Medical Insurance Plans For Family

When considering medical insurance plans for your family, it’s essential to weigh various factors, including the type of coverage, network of providers, deductible amounts, and out-of-pocket expenses. With the myriad of options available, navigating the healthcare landscape can be daunting. In this article, we’ll delve into the intricacies of family medical insurance plans, exploring the different types, benefits, and considerations to help you make an informed decision.

Understanding the Basics of Family Medical Insurance

Family medical insurance plans are designed to provide comprehensive coverage for you, your spouse, and your dependents. These plans typically offer a range of benefits, including preventive care, hospital stays, surgical procedures, and prescription medication coverage. It’s crucial to understand the different types of plans available, as each has its unique features, advantages, and limitations.

Types of Family Medical Insurance Plans

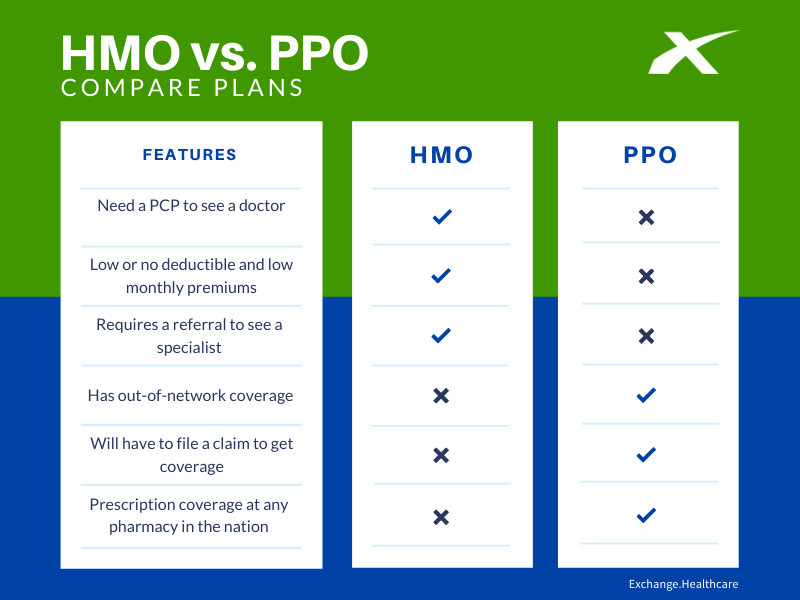

- Preferred Provider Organization (PPO) Plans: These plans offer a network of preferred providers, allowing you to receive care from both in-network and out-of-network providers. PPO plans often come with higher premiums but provide greater flexibility.

- Health Maintenance Organization (HMO) Plans: HMO plans require you to receive care from within the network, except in emergency situations. These plans typically have lower premiums but may limit your access to specialized care.

- Exclusive Provider Organization (EPO) Plans: EPO plans combine elements of PPO and HMO plans, offering a network of providers but without out-of-network coverage, except in emergencies.

- Point of Service (POS) Plans: POS plans allow you to choose between receiving care from in-network or out-of-network providers, often with different cost-sharing structures.

Key Considerations for Family Medical Insurance

When selecting a medical insurance plan for your family, several factors come into play:

- Network of Providers: Ensure the plan’s network includes your primary care physician, specialists, and hospitals you prefer.

- Deductible and Out-of-Pocket Expenses: Consider the deductible amount and maximum out-of-pocket expenses to understand your financial obligations.

- Coverage and Benefits: Review the plan’s coverage for essential health benefits, including preventive care, maternity care, mental health services, and prescription medication.

- Premium Costs: Evaluate the monthly premium in relation to the plan’s benefits and your budget.

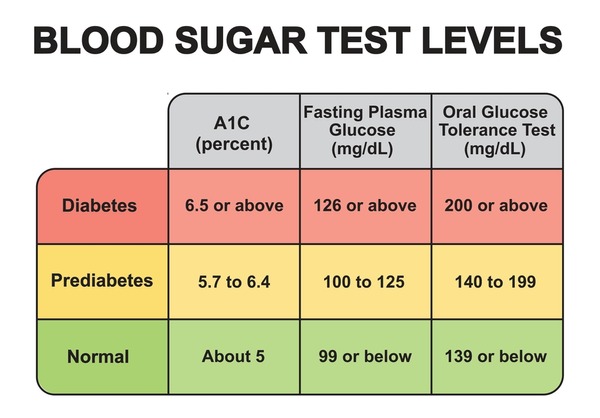

- Pre-existing Conditions: If family members have pre-existing conditions, look for plans that provide comprehensive coverage without exclusions or waiting periods.

Balancing Coverage and Cost

Finding the right balance between coverage and cost is pivotal. While comprehensive coverage is essential, it’s equally important to consider the financial implications. Strategies to balance coverage and cost include:

- High-Deductible Health Plans (HDHPs): HDHPs often have lower premiums but higher deductibles. These plans can be paired with Health Savings Accounts (HSAs) to save for medical expenses on a tax-free basis.

- Cost-Sharing Reductions (CSRs): Depending on your income level, you may be eligible for CSRs, which can significantly reduce your out-of-pocket expenses.

Practical Application Guides

To apply these concepts practically, consider the following steps:

- Assess Your Family’s Needs: Evaluate your family’s health needs, including any chronic conditions or anticipated medical expenses.

- Research Plans: Compare different plans based on coverage, network, deductible, and premium costs.

- Consult with an Insurance Advisor: If possible, consult with an insurance advisor to get personalized advice tailored to your family’s situation.

- Review Plan Documents: Carefully review the plan’s summary of benefits, coverage, and any exclusions or limitations.

Case Study: The Johnson Family

The Johnson family, consisting of two adults and two children, is seeking a medical insurance plan. After assessing their needs, they decided on a PPO plan, which offers the flexibility to see any doctor without a referral. This plan has a moderate premium but provides comprehensive coverage, including preventive care, hospital stays, and prescription medication. The Johnsons also opted for a Health Savings Account (HSA) to save for medical expenses on a tax-free basis.

Thought Experiment: Future of Family Medical Insurance

As the healthcare landscape continues to evolve, it’s interesting to consider future trends and their potential impact on family medical insurance. With advancements in technology and shifts in policy, we might see more personalized and preventive care options. Insurance plans could incorporate genetic testing, AI-driven health analytics, and tailored wellness programs to promote healthier lifestyles. This could lead to more effective and efficient healthcare delivery, ultimately benefiting families and individuals alike.

FAQ Section

What factors should I consider when choosing a family medical insurance plan?

+When choosing a family medical insurance plan, consider the network of providers, deductible and out-of-pocket expenses, coverage and benefits, premium costs, and any pre-existing conditions within your family.

How do I balance the need for comprehensive coverage with the cost of premiums?

+To balance coverage and cost, consider High-Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs), or look into Cost-Sharing Reductions (CSRs) if you're eligible based on your income level.

What is the difference between a PPO and an HMO plan?

+A PPO (Preferred Provider Organization) plan offers a network of preferred providers but also allows you to see out-of-network providers at a higher cost. An HMO (Health Maintenance Organization) plan, on the other hand, requires you to receive care from within the network, except in emergency situations.

Can I change my family medical insurance plan after enrollment?

+Typically, you can change your family medical insurance plan during the annual open enrollment period or if you experience a qualifying life event, such as having a baby, getting married, or losing other coverage.

How do Health Savings Accounts (HSAs) work with High-Deductible Health Plans (HDHPs)?

+HSAs allow you to set aside pre-tax dollars to pay for medical expenses when paired with an HDHP. Funds in an HSA can be used to cover deductibles, copays, and other qualified medical expenses, and they roll over from year to year, providing a long-term savings option for healthcare costs.

In conclusion, selecting the right medical insurance plan for your family is a critical decision that requires careful consideration of various factors. By understanding the different types of plans, their benefits, and limitations, you can make an informed choice that meets your family’s unique needs and budget. Whether you opt for a PPO, HMO, EPO, or POS plan, the key is finding the balance that works best for you, ensuring that you and your loved ones have access to quality healthcare without undue financial strain.