Medical Insurance Plans: Protect Your Family's Health

The importance of medical insurance cannot be overstated, especially when it comes to protecting the health and well-being of your family. With the rising costs of medical care, having a comprehensive medical insurance plan in place can provide peace of mind and financial security in the event of unexpected medical expenses. In this article, we will delve into the world of medical insurance plans, exploring the different types of plans available, the benefits of having medical insurance, and the key factors to consider when selecting a plan that meets your family’s unique needs.

Understanding the Landscape of Medical Insurance

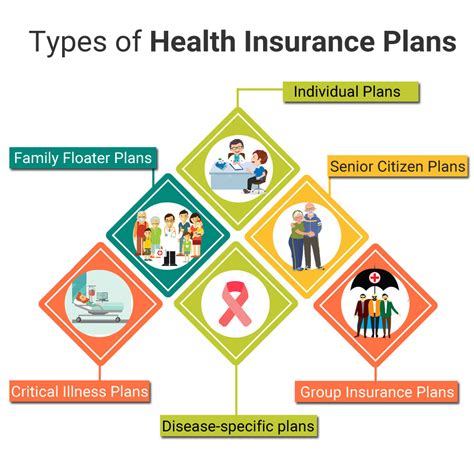

The medical insurance landscape is vast and complex, with a multitude of plans and providers to choose from. At its core, medical insurance is designed to provide financial protection against medical expenses, including doctor visits, hospital stays, surgeries, and prescription medications. There are several types of medical insurance plans, including:

- Individual and Family Plans: These plans are designed for individuals and families who are not covered by an employer-sponsored plan.

- Group Plans: These plans are offered by employers to their employees and are often more cost-effective than individual plans.

- Medicare and Medicaid: These government-sponsored plans provide coverage for seniors, low-income individuals, and families.

- Short-Term Plans: These plans provide temporary coverage for individuals who are between jobs or waiting for other coverage to begin.

The Benefits of Medical Insurance

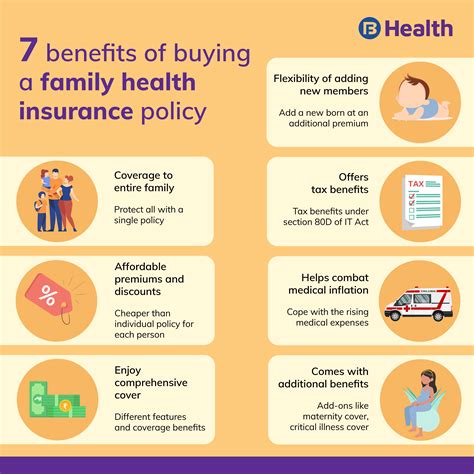

Having medical insurance provides numerous benefits, including:

- Financial Protection: Medical insurance helps to protect against unexpected medical expenses, which can be devastating to a family’s finances.

- Access to Quality Care: Medical insurance provides access to a network of healthcare providers, including doctors, hospitals, and specialists.

- Preventive Care: Many medical insurance plans cover preventive care services, such as routine check-ups, vaccinations, and screenings.

- Peace of Mind: Having medical insurance provides peace of mind, knowing that you and your family are protected against medical expenses.

Key Factors to Consider When Selecting a Medical Insurance Plan

When selecting a medical insurance plan, there are several key factors to consider, including:

- Coverage: What services are covered under the plan, and what are the limitations and exclusions?

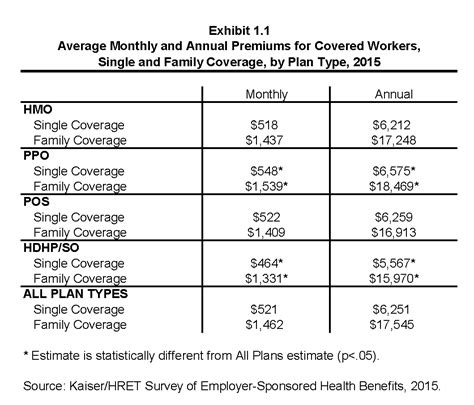

- Cost: What is the premium, deductible, and out-of-pocket maximum?

- Network: Which healthcare providers are included in the plan’s network?

- Pre-Existing Conditions: Does the plan cover pre-existing conditions, and if so, what are the limitations?

- Maximum Out-of-Pocket: What is the maximum amount that you will be required to pay out-of-pocket for medical expenses?

Problem-Solution Framework: Addressing Common Concerns

One of the most common concerns when it comes to medical insurance is the cost. Many individuals and families struggle to afford the premiums, deductibles, and out-of-pocket expenses associated with medical insurance. To address this concern, many insurance providers offer:

- Subsidies: Government subsidies are available to help low-income individuals and families afford medical insurance.

- Cost-Sharing: Some plans offer cost-sharing reductions, which can help to reduce the out-of-pocket expenses.

- Catastrophic Plans: These plans are designed for young adults and others who cannot afford traditional medical insurance.

Comparative Analysis: Evaluating Medical Insurance Plans

When evaluating medical insurance plans, it’s essential to compare the different options available. Some key factors to consider include:

- Provider Network: Which healthcare providers are included in the plan’s network?

- Coverage: What services are covered under the plan, and what are the limitations and exclusions?

- Cost: What is the premium, deductible, and out-of-pocket maximum?

- Ratings: What are the ratings and reviews from other customers?

Future Trends Projection: The Future of Medical Insurance

The medical insurance landscape is constantly evolving, with new trends and technologies emerging all the time. Some of the future trends that are expected to shape the medical insurance industry include:

- Personalized Medicine: With the rise of personalized medicine, medical insurance plans are likely to become more tailored to individual needs.

- Telemedicine: Telemedicine is becoming increasingly popular, and medical insurance plans are likely to cover more virtual care services.

- Artificial Intelligence: Artificial intelligence is being used to improve the efficiency and effectiveness of medical insurance claims processing.

Resource Guide: Finding the Right Medical Insurance Plan

Finding the right medical insurance plan can be overwhelming, but there are many resources available to help. Some of the key resources include:

- Healthcare.gov: This website provides a marketplace for individuals and families to compare and purchase medical insurance plans.

- Insurance Providers: Many insurance providers offer online tools and resources to help individuals and families compare and purchase medical insurance plans.

- Brokers: Insurance brokers can provide expert guidance and advice on selecting the right medical insurance plan.

Decision Framework: Making an Informed Decision

When making an informed decision about medical insurance, it’s essential to consider the following factors:

- Needs: What are your family’s unique needs and requirements?

- Budget: What is your budget for medical insurance premiums, deductibles, and out-of-pocket expenses?

- Provider Network: Which healthcare providers are included in the plan’s network?

- Coverage: What services are covered under the plan, and what are the limitations and exclusions?

FAQ Section

What is the difference between a deductible and an out-of-pocket maximum?

+A deductible is the amount that you must pay out-of-pocket for medical expenses before your insurance plan begins to pay. An out-of-pocket maximum is the maximum amount that you will be required to pay for medical expenses in a given year.

Can I purchase medical insurance outside of the open enrollment period?

+Yes, you can purchase medical insurance outside of the open enrollment period if you experience a qualifying event, such as the loss of a job or the birth of a child.

What is the difference between a copayment and coinsurance?

+A copayment is a fixed amount that you pay for a specific medical service, such as a doctor visit. Coinsurance is a percentage of the medical expenses that you pay after meeting your deductible.

In conclusion, medical insurance is a vital component of protecting your family’s health and well-being. With the numerous options available, it’s essential to carefully evaluate the different plans and providers to find the right fit for your unique needs and budget. By considering the key factors, such as coverage, cost, and network, you can make an informed decision and ensure that you and your family have access to quality medical care when you need it most.