Discounted Cash Flow Excel Template

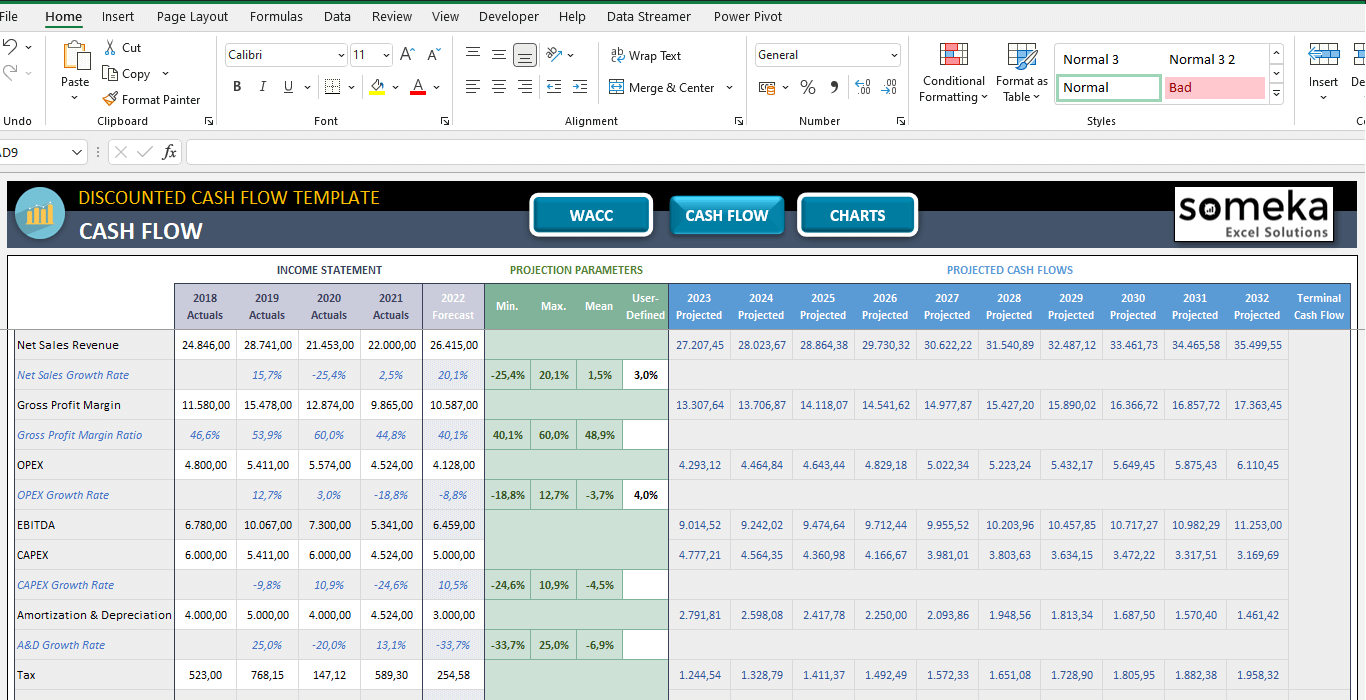

Discounted Cash Flow Excel Template - The present value of each discounted cash flow is then calculated. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive. This template allows you to build your own discounted cash flow model with different assumptions. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining a company’s intrinsic value, investments, and real estate based on expected future cash flows. Web the goal in a dcf is to reflect the company’s cash revenue, cash expenses, and cash taxes, so we believe the best approach is to deduct the entire operating lease expense in ufcf.

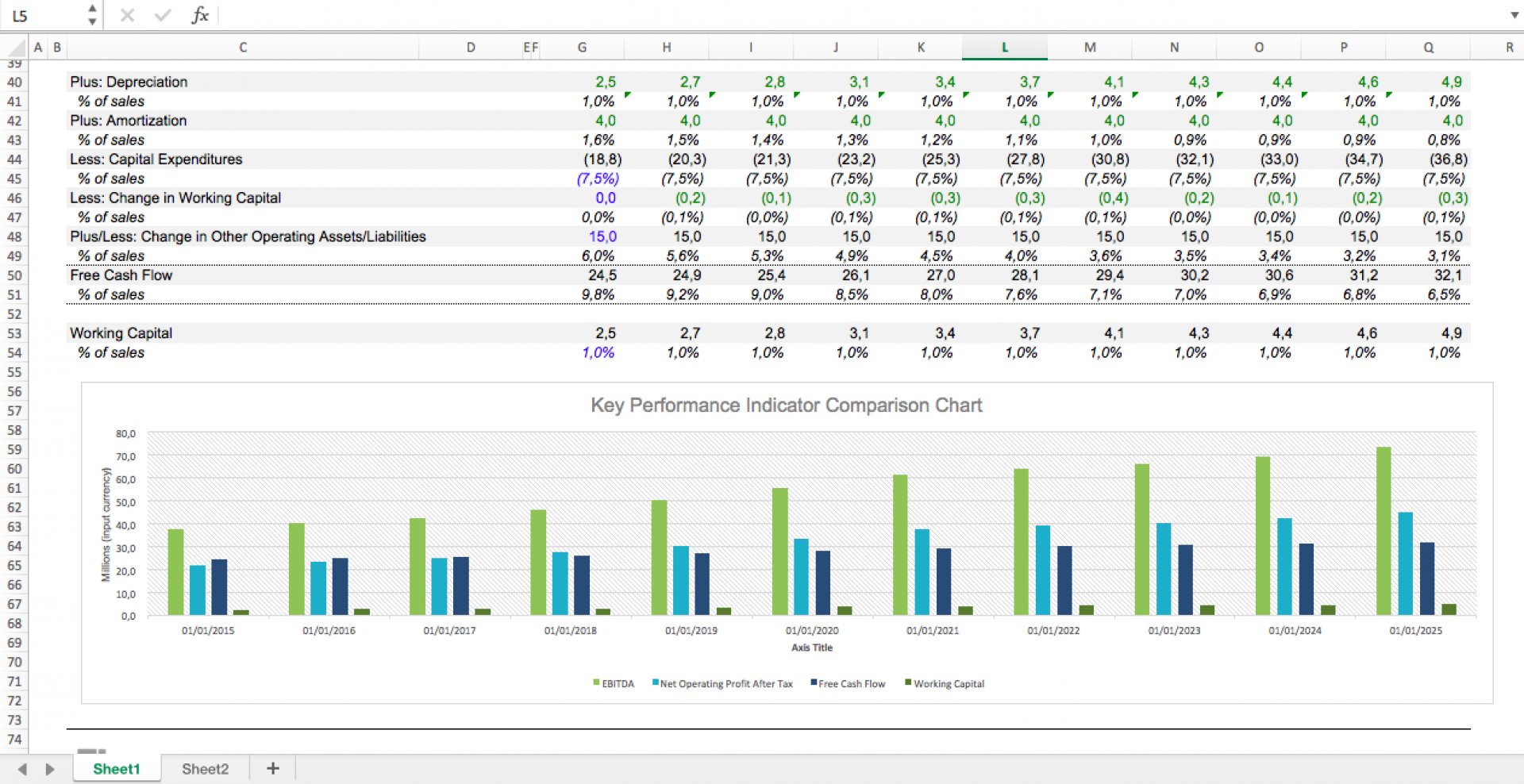

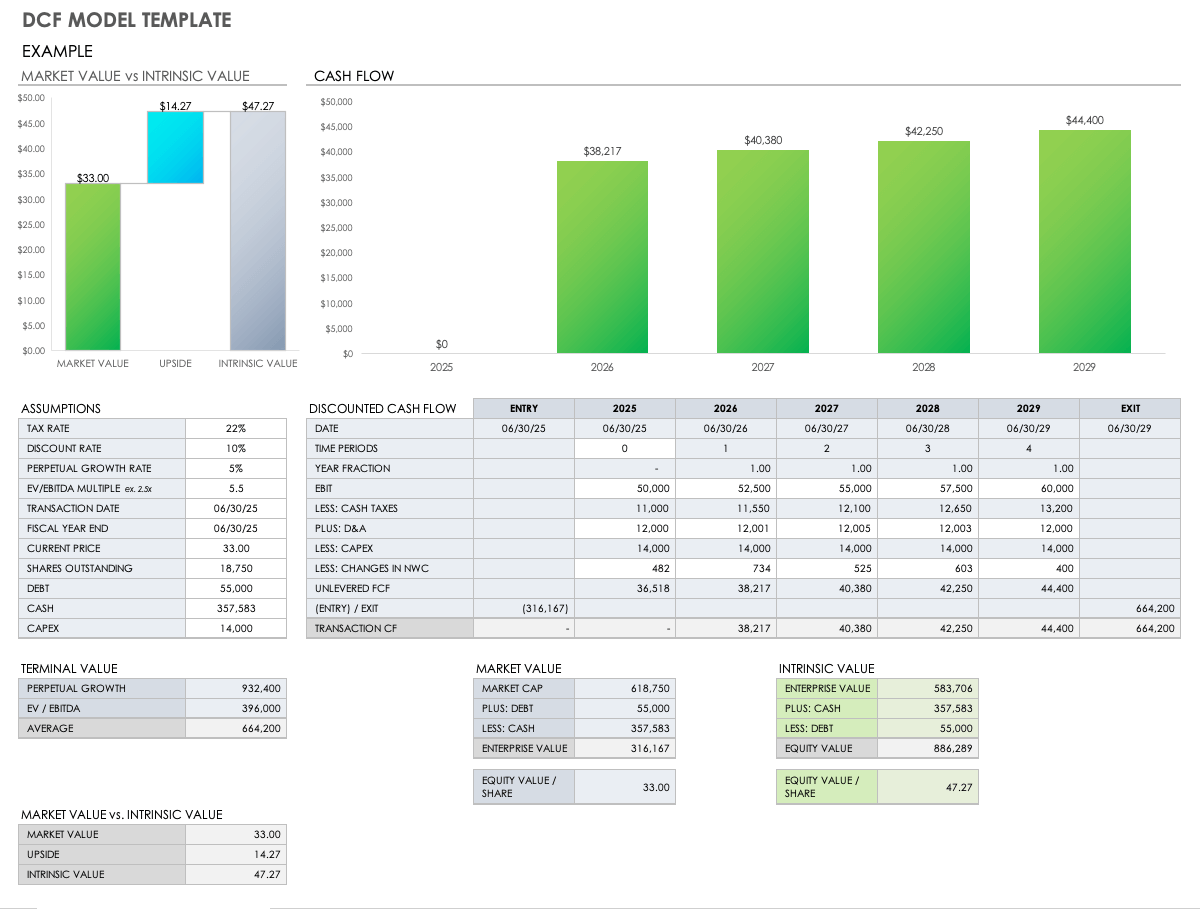

Do you need to calculate the present value of future cash flows or assess two options that will impact your cash flow over many years? Sum the discounted cash flows to find the investment’s npv. This template allows you to build your own discounted cash flow model with different assumptions. Before calculating the discount rate, you’ll need to gather some essential information, including the future cash flows of the investment and the period over which those cash flows will occur. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Web microsoft excel has made our work easier with the discounted cash flow formula. Our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future.

DCF Discounted Cash Flow Model Excel Template Eloquens

Web microsoft excel has made our work easier with the discounted cash flow formula. Tips for doing a discounted cash flow analysis; Tailored for both beginners and professionals. The discounted cash flow formula; Click on.

discounted cash flow excel template —

Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Web master the formula for discounted cash flow.

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

What is a dcf model? It is used to determine the value of a business or security. Do you need to calculate the present value of future cash flows or assess two options that will.

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Web this involves dividing each cash flow by the appropriate discount factor, which is calculated as (1+discount~rate)^n (1+discount rate)n, where ‘n’ represents the number of periods into the future. Web 1.1 future value • 9.

Discounted Cash Flow Excel Template DCF Valuation Template

The discounted cash flow formula; Web this involves dividing each cash flow by the appropriate discount factor, which is calculated as (1+discount~rate)^n (1+discount rate)n, where ‘n’ represents the number of periods into the future. Before.

Free Discounted Cash Flow Templates Smartsheet

Understanding the discount factor and the initial investment is crucial as these elements are foundational for. Enter your name and email in the form and download the free template now! Web the dcf template is.

Free Discounted Cash Flow Templates Smartsheet

The template uses the discounted cash flow (dcf) method, which discounts future cash. Web have you ever wondered how to calculate the discounted cash flows (dcf) in excel? Web discounted cash flow (dcf) model template..

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Web list all projected cash flows in a column. Dcf is a valuation method used to determine the present value of an investment by discounting future cash flows. Use our dcf model template for your.

Discounted Cash Flow Excel Template Free

Tailored for both beginners and professionals. The purpose of the discounted free cash flow financial model template is to provide the user with a useful tool to estimate investment return potential by discounting future cash..

DCF Discounted Cash Flow Model Excel Template Eloquens

Discounted cash flow templates, including customizable options that allow you to plug in your own numbers; Web open excel and click blank workbook. Web download wso's free discounted cash flow (dcf) model template below! Web.

Discounted Cash Flow Excel Template Before calculating the discount rate, you’ll need to gather some essential information, including the future cash flows of the investment and the period over which those cash flows will occur. Web the discounted cash flow (dcf) model is a valuation method, used to estimate the value of an investment based on its expected future cash flows. 1.5 present value of annuity • 3 minutes. The discounted cash flow formula; It is used to determine the value of a business or security.