente’s California plans offer a comprehensive approach to healthcare, focusing on preventive care, integrated services, and member-centric benefits. Whether you’re an individual, part of a family, or an employer looking to provide health coverage to your employees, understanding the specifics of these plans can help you make an informed decision about your health insurance needs.

FAQ Section

What are the different types of plans offered by Kaiser Permanente in California?

+Kaiser Permanente offers individual and family plans, group plans for businesses, Medicare plans for seniors and those with disabilities, and standalone dental and vision plans.

How do I enroll in a Kaiser Permanente plan in California?

+Enrollment in Kaiser Permanente plans can occur during specific periods, such as the annual Open Enrollment period for individual and family plans, or at any time for group plans, with certain qualifications. Medicare plans have their own enrollment periods.

What is the cost of Kaiser Permanente plans in California, and is financial assistance available?

+The cost of Kaiser Permanente plans in California varies based on several factors, including the plan type, age, location, and family size. Financial assistance, such as subsidies for individual plans or Medicare Extra Help, may be available to eligible individuals to help reduce costs.

Can I get dental and vision coverage through Kaiser Permanente in California?

+Yes, Kaiser Permanente offers standalone dental and vision plans in California, providing coverage for routine care, procedures, and corrective devices. These plans can be purchased separately from medical plans.

How does Kaiser Permanente’s approach to healthcare differ from other insurance providers?

+Kaiser Permanente’s integrated care model focuses on preventive care, wellness, and member engagement, setting it apart from traditional insurance providers. This approach aims to provide high-quality, affordable healthcare through a network of physicians, hospitals, and medical facilities working together.

Are Kaiser Permanente plans available throughout California, and how do I find a plan that suits my needs?

+Kaiser Permanente plans are available in many areas of California. To find a plan that suits your needs, you can visit the Kaiser Permanente website, contact their customer service, or work with a licensed insurance agent who can help guide you through the selection process based on your health needs, budget, and eligibility.