Medical Insurance Plans

In the complex and often daunting world of healthcare, medical insurance plans serve as a vital lifeline for individuals and families seeking to protect themselves against the financial burdens associated with medical care. The breadth and depth of medical insurance plans vary significantly, reflecting the diverse needs and circumstances of potential policyholders. This article will delve into the core aspects of medical insurance plans, exploring their types, benefits, limitations, and the considerations that individuals and families must take into account when selecting a plan that aligns with their health and financial objectives.

Understanding Medical Insurance Plans

At their core, medical insurance plans are designed to provide financial protection against health-related expenses. They work by pooling resources from a large group of people to pay for the medical expenses of those who fall ill or get injured, thereby distributing the risk and making healthcare more accessible and affordable. The coverage can include doctor visits, hospital stays, surgical procedures, medications, and sometimes even preventive care services such as vaccinations and health screenings.

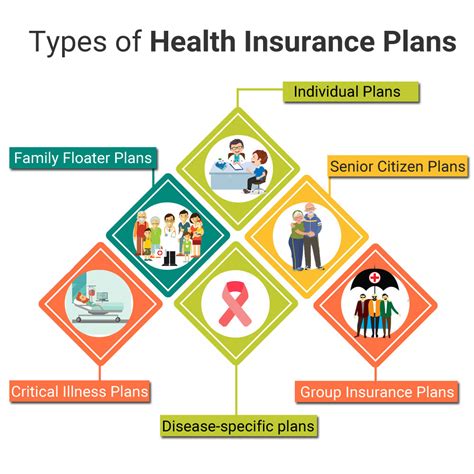

Types of Medical Insurance Plans

The landscape of medical insurance plans is diverse, catering to different segments of the population with varying needs and preferences. Some of the primary types of medical insurance plans include:

Health Maintenance Organization (HMO) Plans: These plans require policyholders to receive medical care and services from providers within a specified network, except in emergency situations. HMOs often focus on preventive care and may offer lower premiums but with limited flexibility in choosing healthcare providers.

Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility than HMOs by allowing individuals to seek care from any healthcare provider, both in-network and out-of-network. While seeing an out-of-network provider may result in higher out-of-pocket costs, PPO plans provide greater freedom of choice.

Exclusive Provider Organization (EPO) Plans: EPOs balance between HMOs and PPOs by allowing policyholders to receive care from any provider within the network without a referral, but they do not cover care from out-of-network providers except in emergencies.

Point of Service (POS) Plans: POS plans combine elements of HMOs and PPOs. Policyholders can choose to receive care from within the network or go outside of it, but they must designate a primary care physician and obtain referrals for specialized care.

Benefits of Medical Insurance Plans

The benefits of medical insurance plans are multifaceted and can be crucial for individuals and families facing health challenges:

- Financial Protection: Medical insurance provides a safety net against the high costs of healthcare, protecting individuals from financial ruin due to medical expenses.

- Access to Care: Insurance can make healthcare services more accessible by reducing the financial barriers to care.

- Preventive Care: Many plans cover preventive services, promoting early detection and treatment of health issues.

- Tax Benefits: In some jurisdictions, premiums for medical insurance may be tax-deductible, providing additional financial incentives.

Limitations and Considerations

While medical insurance plans offer significant benefits, they also come with limitations and considerations that potential policyholders must carefully evaluate:

- Cost: Premiums, deductibles, copays, and coinsurance can add up, making healthcare expensive even with insurance.

- Network Restrictions: Depending on the plan, restrictions on which healthcare providers one can see can limit access to specialized care.

- Pre-existing Conditions: Historically, individuals with pre-existing conditions have faced challenges in obtaining coverage, though many countries have implemented reforms to address this issue.

- Coverage Gaps: Some services, such as dental or vision care, may not be covered under standard medical insurance plans, requiring additional coverage.

Selecting the Right Medical Insurance Plan

Choosing the right medical insurance plan is a personal decision that depends on several factors, including health status, financial situation, age, and family size. Individuals and families should consider the following steps when selecting a plan:

- Assess Health Needs: Evaluate current health status and potential future health needs.

- Compare Plans: Research different types of plans, their coverage, and costs.

- Network Considerations: Ensure that preferred healthcare providers are included in the plan’s network.

- Financial Planning: Consider not just the premium but also out-of-pocket expenses like deductibles and copays.

- Consult Professionals: If possible, consult with insurance advisors or brokers who can provide personalized guidance.

Future of Medical Insurance Plans

The future of medical insurance plans is evolving, influenced by technological advancements, shifts in healthcare delivery models, and policy reforms. Trends such as personalized medicine, telehealth, and value-based care are reshaping the landscape of healthcare and, by extension, medical insurance. Furthermore, efforts to expand coverage, improve affordability, and enhance the quality of care will continue to be central themes in the discussion around medical insurance plans.

Conclusion

Medical insurance plans are a critical component of healthcare systems worldwide, providing individuals and families with the financial security to access necessary medical care. Understanding the types of plans available, their benefits, limitations, and the process of selecting an appropriate plan are essential for navigating the complex healthcare landscape. As healthcare continues to evolve, the importance of adaptable, comprehensive, and accessible medical insurance plans will only continue to grow.

Frequently Asked Questions

What is the main purpose of having a medical insurance plan?

+The main purpose of having a medical insurance plan is to provide financial protection against health-related expenses, ensuring that individuals can access necessary medical care without facing financial hardship.

How do I choose the right medical insurance plan for my needs?

+Choosing the right medical insurance plan involves assessing your health needs, comparing different plans and their costs, considering network restrictions, and evaluating out-of-pocket expenses. It may also be helpful to consult with insurance professionals for personalized advice.

What are the common types of medical insurance plans available?

+Common types of medical insurance plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Exclusive Provider Organization (EPO) plans, and Point of Service (POS) plans. Each type has its unique characteristics, benefits, and limitations.

How has the landscape of medical insurance plans changed over time?

+The landscape of medical insurance plans has evolved significantly over time, influenced by technological advancements, changes in healthcare delivery models, and policy reforms aimed at improving access, quality, and affordability of care. Trends such as personalized medicine, telehealth, and value-based care are currently reshaping the healthcare and insurance sectors.

What factors should I consider when evaluating the cost of a medical insurance plan?

+When evaluating the cost of a medical insurance plan, consider not just the premium but also other out-of-pocket expenses such as deductibles, copays, and coinsurance. Additionally, factor in the potential for rate increases over time and any tax benefits that may apply to your premiums.