Ppo Or Hmo: Choose Best Health Plan

Understanding the nuances of health insurance can be a daunting task, especially when it comes to deciding between a Preferred Provider Organization (PPO) and a Health Maintenance Organization (HMO) plan. Both types of plans have their own set of benefits and drawbacks, and choosing the right one depends on various factors, including your health needs, budget, and personal preferences. In this comprehensive guide, we will delve into the details of PPO and HMO plans, exploring their definitions, pros, and cons, as well as the key considerations you should keep in mind when making your decision.

Introduction to PPO and HMO Plans

Before we dive into the comparisons, it’s essential to understand what each type of plan entails:

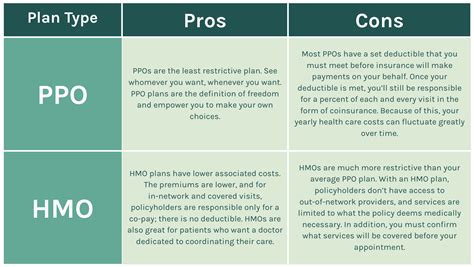

PPO (Preferred Provider Organization): A PPO plan offers a network of healthcare providers from which you can choose. You have the flexibility to see any healthcare provider, both in-network and out-of-network, though seeing an out-of-network provider will cost you more. PPO plans often come with higher premiums compared to HMOs but offer more flexibility.

HMO (Health Maintenance Organization): An HMO plan also has a network of healthcare providers, but it typically requires you to receive medical care and services from providers within the network, except in emergency situations. HMOs often have lower premiums than PPOs but are more restrictive in terms of provider choice.

Comparative Analysis: PPO vs. HMO

When deciding between a PPO and an HMO, several factors come into play, including cost, flexibility, and the quality of care. Let’s break down the key differences:

Cost Considerations

- Premiums: HMOs generally have lower premiums compared to PPOs. If budget is a significant concern, an HMO might be more appealing.

- Out-of-Pocket Costs: PPOs tend to have higher out-of-pocket costs, especially if you choose to see an out-of-network provider. HMOs usually have lower out-of-pocket costs, but you’re limited to in-network care.

- Deductibles and Co-pays: Both types of plans may have deductibles and co-pays, but the amounts can vary significantly between PPOs and HMOs.

Network and Provider Choice

- Flexibility: PPOs offer more flexibility, allowing you to see any healthcare provider without a referral. HMOs, on the other hand, often require you to get a referral from your primary care physician to see a specialist, and you must stay within the network for non-emergency care.

- Network Size: The size and quality of the network can vary between plans. Some PPOs and HMOs have extensive, high-quality networks, while others might be more limited.

Quality of Care and Customer Service

- Quality: The quality of care in both PPO and HMO plans can be high, but it largely depends on the specific network of providers and the plan’s emphasis on preventive care.

- Customer Service: The level of customer service can vary between insurance companies. Some might offer better support, online resources, and claims processing than others.

Decision Framework: Choosing Between PPO and HMO

When making your decision, consider the following steps:

- Assess Your Health Needs: If you have ongoing health issues or prefer the flexibility to choose your healthcare providers, a PPO might be more suitable. For those with minimal health needs or who are looking for a more affordable option, an HMO could be preferable.

- Evaluate Your Budget: Consider not just the premiums but also the potential out-of-pocket costs. If budget is a concern, an HMO might offer a more affordable option.

- Research Provider Networks: Ensure that your preferred healthcare providers are included in the plan’s network. For PPOs, also consider the out-of-network benefits.

- Review Plan Details: Look beyond the basics and review the plan’s coverage, including any exclusions, limitations, and benefits. Consider factors like prescription drug coverage, mental health services, and preventive care.

- Consider Future Needs: Think about your potential future health needs. If you anticipate needing more flexible care options, a PPO might be a better choice.

Conclusion

Choosing between a PPO and an HMO health plan is a personal decision that depends on your unique circumstances, health needs, and preferences. By understanding the differences between these two types of plans and considering your own situation, you can make an informed decision that best suits you. Remember, the key to making the right choice is to weigh the pros and cons carefully and consider what matters most to you in a health insurance plan.

Frequently Asked Questions

What is the main difference between a PPO and an HMO health plan?

+The main difference lies in the flexibility and cost. PPO plans offer more flexibility in choosing healthcare providers, both in-network and out-of-network, at a potentially higher cost. HMO plans are more restrictive, requiring you to stay within the network for non-emergency care, but often at a lower cost.

Can I see any doctor with a PPO plan?

+Do HMO plans cover emergency care outside of the network?

+In the end, whether a PPO or HMO is the “best” health plan for you depends on your individual needs, preferences, and circumstances. By carefully evaluating the pros and cons of each and considering your unique situation, you can make an informed decision that ensures you have the right health insurance coverage for your needs.