Ppo R Planning: Maximize Your Retirement Benefits

Retirement planning is a crucial aspect of financial management, and understanding the nuances of various retirement plans can significantly impact the quality of your post-work life. Among the numerous options available, the Pension Protection Act of 2006 introduced a highly beneficial plan known as the Defined Benefit Pension Plan, but for many, the focus has shifted towards more flexible and portable options like the Personal Pension Plan (PPO). However, the term “PPO” is more commonly associated with Preferred Provider Organization, a type of health insurance plan. For the sake of clarity and relevance to retirement planning, we’ll delve into maximizing benefits under defined contribution plans, such as the 401(k), which many employers offer, and how elements of flexibility and personalization, akin to what one might seek in a “PPO R Planning” approach, can be applied to enhance retirement savings.

Understanding Defined Contribution Plans

Defined contribution plans, such as 401(k), 403(b), and Thrift Savings Plan, are ubiquitous in the employment landscape. These plans allow employees to contribute a portion of their salary to a retirement account on a pre-tax basis, reducing their taxable income for the year. Employers often match a percentage of the employee’s contribution, which not only adds to the retirement fund but also serves as an incentive for employees to participate and save more.

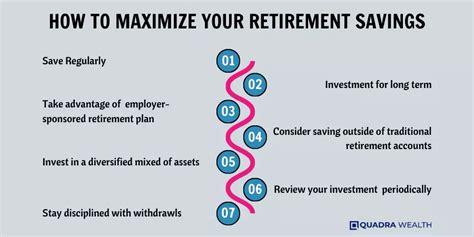

Maximizing Retirement Benefits

Contribute Enough to Get the Full Employer Match: This is essentially free money that adds to your retirement fund. Not contributing enough to get the full match is leaving benefits on the table.

Automate Your Contributions: Increase your contribution percentage gradually. Even small, regular increases can make a significant difference over time due to the power of compound interest.

Consider Catch-Up Contributions: If you’re 50 or older, you can make catch-up contributions to your 401(k) or other defined contribution plans. This allows you to save more than the standard annual limit, which can be particularly beneficial as you approach retirement.

Diversify Your Investments: The investments within your retirement plan should be diversified to minimize risk. Most plans offer a range of investment options, from conservative to aggressive. Ensure your portfolio aligns with your risk tolerance and retirement horizon.

Review and Adjust: Periodically review your retirement account to ensure it remains aligned with your financial goals. Adjust your contributions or investment mix as needed.

Applying a PPO R Planning Mindset

While the term “PPO R Planning” might not directly correspond to standard retirement planning terminology, the concept of personalizing and optimizing (as implied by “PPO”) your retirement plan can be invaluable. This involves:

Personalization: Tailor your retirement plan to fit your specific needs, goals, and risk tolerance. Consider your expected retirement age, desired lifestyle in retirement, and other sources of income.

Optimization: Regularly review and adjust your plan to ensure it’s performing optimally. This might involve adjusting your investment portfolio, increasing contributions, or exploring other retirement savings vehicles.

Retirement Planning Strategies

Start Early: The power of compound interest makes early start-ups crucial. Even small, consistent contributions can grow significantly over decades.

Consider Roth Contributions: If your plan allows Roth 401(k) contributions, consider them. While they don’t offer an upfront tax deduction, the money grows tax-free and isn’t taxed upon withdrawal.

Develop a Withdrawal Strategy: Once you’re in retirement, having a thoughtful withdrawal strategy can help ensure your savings last. This might involve taking required minimum distributions (RMDs) at the appropriate time and managing your tax liabilities.

Case Study: Maximizing Retirement Benefits

Let’s consider an example of how maximizing employer match and making consistent contributions can impact retirement savings. Sarah, a 30-year-old marketing professional, earns 60,000 annually and contributes 10% of her salary to her 401(k), to which her employer matches 5%. Over 35 years, assuming an average annual return of 7%, Sarah's contributions and the employer match could grow to over 1 million. If Sarah increases her contribution rate by 1% every year, reaching 15% by age 40, and her employer continues to match 5%, her total retirement savings could exceed $1.5 million by the time she retires at 65.

Conclusion

Retirement planning is a personal and dynamic process that requires ongoing attention and adjustment. By understanding the options available, maximizing employer contributions, and adopting a personalized approach to retirement planning, individuals can significantly enhance their post-work financial security. Remember, every small action taken today, whether it’s increasing your contribution rate or rebalancing your investment portfolio, can have a profound impact on your retirement benefits and overall quality of life in your golden years.

FAQ Section

What is the main benefit of contributing to a defined contribution retirement plan?

+The main benefit is the potential for tax-deferred growth of your investments and, in many cases, employer matching contributions, which can significantly enhance your retirement savings over time.

How can I maximize my retirement benefits in a defined contribution plan?

+To maximize your benefits, contribute enough to receive the full employer match, automate your contributions, consider making catch-up contributions if you’re eligible, diversify your investments, and regularly review and adjust your plan as needed.

What’s the difference between a Roth contribution and a traditional contribution to a retirement plan?

+A traditional contribution reduces your taxable income for the year but is taxed upon withdrawal in retirement. A Roth contribution, on the other hand, is made with after-tax dollars, so it doesn’t reduce your taxable income for the year, but the money grows tax-free and is not taxed upon withdrawal.