My Kaiser Hr: Simplify Benefits And Pay

In today’s fast-paced work environment, managing benefits and pay can be a daunting task, especially for employees of large organizations like Kaiser Permanente. With a myriad of options and complexities, it’s essential to have a simplified and streamlined approach to understanding and navigating these essential aspects of employment. This article aims to provide a comprehensive guide on simplifying benefits and pay for Kaiser Permanente employees, helping them make the most of their employment package.

To begin with, let’s delve into the world of benefits. Kaiser Permanente offers a wide range of benefits to its employees, including medical, dental, and vision coverage, as well as retirement plans, life insurance, and disability benefits. While these benefits are designed to provide financial security and peace of mind, they can be overwhelming to navigate. For instance, the medical coverage options include various plans with different deductibles, copays, and coinsurance rates. To simplify this process, employees can start by identifying their specific needs and priorities. Do they have a large family to cover, or are they primarily concerned with individual coverage? By understanding their unique circumstances, employees can narrow down their options and make informed decisions.

Another critical aspect of benefits is the concept ofFlexible Spending Accounts (FSAs). FSAs allow employees to set aside pre-tax dollars for eligible expenses, such as medical bills or childcare costs. However, navigating the rules and regulations surrounding FSAs can be complex. For example, employees need to understand the annual contribution limits, the eligibility criteria for expenses, and the deadline for submitting claims. To simplify this process, Kaiser Permanente provides online resources and tools, such as the My Kaiser HR portal, which offers personalized guidance and support.

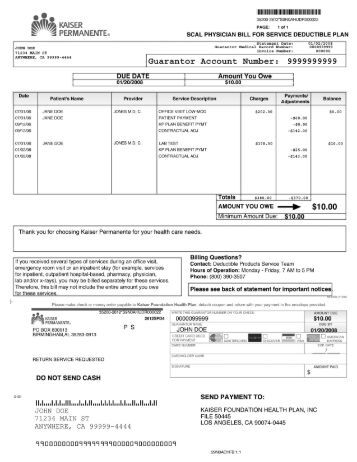

Moving on to pay, let’s discuss the various components that make up an employee’s compensation package. Base salary, bonuses, and incentives are just a few of the elements that contribute to an employee’s overall pay. However, understanding how these components interact and impact take-home pay can be challenging. For instance, employees may need to consider factors like taxes, deductions, and benefits premiums when calculating their net pay. To simplify this process, employees can utilize online pay calculators or consult with HR representatives to get a clearer picture of their compensation.

It's essential to note that benefits and pay are not mutually exclusive. In fact, they are closely intertwined. For example, employees who opt for a higher deductible health plan may pay less in premiums but more out-of-pocket for medical expenses. On the other hand, employees who choose a lower deductible plan may pay more in premiums but less out-of-pocket for medical expenses. By understanding these trade-offs, employees can make informed decisions that balance their benefits and pay.

In addition to these core benefits and pay components, Kaiser Permanente employees may also be eligible for other perks, such as employee discounts, wellness programs, and professional development opportunities. These additional benefits can significantly enhance the overall employment experience, but they can also add complexity to the benefits and pay landscape. To simplify this process, employees can focus on their individual priorities and interests. For example, employees who value work-life balance may be more interested in wellness programs or flexible scheduling options, while employees who are focused on career advancement may be more interested in professional development opportunities.

How do I enroll in Kaiser Permanente's benefits programs?

+To enroll in Kaiser Permanente's benefits programs, employees can log in to the My Kaiser HR portal and follow the prompts to select their benefits options. Employees can also contact the HR department for assistance with the enrollment process.

Can I change my benefits elections during the plan year?

+Generally, employees can only change their benefits elections during the annual open enrollment period or if they experience a qualifying life event, such as a marriage or the birth of a child. However, employees should review the plan documents and consult with HR to determine the specific rules and deadlines for making changes to their benefits elections.

How do I access my pay stubs and benefits information online?

+Employees can access their pay stubs and benefits information online by logging in to the My Kaiser HR portal. From there, they can view their pay history, benefits enrollments, and other relevant information.

In conclusion, simplifying benefits and pay for Kaiser Permanente employees requires a comprehensive approach that takes into account individual needs, priorities, and circumstances. By understanding the various components of benefits and pay, employees can make informed decisions that balance their financial security, health, and well-being. Whether it’s navigating the complexities of medical coverage, optimizing Flexible Spending Accounts, or maximizing pay and incentives, employees can rely on the resources and support provided by Kaiser Permanente to simplify their benefits and pay experience.

The key to simplifying benefits and pay is to focus on individual priorities and needs. By understanding the unique circumstances and goals, employees can make informed decisions that balance their benefits and pay, ultimately enhancing their overall employment experience.

Ultimately, the goal of simplifying benefits and pay is to empower employees to take control of their employment package and make the most of their benefits and compensation. By providing a streamlined and intuitive approach to benefits and pay, Kaiser Permanente can help its employees achieve financial security, improve their health and well-being, and advance their careers. As the employment landscape continues to evolve, it’s essential for organizations like Kaiser Permanente to prioritize the simplification of benefits and pay, ensuring that their employees can thrive in an increasingly complex world.