Owners Draw S Corp

Owners Draw S Corp - Learn more about this practice with paychex. Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. Web an owner's draw is an amount of money taken out from a sole proprietorship, partnership, limited liability company (llc), or s corporation by the owner for their personal use. If a draws a $100,000 salary, s’s taxable income will be reduced to zero. Are usually either for estimated taxes, due to a specific event, or from business growth.

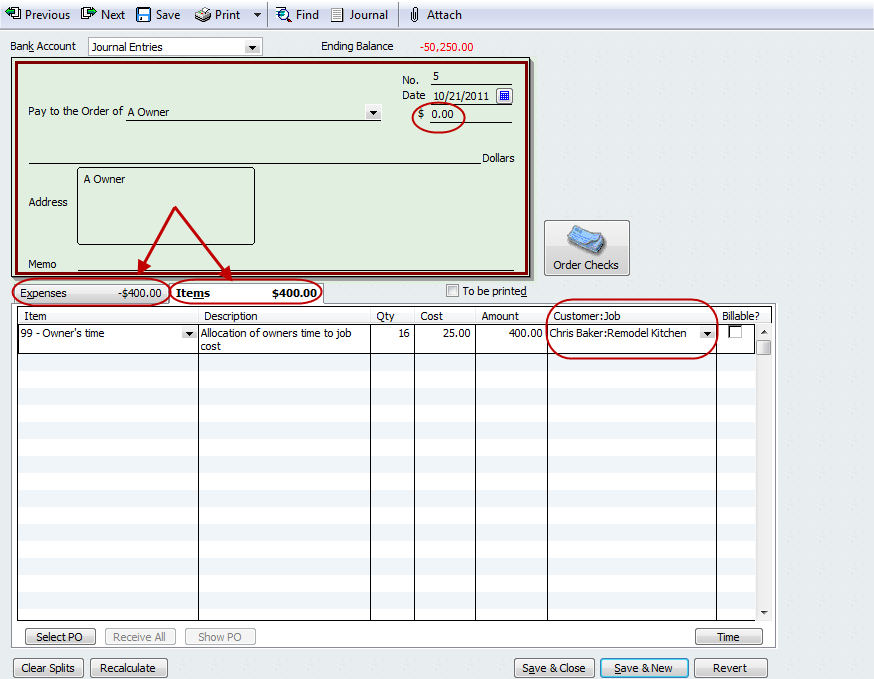

Inactivate the compensation of officers account if necessary. The money is used for personal. Web in most cases, you must be a sole proprietor, member of an llc, or a partner in a partnership to take owner’s draws. It's a way for them to pay themselves instead of taking a salary. Web the two main ways to pay yourself as a business owner are owner’s draw and salary. Web s t er i ng b usiness s tructures and r egistration 38 az ee limited liability company (llc) a limited liability company (llc) is a flexible form of enterprise that blends elements of the partnership and corporate structures. Reduce your basis (ownership interest) in the company because they are.

owner draw quickbooks scorp Anton Mintz

Web an owner’s draw refers to an owner taking funds out of the business for personal use. Web you are able to take an owner’s draw from your business if your business is part of:.

owner draw quickbooks scorp Arlinda Lundberg

Web in its most simple terms, an owner’s draw is a way for owners to with draw (get it?) money from their business for their own personal use. Technically, it’s a distribution from your equity.

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

But is your current approach the best one? S corp shareholder distributions are the earnings by s corporations that are paid out or passed through as dividends to shareholders and only taxed at the shareholder.

owner draw quickbooks scorp Arlinda Lundberg

Many small business owners compensate themselves using a draw rather than paying themselves a salary. Inactivate the compensation of officers account if necessary. It's a way for them to pay themselves instead of taking a.

Owners draw balances

Web if an owner takes a draw from the business account, it increases the business’s liabilities and decreases the owner’s equity. However, owners who do not oversee daily operations are classified only. Web in its.

owner draw quickbooks scorp Anton Mintz

Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. It found that many attorneys were violating the reasonable compensation. Typically, corporations, like an s corp, can’t take owner’s withdrawals..

How to pay invoices using owner's draw?

Create a new account for the owner's draw and set it up as an owner's equity account. Web if an owner takes a draw from the business account, it increases the business’s liabilities and decreases.

owner draw quickbooks scorp Arlinda Lundberg

A is also s’s president and only employee. Web on november 19, 2021 if you're the owner of a company, you’re probably getting paid somehow. Technically, it’s a distribution from your equity account, leading to.

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

Web example 1 : Consider your profits, business structure, and business growth when deciding how to pay yourself as a business owner. Web if an owner takes a draw from the business account, it increases.

owner's drawing account definition and Business Accounting

Web s t er i ng b usiness s tructures and r egistration 38 az ee limited liability company (llc) a limited liability company (llc) is a flexible form of enterprise that blends elements of.

Owners Draw S Corp For sole proprietors, an owner’s draw is the only option for payment. If a draws a $100,000 salary, s’s taxable income will be reduced to zero. Llcs are popular because, similar to a corporation, owners have limited personal liability for the debts and actions of. The distributions are subject only to regular income tax. Web the two main ways to pay yourself as a business owner are owner’s draw and salary.