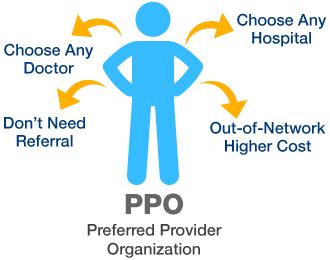

Preferred Provider Organization

In the realm of health insurance, various models have been developed to provide individuals and groups with access to medical services. One such model is the Preferred Provider Organization (PPO). A PPO is a type of health plan that combines elements of both Health Maintenance Organizations (HMOs) and traditional indemnity plans, offering a balance between cost and flexibility. This article will delve into the details of PPOs, exploring their structure, benefits, drawbacks, and how they compare to other health insurance models.

Structure of a PPO

A PPO is essentially a network of healthcare providers who have agreed to provide medical services to a specific group of patients at a negotiated rate. This network includes a variety of healthcare professionals, such as primary care physicians, specialists, hospitals, and other medical facilities. The key feature of a PPO is that it offers a discounted rate to patients who choose to receive care from providers within the network. However, unlike an HMO, a PPO also allows patients to seek care outside of the network, albeit at a higher cost.

A critical aspect of PPOs is the concept of "preferred" providers. These are healthcare providers who have contracted with the PPO to offer discounted services. By choosing to receive care from preferred providers, patients can significantly reduce their out-of-pocket expenses.

Benefits of PPOs

Flexibility: PPOs offer a high degree of flexibility, allowing patients to choose their healthcare providers without needing a referral. This is particularly beneficial for individuals who have established relationships with specific healthcare providers or for those who prefer the freedom to select their own doctors.

Network and Out-of-Network Coverage: While care within the network is less expensive, PPOs also cover care received outside of the network, albeit at a higher cost to the patient. This provision ensures that patients can still access necessary medical care even if their preferred provider is not part of the network.

Cost-Effectiveness: For many, the discounted rates offered by in-network providers make PPOs a cost-effective option. Additionally, the requirement for pre-authorization for certain services can help manage healthcare costs by ensuring that treatments are medically necessary.

Drawbacks of PPOs

Higher Premiums: The flexibility offered by PPOs often comes at a cost. Premiums for PPO plans are typically higher than those for HMOs or other more restrictive plans. This can be a significant drawback for individuals or families on a tight budget.

Out-of-Pocket Expenses: While in-network care is discounted, out-of-pocket expenses for out-of-network care can be substantial. This includes higher deductibles, copays, and coinsurance rates, making it essential for patients to carefully consider their healthcare needs and budget.

Complexity: Navigating the terms of a PPO can be complex, especially for those unfamiliar with health insurance terminology. Understanding the differences between in-network and out-of-network care, as well as the various costs associated with each, can be daunting.

Comparison to Other Health Insurance Models

HMOs (Health Maintenance Organizations): Unlike PPOs, HMOs require patients to receive medical care and services from specific healthcare providers who are part of the HMO’s network, except in emergency situations. HMOs often have lower premiums than PPOs but offer less flexibility.

EPOs (Exclusive Provider Organizations): EPOs combine elements of HMOs and PPOs but do not cover out-of-network care except in emergencies. They offer a balance between cost and flexibility, though less flexible than PPOs.

POS (Point of Service) Plans: POS plans are a type of plan that combines features of HMOs and PPOs. Patients can choose to receive care within the network or go outside of the network for care, with different levels of coverage and cost-sharing.

Conclusion

Preferred Provider Organizations offer a unique blend of flexibility and cost management in the health insurance market. By understanding the structure, benefits, and drawbacks of PPOs, individuals can make informed decisions about their healthcare coverage. Whether a PPO is the right choice depends on a variety of factors, including healthcare needs, budget, and personal preferences regarding flexibility and provider choice.

What is the primary advantage of choosing a PPO over other health insurance plans?

+The primary advantage of a PPO is its flexibility, allowing patients to seek care from any healthcare provider, both in-network and out-of-network, without needing a referral from a primary care physician.

How do the costs of PPOs compare to those of HMOs?

+PPOs generally have higher premiums than HMOs due to their greater flexibility and coverage of out-of-network care. However, for individuals who frequently need to see specialists or prefer the option to go out-of-network, the added cost may be justified.

What should individuals consider when deciding between a PPO and another type of health insurance plan?

+Individuals should consider their healthcare needs, budget, the importance of flexibility in choosing healthcare providers, and the trade-offs between premiums, deductibles, copays, and coinsurance rates. It’s also essential to review the network of providers included in the plan to ensure it meets their needs.