How To Calculate Tax In Excel

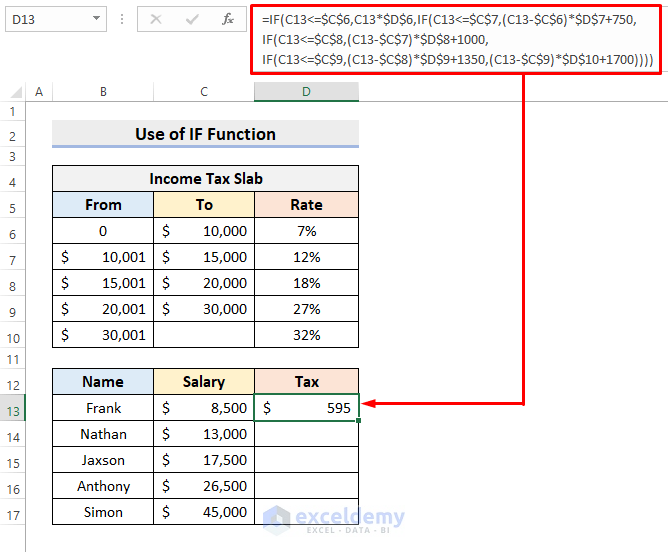

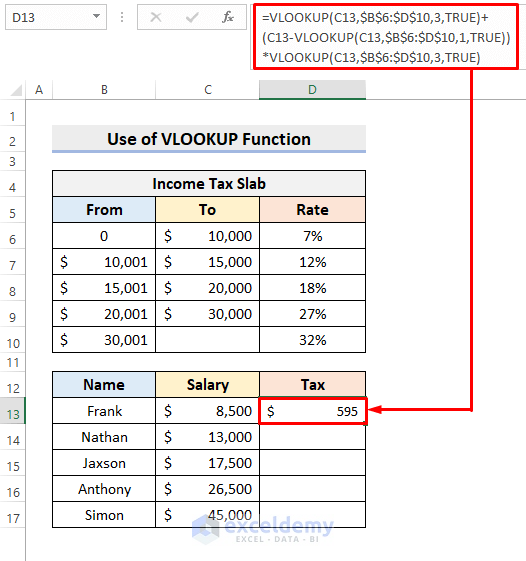

How To Calculate Tax In Excel - The tax rate is organized into 5 tiers in the range f5:f9 with the corresponding tax rate in the range g5:g9. I have deducted b14 from b16 since the interest expense appears as a negative number in the income statement. The answer is the percent increase. Web in this microsoft excel tutorial, i'll teach you how to calculate your federal income tax based on your taxable income. Web in this post, we’ll examine a couple of ideas for computing income tax in excel using tax tables.

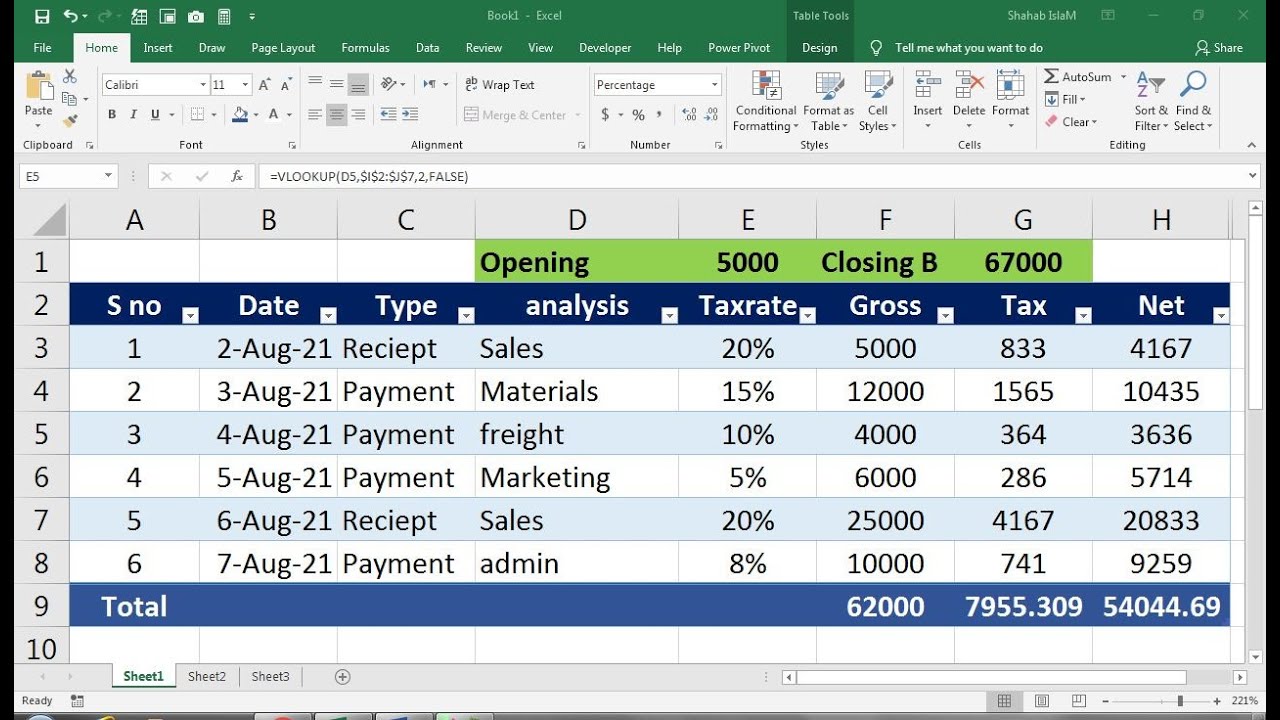

The formula in c5 is: Add sales tax to price. The sum function in excel allows you to quickly add up multiple cells. $750 + 12% for income from $10,001 to $15,000. Web in this video, i use a simple excel example to show how you can calculate federal income taxes depending on your taxable income and tax bracket. If you do not, go to ‘ file ’ > ‘ options ’ > ‘ customize ribbon ’, and tick ‘ developer ’. There are several variables involved in the sales tax formula:

tax calculating formula in Excel javatpoint

If you do not, go to ‘ file ’ > ‘ options ’ > ‘ customize ribbon ’, and tick ‘ developer ’. Ensure you have the ‘ developer ’ tab on your microsoft excel..

how to calculate tax in excel using formula YouTube

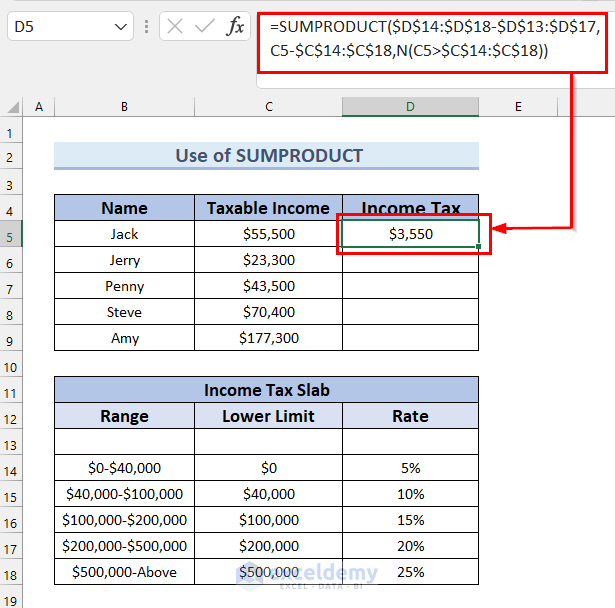

Understanding the formula for tax percentage calculation and applying it to different scenarios is important for accuracy and efficiency. Specifically, we’ll use vlookup with a helper column, we’ll remove the helper column with sumproduct, and.

Tax rate calculation with fixed base Excel formula Exceljet

Understanding the formula for tax percentage calculation and applying it to different scenarios is important for accuracy and efficiency. This is the cost of the item or service before tax. Home characteristics including square footage,.

How to Calculate Tax in Excel Using IF Function (With Easy Steps)

This gives the total amount payable including sales tax. Web the basic sales tax formula in excel is: Financial statements of the business that include income statement, balance sheet, and cash flow statement. Begin by.

Calculate Tax in Excel AY 202324 Template & Examples

A flat 7% for incomes 0 to $10,000. The formula in g5 is: The following examples show how to use each formula in practice. Turn microsoft excel into a tax calculator with these templates. Web.

How to Calculate Taxes in Excel

Discussing the variables involved in the formula. Step 2) add the interest expense to it. Calculating tax percentage in excel is crucial for financial data analysis and budget management. This gives the total amount payable.

How to Calculate Tax in Excel Using IF Function (With Easy Steps)

Financial statements of the business that include income statement, balance sheet, and cash flow statement. Web here i have an income statement in excel. We'll learn how a graduated (progressive) tax bracket system works,. Web.

Chapter 1 Excel Part II How to Calculate Corporate Tax YouTube

To start, you will need the following: Web income tax bracket calculation. Step 2) add the interest expense to it. The sum function in excel allows you to quickly add up multiple cells. Web your.

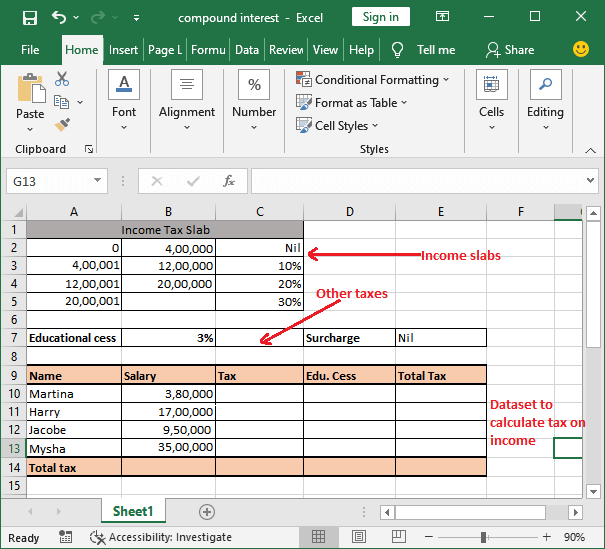

How to Calculate Tax on Salary with Example in Excel

Web the income tax calculator estimates the refund or potential owed amount on a federal tax return. Tax laws of the country where the business operates. I have deducted b14 from b16 since the interest.

How to Calculate Tax in Excel Using IF Function (With Easy Steps)

Web in this video, i use a simple excel example to show how you can calculate federal income taxes depending on your taxable income and tax bracket. This example teaches you how to calculate the.

How To Calculate Tax In Excel The sum function in excel allows you to quickly add up multiple cells. Web when it comes to calculating taxes in excel, it’s important to understand the basic tax formulas and how they are used. Most of the legwork actually involves. Calculating the right amount of tax can be difficult. Input the values into the formula.