Medical Insurance Plans For Individuals

Navigating the complex landscape of medical insurance plans can be a daunting task, especially for individuals seeking coverage outside of employer-sponsored plans. With the myriad of options available, it’s essential to understand the fundamentals of individual medical insurance plans to make an informed decision. In this comprehensive guide, we will delve into the world of individual medical insurance plans, exploring the various types, benefits, and factors to consider when selecting the right plan for your needs.

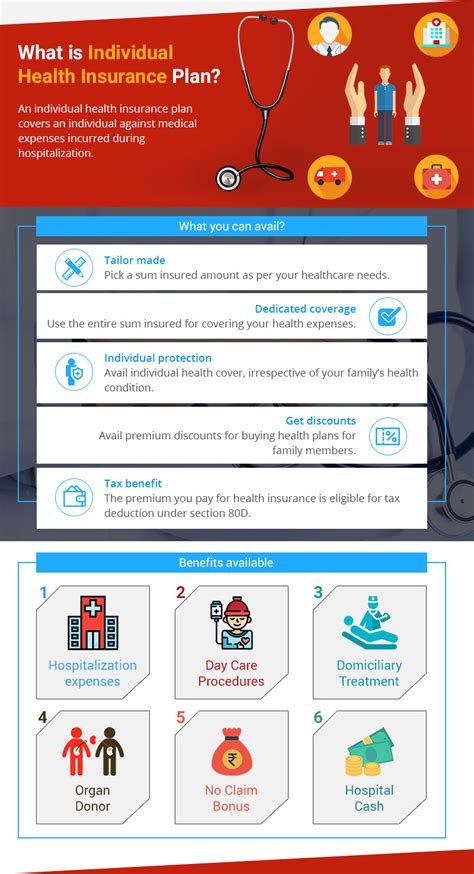

Understanding Individual Medical Insurance Plans

Individual medical insurance plans are designed for individuals and families who do not have access to group coverage through an employer. These plans can be purchased directly from insurance companies, through licensed agents, or via the health insurance marketplace. The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted the individual insurance market by introducing regulations that prohibit insurance companies from denying coverage based on pre-existing conditions and requiring plans to cover essential health benefits.

Types of Individual Medical Insurance Plans

Major Medical Plans: These plans are comprehensive and cover a wide range of health services, including doctor visits, hospital stays, prescription drugs, and more. They are typically more expensive but provide extensive coverage.

Catastrophic Plans: Designed for young adults or those who cannot afford other types of plans, catastrophic plans have lower premiums but higher deductibles. They cover essential health benefits but are more suited for emergency situations rather than routine care.

Short-Term Limited-Duration Insurance (STLDI) Plans: These plans provide temporary coverage for a limited period, usually up to 12 months, and can be renewed for up to 36 months. They do not comply with ACA requirements and typically do not cover pre-existing conditions, making them less comprehensive than major medical plans.

Medicare Supplement Insurance Plans: For individuals aged 65 or older, or those under 65 with certain disabilities, Medicare supplement insurance plans (Medigap) can help fill the gaps in Original Medicare coverage, such as copayments, coinsurance, and deductibles.

Key Factors to Consider

When selecting an individual medical insurance plan, several factors come into play, including:

- Premium Costs: The monthly cost of the plan, which can vary significantly based on age, location, and plan type.

- Deductible: The amount you must pay out-of-pocket before the insurance plan begins to pay its share of costs.

- Out-of-Pocket Maximum: The maximum amount you’ll pay for covered health care expenses during the year, excluding premiums.

- Network Providers: Check if your current healthcare providers are part of the plan’s network to avoid out-of-network costs.

- Pre-existing Conditions: If you have a pre-existing condition, look for plans that cover these conditions without waiting periods or exclusions.

- Prescription Drug Coverage: If you take prescription medications, ensure the plan covers your medications and understand the copays or coinsurance.

Enrollment and Eligibility

Enrollment in individual medical insurance plans typically occurs during the Open Enrollment Period, which usually runs from November to December. However, special enrollment periods may be available if you experience qualifying life events such as marriage, having a baby, or losing other health coverage.

Tips for Choosing the Right Plan

- Assess Your Health Needs: Consider your current health status and any anticipated medical needs for the upcoming year.

- Compare Plans: Use online tools or consult with a licensed insurance agent to compare different plans and their benefits.

- Check the Plan’s Network: Ensure your healthcare providers are in-network to minimize costs.

- Evaluate the Costs: Beyond premiums, consider deductibles, copays, coinsurance, and out-of-pocket maximums.

- Read Reviews and Ask Questions: Research the insurance company’s reputation and ask about any concerns or questions you may have.

Conclusion

Selecting the right individual medical insurance plan is a personal decision that requires careful consideration of your health needs, financial situation, and the plan details. By understanding the different types of plans available, the factors to consider, and how to navigate the enrollment process, you can make an informed decision that provides you with the coverage you need at a price you can afford.

Frequently Asked Questions

What is the difference between a Major Medical Plan and a Catastrophic Plan?

+A Major Medical Plan offers comprehensive coverage for a wide range of health services, including routine care and emergencies, but comes with a higher premium. A Catastrophic Plan, on the other hand, has lower premiums but higher deductibles and is designed to provide basic coverage in case of serious illnesses or accidents, making it more suited for young, healthy individuals or those on a tight budget.

Can I purchase an individual medical insurance plan at any time?

+Typically, enrollment in individual medical insurance plans occurs during the Open Enrollment Period. However, if you experience a qualifying life event such as marriage, the birth of a child, or loss of other health coverage, you may be eligible for a Special Enrollment Period, allowing you to purchase a plan outside of the open enrollment period.

What factors should I consider when choosing an individual medical insurance plan?

+When selecting a plan, consider factors such as premium costs, deductible, out-of-pocket maximum, network providers, coverage of pre-existing conditions, prescription drug coverage, and any additional benefits that may be important to you, such as dental or vision coverage. Assessing your current health needs and financial situation will help guide your decision.

By carefully evaluating these aspects and considering your unique circumstances, you can find an individual medical insurance plan that provides the protection and peace of mind you need. Remember, health insurance is a critical investment in your well-being, and the right plan can make all the difference in managing healthcare costs and ensuring access to quality medical care.