How To Calculate Wacc In Excel

How To Calculate Wacc In Excel - As with many other financial concepts, the formula is simple; Web the wacc can be used as the discount rate when calculating the value of a company. 28k views 2 years ago #financialmodeling #excel #wacc. A closer look into the formula reveals that we are multiplying. Assessing project risk a company can use the wacc to evaluate whether an internal project is worth pursuing or not.

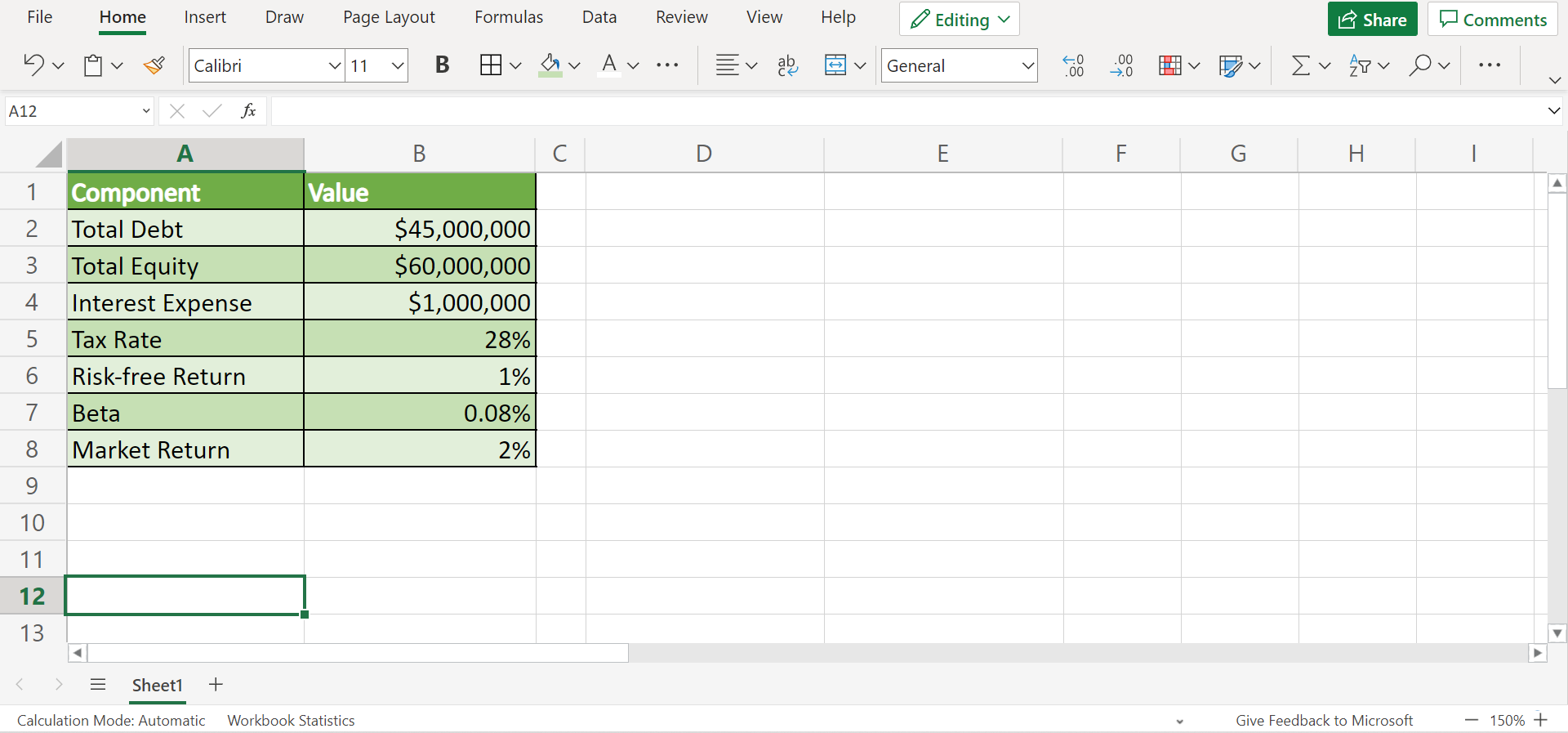

We use it as a discount rate when calculating the net present value of an investment. D = market value of debt capital. Web in this video, we will over how to calculate the weighted average cost of capital which is also know by its acronym wacc. E is the market value of the company’s equity. Web wacc= (we x ke) + (wd x kd) below is the explanation of arguments used in the formula given above: How to calculate beta (systematic risk) industry beta approach. 28k views 2 years ago #financialmodeling #excel #wacc.

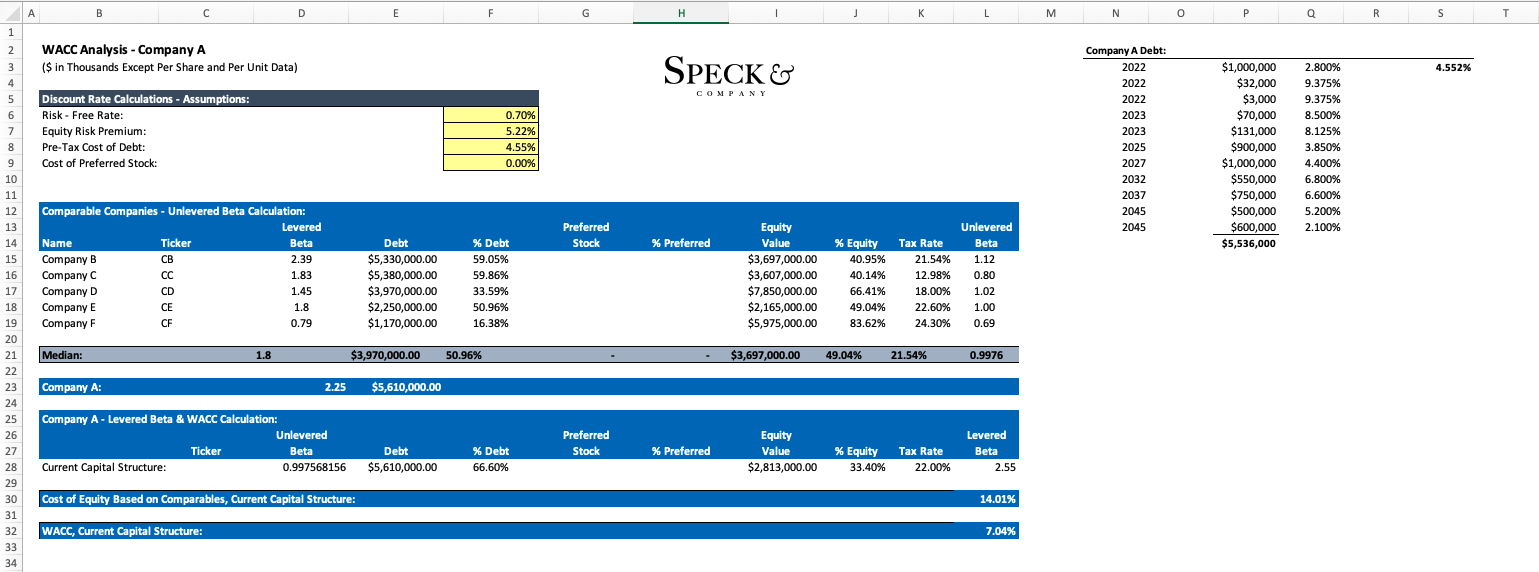

How to Calculate WACC in Excel Speck & Company

V = total value of capital (equity plus debt) e/v = percentage of capital that is equity. All these arguments are needed one by one to calculate the wacc in excel. Insert a new column.

How to Calculate WACC in Excel (with Easy Steps) ExcelDemy

W = the respective weight of debt, preferred stock/equity, and equity in the total capital structure. V is the total market value of the company (e + d) e/v is the weightage of the equity..

How to Calculate the WACC in Excel WACC Formula Earn & Excel

Re = cost of equity ( required rate of return) The weighted average cost of capital (wacc) is the average rate that a firm is expected to pay to all creditors, owners, and other capital.

How to Calculate WACC in Excel Sheetaki

W = the respective weight of debt, preferred stock/equity, and equity in the total capital structure. Web in this video, we will over how to calculate the weighted average cost of capital which is also.

How to Calculate WACC in Excel Sheetaki

Web wacc is calculated with the following equation: A closer look into the formula reveals that we are multiplying. Web the wacc formula is: Web the formula for wacc is as follows: Rd is the.

How to Calculate WACC in Excel Sheetaki

The cost of debt to the debt’s portion of the total capital. Web wacc is calculated with the following equation: See investopedia's explanation of how to calculate wacc in excel. D/v = percentage of capital.

How to Calculate the WACC in Excel WACC Formula Earn & Excel

= (equity / total capital) * cost of equity + (debt / total capital) * cost of debt. All these arguments are needed one by one to calculate the wacc in excel. V is the.

How to Calculate WACC in Excel Sheetaki

Web the formula for wacc is as follows: The weighted average cost of capital (wacc) is the average rate that a firm is expected to pay to all creditors, owners, and other capital providers. E.

How to Calculate WACC in Excel Sheetaki

Re is the cost of equity. D/v = debt to total capitalization ratio. Re = cost of equity ( required rate of return) D/v is the weightage of the debt. See investopedia's explanation of how.

How to Calculate WACC in Excel Sheetaki

Web ryan o'connell, cfa, frm explains how to calculate weighted average cost of capital (wacc) using excel. Assessing project risk a company can use the wacc to evaluate whether an internal project is worth pursuing.

How To Calculate Wacc In Excel W = the respective weight of debt, preferred stock/equity, and equity in the total capital structure. Web ryan o'connell, cfa, frm explains how to calculate weighted average cost of capital (wacc) using excel. Web how to calculate cost of equity ratio. V = total capitalization (equity plus debt at market values) coe = cost of equity. Below we present the wacc formula, it is necessary to understand the intuition behind the formula and how to arrive at each calculation.