Kaiser Permanente Wa Plans: Compare Benefits

When it comes to navigating the complex world of health insurance, understanding the specifics of each plan is crucial for making an informed decision. Kaiser Permanente, a well-established and respected name in healthcare, offers a range of plans tailored to meet the diverse needs of individuals and families. For those residing in Washington, Kaiser Permanente WA plans are designed to provide comprehensive coverage with a focus on preventive care, ensuring that members receive high-quality, coordinated healthcare.

Introduction to Kaiser Permanente

Kaiser Permanente is more than just an insurance provider; it’s an integrated health system that combines insurance, medical care, and health education into one seamless package. This integrated approach allows for coordinated care, where doctors, hospitals, and health plans work together to ensure that patients receive the best possible care. The Washington plans, specifically, are crafted to cater to the unique needs of the community, emphasizing preventive care, wellness, and accessibility.

Overview of Kaiser Permanente WA Plans

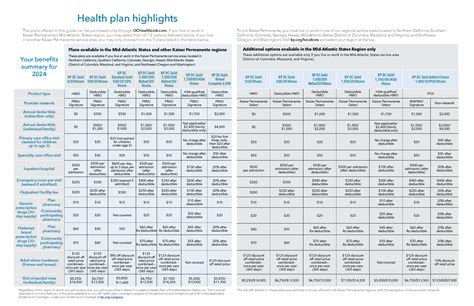

Kaiser Permanente offers a variety of plans in Washington, each designed to fit different lifestyles, budgets, and health needs. These plans can generally be categorized into several tiers, ranging from bronze to gold, with each tier offering a different level of coverage and out-of-pocket costs.

- Bronze Plans: These plans are ideal for those who want lower monthly premiums but are willing to pay more out of pocket for healthcare services. They’re a good choice for individuals who are generally healthy and don’t expect to need a lot of medical care.

- Silver Plans: Silver plans offer a balance between monthly premiums and out-of-pocket costs. They’re a popular choice for many, as they provide a moderate level of coverage and are eligible for cost-sharing reductions, which can lower deductibles, copays, and coinsurance for those who qualify.

- Gold Plans: Gold plans provide more comprehensive coverage with higher monthly premiums but lower out-of-pocket costs when you need care. They’re best for individuals or families who expect to need more medical services throughout the year.

- Platinum Plans: These are the highest tier of coverage offered by Kaiser Permanente, with the lowest out-of-pocket costs but the highest monthly premiums. Platinum plans are ideal for those who want the best coverage possible and are willing to pay for it.

Benefits of Kaiser Permanente WA Plans

One of the standout benefits of choosing a Kaiser Permanente WA plan is the emphasis on preventive care. Members have access to a wide range of preventive services, including routine check-ups, vaccinations, and screenings, all covered at no additional cost. This approach not only helps in maintaining good health but also in early detection and management of potential health issues.

Furthermore, Kaiser Permanente’s integrated system allows for seamless coordination between different healthcare providers. This means that whether you’re seeing a primary care physician, a specialist, or receiving care at a hospital, all your healthcare providers have access to your medical records and can work together to ensure you receive the best possible care.

Additional Features and Services

In addition to comprehensive medical coverage, Kaiser Permanente WA plans often include additional features and services designed to support overall well-being. These can include:

- Mental Health and Substance Abuse Services: Recognizing the importance of mental health, Kaiser Permanente provides coverage for mental health services, including therapy sessions and substance abuse treatment.

- Dental and Vision Coverage: Many plans offer or have the option to add dental and vision coverage, providing a more complete approach to health care.

- Wellness Programs: Kaiser Permanente members may have access to various wellness programs and resources, such as fitness classes, nutrition counseling, and stress management workshops, all aimed at promoting healthy lifestyles.

- Telehealth Services: With the advancement in technology, Kaiser Permanente offers telehealth services, allowing members to consult with healthcare providers remotely, making healthcare more accessible and convenient.

Comparison of Plans

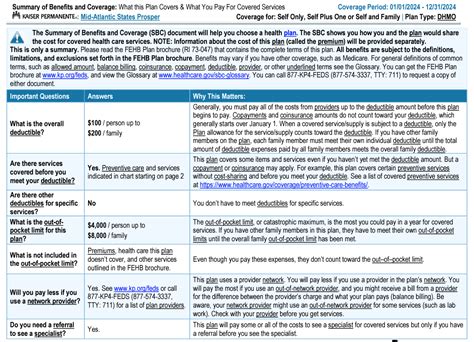

When comparing Kaiser Permanente WA plans, it’s essential to consider several factors beyond just the monthly premium. Out-of-pocket costs, including deductibles, copays, and coinsurance, can significantly impact the overall cost of care. Additionally, the network of providers, coverage for specific services, and any additional benefits or programs should be taken into account.

| Plan Tier | Monthly Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Bronze | Lower | Higher | Higher |

| Silver | Moderate | Moderate | Moderate |

| Gold | Higher | Lower | Lower |

| Platinum | Highest | Lowest | Lowest |

Conclusion

Choosing the right health insurance plan is a critical decision that depends on a variety of personal factors, including health status, budget, and individual or family needs. Kaiser Permanente WA plans offer a compelling option for those seeking comprehensive, integrated care with a focus on preventive health and wellness. By understanding the benefits, features, and structures of these plans, individuals can make informed decisions to select the plan that best aligns with their health goals and financial situation.

What is the main difference between the plan tiers offered by Kaiser Permanente WA?

+The main difference between the plan tiers (Bronze, Silver, Gold, Platinum) is the balance between monthly premiums and out-of-pocket costs. Bronze plans have lower premiums but higher out-of-pocket costs, while Platinum plans have higher premiums but lower out-of-pocket costs.

Are preventive services covered by Kaiser Permanente WA plans?

+Yes, Kaiser Permanente WA plans cover a wide range of preventive services at no additional cost to the member. This includes routine check-ups, vaccinations, and screenings, among others.

Can I customize my Kaiser Permanente WA plan to fit my specific health needs?

+While the core benefits of Kaiser Permanente WA plans are standardized, members may have the option to add additional coverage for dental, vision, or other specialized services, depending on their specific needs and the plans available.

In conclusion, navigating the world of health insurance requires careful consideration of numerous factors. Kaiser Permanente WA plans, with their emphasis on integrated care, preventive services, and comprehensive coverage, offer a valuable option for those seeking high-quality healthcare in Washington. By understanding the nuances of these plans and comparing them based on individual needs, individuals can make informed decisions that support their health and well-being.