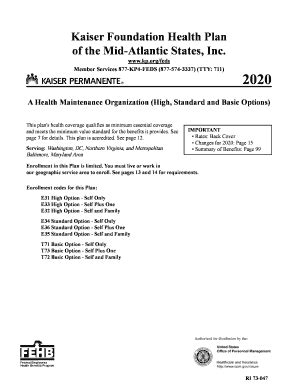

Kaiser Permanente Insurance Plans

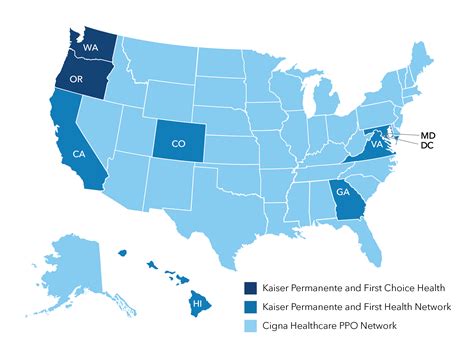

Kaiser Permanente is one of the largest and most well-known not-for-profit health insurance providers in the United States, offering a wide range of insurance plans to individuals, families, and groups. With a strong focus on preventive care, integrated healthcare services, and innovative medical approaches, Kaiser Permanente has established itself as a leader in the healthcare industry.

Overview of Kaiser Permanente Insurance Plans

Kaiser Permanente offers various insurance plans, catering to different needs and budgets. These plans can be broadly categorized into several types, including individual and family plans, group plans for employers, Medicare plans for seniors, and Medicaid plans for low-income individuals and families. Each plan type has its unique features, benefits, and eligibility criteria, allowing members to choose the one that best fits their healthcare requirements.

Individual and Family Plans

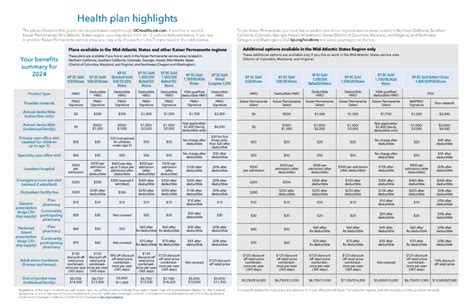

Kaiser Permanente’s individual and family plans are designed for those who are not covered by their employer or are self-employed. These plans are available through the health insurance marketplace or directly through Kaiser Permanente. They offer a range of benefits, including doctor visits, hospital stays, prescription drugs, and preventive care services. The plans are often categorized into different metal tiers (Bronze, Silver, Gold, Platinum), which vary in terms of premium costs, deductible amounts, and out-of-pocket expenses.

Group Plans for Employers

For businesses, Kaiser Permanente offers a variety of group plans that can be tailored to the specific needs of the company and its employees. These plans aim to provide comprehensive healthcare coverage while also considering the employer’s budget and benefits strategy. Group plans often include additional services such as wellness programs, health education, and employee assistance programs, designed to promote a healthier workforce and reduce healthcare costs in the long run.

Medicare Plans

Kaiser Permanente’s Medicare plans are designed for individuals aged 65 and older, as well as those under 65 with certain disabilities. These plans include Medicare Advantage (Part C) and Medicare Supplement (Medigap) insurance. Medicare Advantage plans combine the benefits of Original Medicare (Parts A and B) and often include additional coverage for prescription drugs, dental, vision, and hearing services. Medicare Supplement plans, on the other hand, help cover out-of-pocket costs associated with Original Medicare, such as deductibles, copayments, and coinsurance.

Medicaid Plans

For low-income individuals and families, Kaiser Permanente participates in Medicaid programs, which vary by state. These plans provide essential health benefits, including doctor visits, hospital care, prescription drugs, and preventive services, with little to no out-of-pocket costs. Medicaid plans aim to ensure that underserved populations have access to necessary healthcare services, improving their health outcomes and quality of life.

Benefits of Choosing Kaiser Permanente Insurance Plans

One of the significant advantages of choosing Kaiser Permanente is its integrated care model, which brings together physicians, hospitals, and health insurance services under one roof. This approach facilitates coordinated care, where healthcare providers work together to provide high-quality, patient-centered care. Members also have access to a wide range of health and wellness programs, online tools, and mobile apps designed to support healthy living and disease management.

Integrated Healthcare Services

Kaiser Permanente’s integrated healthcare system ensures that members receive comprehensive and coordinated care. With a focus on preventive medicine, members have access to regular check-ups, screenings, and educational resources to manage their health proactively. This approach has been shown to improve health outcomes, reduce hospital readmissions, and enhance patient satisfaction.

Preventive Care Focus

Preventive care is at the heart of Kaiser Permanente’s healthcare philosophy. Members are encouraged to take an active role in their health through regular health check-ups, vaccinations, cancer screenings, and management of chronic conditions. By emphasizing prevention, Kaiser Permanente aims to reduce the risk of disease, improve the quality of life for its members, and lower healthcare costs over time.

Innovative Medical Approaches

Kaiser Permanente is known for its commitment to medical innovation, investing in research and adopting cutting-edge technologies to improve patient care. From advanced diagnostic tools to personalized medicine approaches, members benefit from the latest in medical science. This emphasis on innovation not only enhances treatment options but also contributes to the broader advancement of healthcare knowledge and practices.

Member Resources and Support

To support its members in navigating the healthcare system, Kaiser Permanente offers a range of resources and tools. These include online portals for accessing medical records, scheduling appointments, and messaging with healthcare providers. Additionally, members can benefit from health education classes, counseling services, and support groups, all designed to empower them to make informed health decisions.

How to Choose the Right Kaiser Permanente Plan

With the variety of plans offered by Kaiser Permanente, choosing the right one can seem overwhelming. However, by considering a few key factors, individuals and families can make an informed decision.

Assessing Health Needs

The first step is to assess your health needs and those of your family members. Consider any chronic conditions, expected medical expenses, and the importance of having a wide network of healthcare providers.

Evaluating Plan Benefits

Next, evaluate the benefits of each plan, including coverage for doctor visits, hospital stays, prescription drugs, and preventive services. Also, consider the out-of-pocket costs, such as deductibles, copayments, and coinsurance.

Checking Provider Networks

It’s essential to check the provider network of each plan to ensure that your preferred healthcare providers are included. This is particularly important if you have established relationships with certain doctors or hospitals.

Reviewing Plan Costs

Compare the premium costs of different plans, along with any additional expenses such as copays and coinsurance. Consider your budget and whether you qualify for any financial assistance programs.

Seeking Professional Advice

If needed, seek advice from a licensed insurance agent or broker who can provide personalized guidance based on your specific situation.

Conclusion

Kaiser Permanente’s insurance plans offer a comprehensive and integrated approach to healthcare, emphasizing preventive care, innovative medical practices, and coordinated patient services. By understanding the different types of plans available and carefully evaluating individual and family needs, prospective members can choose a plan that provides the right balance of coverage, quality, and affordability.

Future Outlook

As the healthcare landscape continues to evolve, Kaiser Permanente remains committed to delivering high-quality, patient-centered care. With ongoing investments in medical research, digital health technologies, and community health initiatives, Kaiser Permanente is well-positioned to meet the changing needs of its members and contribute to the advancement of healthcare in the United States.

What are the main types of insurance plans offered by Kaiser Permanente?

+Kaiser Permanente offers individual and family plans, group plans for employers, Medicare plans for seniors, and Medicaid plans for low-income individuals and families.

How does Kaiser Permanente's integrated care model benefit its members?

+Kaiser Permanente's integrated care model brings together physicians, hospitals, and health insurance services to provide coordinated and patient-centered care, improving health outcomes and patient satisfaction.

What resources are available to help members choose the right Kaiser Permanente plan?

+Members can access online tools, consult with licensed insurance agents or brokers, and review plan details on Kaiser Permanente's website to make an informed decision.

In conclusion, Kaiser Permanente’s insurance plans are designed to meet the diverse healthcare needs of individuals, families, and groups. With a strong emphasis on preventive care, integrated healthcare services, and innovative medical approaches, Kaiser Permanente continues to be a leading choice for those seeking high-quality and comprehensive healthcare coverage.